As companies start reporting their quarterly earnings, the stock market is paying close attention to how businesses are actually doing. With stock prices near record highs, many investors are wondering if these valuations make sense and if companies can keep growing their profits.

Early forecasts suggest that companies ended 2025 with strong growth. Think of earnings reports like report cards for companies—they show how well businesses are performing and if their plans are working. These reports include key numbers that help determine what stocks and bonds are worth.

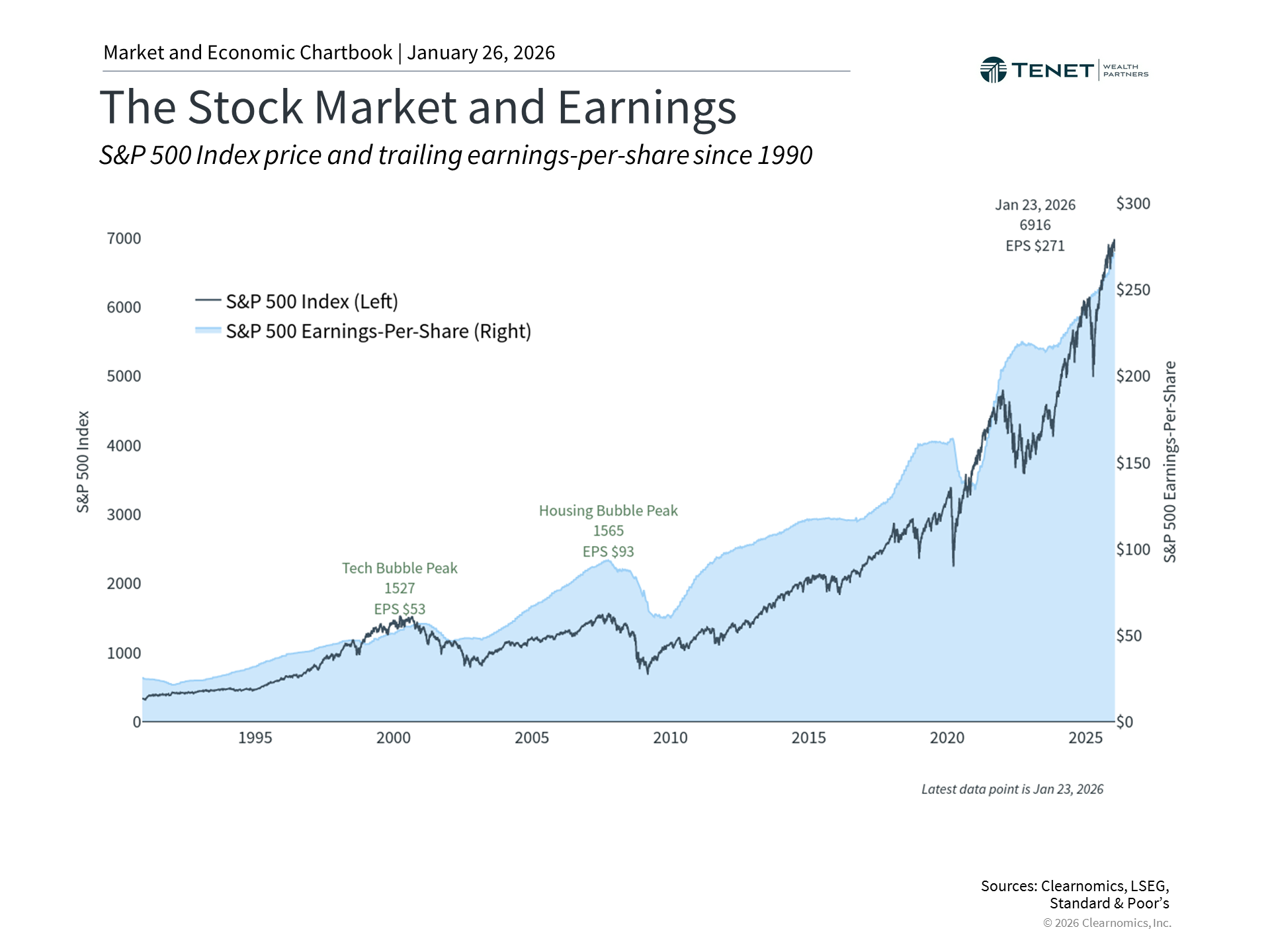

For long-term investors, growing company earnings have been the main reason stock prices go up over time. What matters most is understanding what these earnings tell us about the economy, consumer spending, and whether the current market can continue.

Growing earnings help your portfolio grow

|

Company earnings connect the stock market to the economy. When the economy is healthy with strong job growth and consumer spending, companