“Life affords no greater responsibility, no greater privilege, than the raising of the next generation.” This profound observation by former United States Surgeon General C. Everett Koop captures what many consider the ultimate aspiration: creating an enduring legacy that extends far beyond personal financial security.

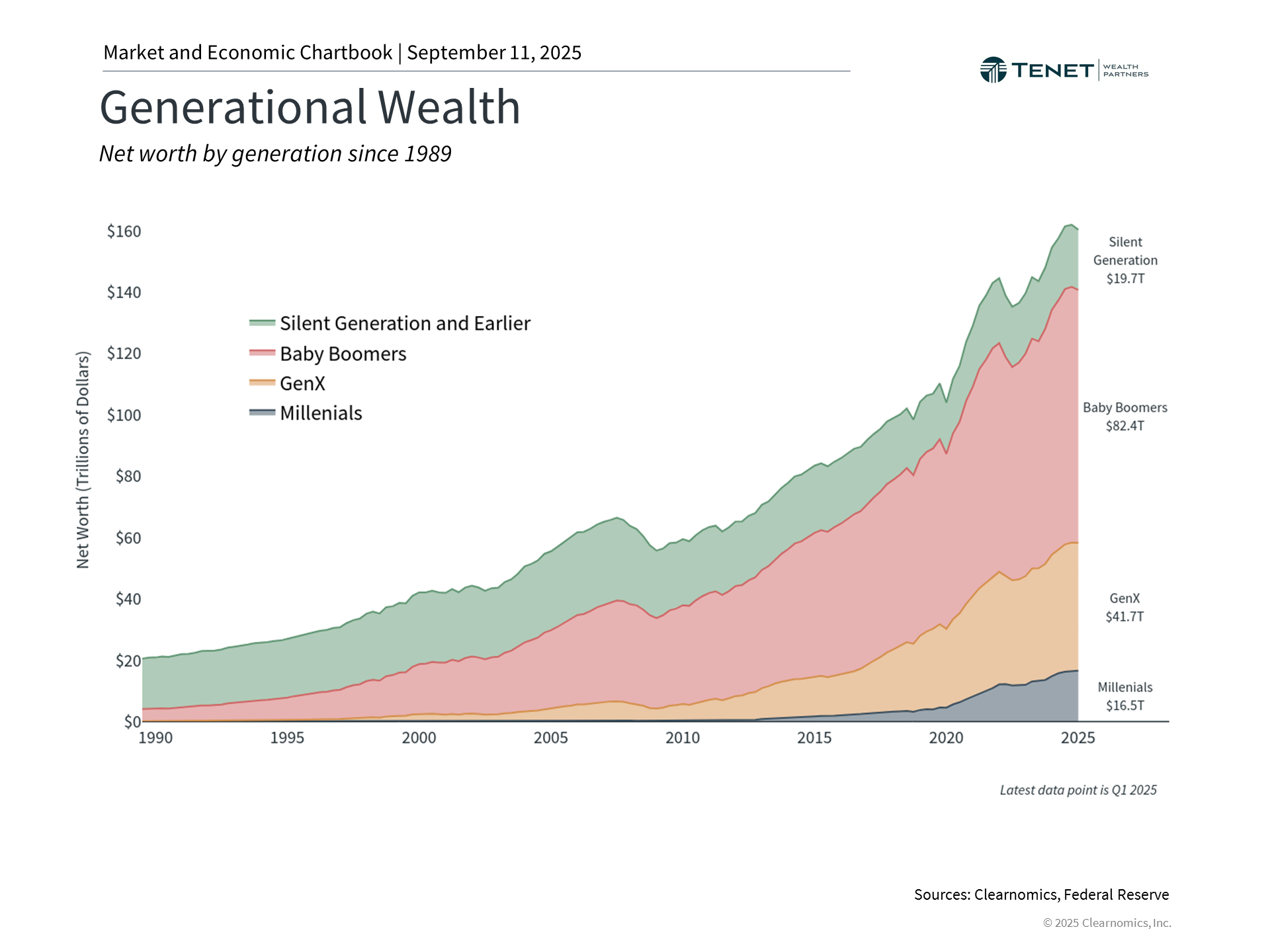

In the coming twenty years, approximately $84 trillion is projected to move from the Silent Generation and Baby Boomers to younger family members, a phenomenon economists have termed the Great Wealth Transfer.1 This massive transition represents far more than simple asset movement – it’s fundamentally transforming how families approach financial planning, philanthropic endeavors, and the creation of enduring legacies through sophisticated planning techniques.

For numerous investors, this wealth transition presents both significant opportunities and weighty responsibilities. Whether you’re preparing to pass assets to future generations or anticipating receiving them, learning to navigate this process with careful consideration can determine whether wealth is preserved or whether outcomes occur that don’t match the original legacy objectives. Success depends on adopting a more holistic approach to intergenerational wealth transitions.

The significance of the Great Wealth Transfer

|

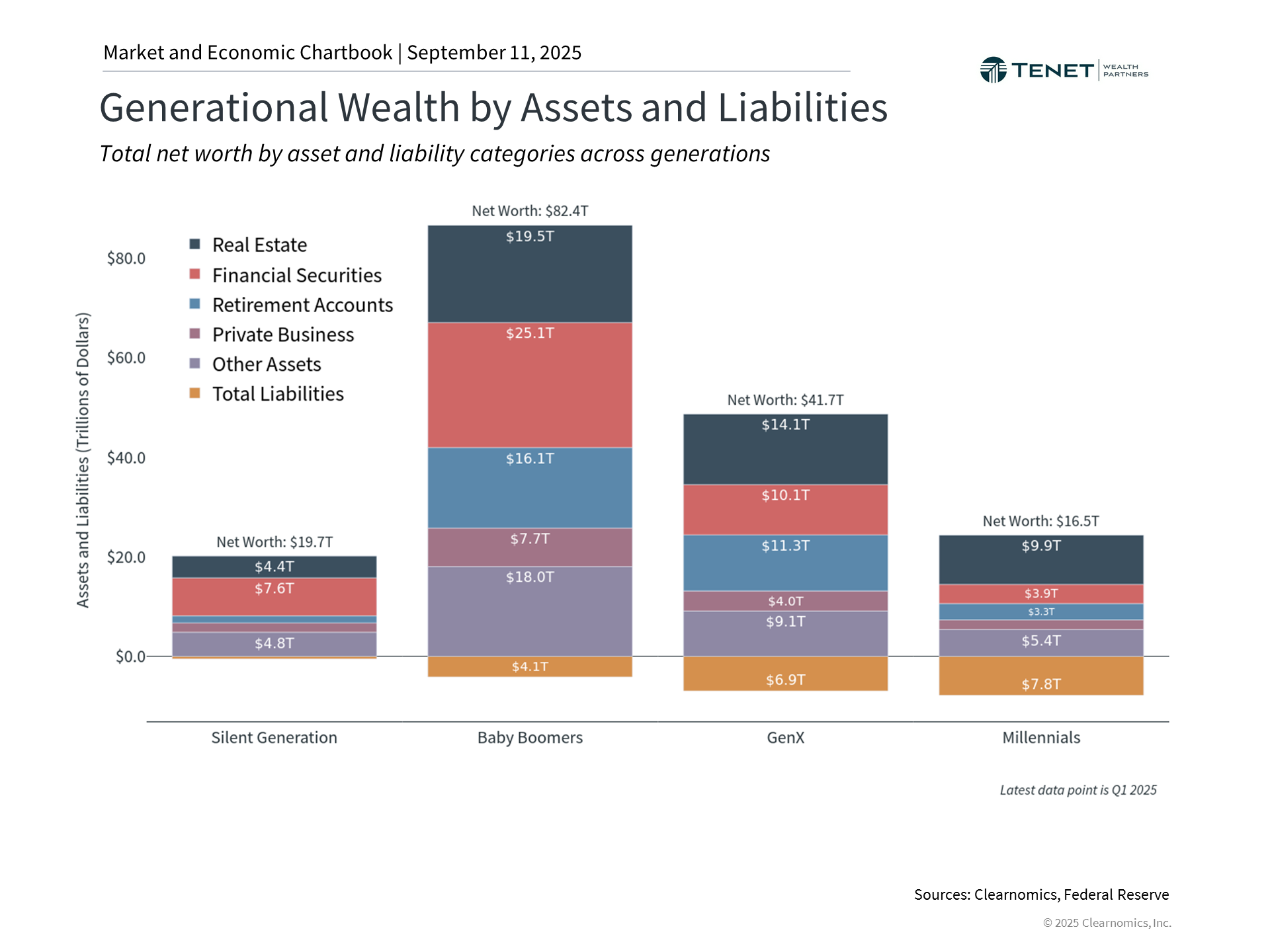

The scale and nature of wealth transitions have changed dramatically in recent decades. Unlike earlier generations who depended mainly on pensions and Social Security, current retirees have built considerable assets through retirement accounts and investment portfolios. Baby Boomers, currently aged 61 to 79 in 2025, control more than $82 trillion in wealth according to Federal Reserve data.

This wealth accumulation reflects structural changes, including increased longevity, an extended period of strong financial market performance, and a widespread shift from defined benefit pension plans to retirement vehicles like 401(k)s and individual retirement accounts (IRAs). Although this transition placed greater responsibility on individuals to save for retirement, it also generated larger pools of investable assets that will ultimately transfer to heirs. Consequently, more families than ever before face substantial wealth transfer considerations.

Strategic wealth transfer planning ensures lasting impact

|

What makes this especially significant is that these assets typically represent decades of careful saving and investing. Modern wealth transfers commonly include diversified investment portfolios, multiple retirement accounts, and various tax-advantaged savings vehicles. Combined with inherited real estate or family businesses that previous generations may have transferred, each component requires thoughtful planning to ensure seamless transitions and optimal tax efficiency.

This reality makes estate planning more crucial than ever before. While many view estate planning as simply creating a will and related documents like a durable power of attorney and advance healthcare directives, comprehensive wealth transfer involves more than just asset distribution. This can include not only revocable living trusts but also other vehicles, such as irrevocable trusts, LLCs, or Family Limited Partnerships. By considering how your wealth can generate meaningful impact, optimizing tax efficiency and managing complex or illiquid structures, investors can establish a lasting legacy.

Notably, while everyone’s asset composition and legacy goals differ, the fundamental principles remain consistent. Similar to how Maslow’s hierarchy of needs explains human motivation – where essential needs like food and shelter must be satisfied before people can pursue higher goals – a comparable framework applies to wealth planning. After building adequate retirement savings to meet basic requirements, attention can turn to creating meaningful impact with your wealth.

Remember that many wealth transfer conflicts stem not from inadequate assets, but from complicated structures, ambiguous intentions, or insufficient preparation among heirs. A comprehensive wealth transfer strategy should include values, expectations, and financial responsibility to facilitate smoother transitions.

Techniques to enhance wealth transfers

Moving to practical strategies, some of the most critical decisions in optimizing wealth transfer involve timing and taxation. Here are several impactful approaches to consider:

1. Tax-Efficient Lifetime Giving. Giving during your lifetime isn’t suitable for everyone, as it requires confidence that you won’t need the transferred assets for your own retirement security, particularly considering rising healthcare costs and extended life expectancies.

However, annual gift tax exclusions permit an individual to transfer up to $19,000 per recipient ($38,000 between spouses) in 2025 without reducing your lifetime estate tax exemption (currently $13.99 million for single filers and $27.98 million for married couples filing jointly). Lifetime giving can also offer practical advantages beyond tax savings. You can witness how recipients manage the funds, offer guidance on financial management, and experience the satisfaction of seeing your generosity’s positive effects.

For those interested in charitable contributions, there can be substantial tax benefits to donating cash or appreciated securities into a donor-advised fund (DAF), and including family members in philanthropic decisions can help transmit values alongside wealth.

2. Multigenerational Education Funding. By investing in education, you can equip young family members with the tools and knowledge necessary to build successful futures. This can be especially meaningful given that college expenses have substantially exceeded inflation over recent decades, making assistance with these costs tremendously valuable.

Unlike other transfers, payments made directly to educational institutions for tuition don’t count against annual gift tax exclusions, making this an exceptionally tax-efficient wealth transfer approach. Furthermore, contributions to 529 education savings plans provide unique advantages for legacy planning, as you can contribute significant amounts while maintaining account control. 529s can fund K-12 tuition, college, and even student loan payments.

3. Asset Location Strategies. Asset location involves strategically positioning investments within different account types – taxable, tax-deferred, and tax-free – to maximize outcomes and after-tax return potential.

By thoughtfully considering your financial structures and aligning specific assets with particular bequests, you can ensure both you and your beneficiaries maximize your money’s value. You can even employ techniques such as tax-loss harvesting to minimize tax implications on capital gains, while carrying forward unused capital losses to use in future years.

For instance, if you hold large unrealized capital gains in a taxable account, you have options to reduce the tax burden. This might include waiting until after death for the cost basis to “step up,” or potentially choosing to donate that asset to charity over time. If executed thoughtfully, gifting could provide the dual benefit of immediate tax deductions along with avoiding realization of tax on that gain.

4. Advanced Estate Planning. As wealth transfer amounts grow and tax implications become more intricate, sophisticated estate planning techniques can become advantageous. These advanced techniques may require the use of more specialized irrevocable trust vehicles, such as Intentionally Defective Grantor Trusts (IDGT), Spousal Lifetime Access Trusts (SLATs), or Dynasty Trusts. If you have life insurance, you may consider the use of an ILIT (Irrevocable Life Insurance Trust) to hold the policy, which would remove the death benefit proceeds from your estate and pay the death benefit to the beneficiary tax-free according to the trust’s terms.

The complexity of contemporary wealth transfer also encompasses business interests, proper retirement account beneficiary designations, and coordination between different types of liquid and illiquid assets.

All of these strategies require specialized expertise to ensure optimal outcomes and prevent unintended consequences. Nevertheless, the opportunity to help future generations thrive has never been greater.

The bottom line? The Great Wealth Transfer presents an unprecedented opportunity to generate lasting impact across generations. Whether you’re preparing to transfer wealth or anticipating receiving it, strategic planning can help ensure your family’s financial legacy fulfills its intended purposes.

Our team at Tenet specializes in partnering with multigenerational high-net-worth families to provide personalized guidance on estate and legacy planning strategies. Reach out to us today, or schedule a meeting with us, to discuss your specific estate and legacy plans and how we can help.

1. https://www.cerulli.com/press-releases/cerulli-anticipates-84-trillion-in-wealth-transfers-through-2045

Investment advisory services offered through Tenet Wealth Partners, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third-party sources and is believed to be reliable.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice. This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.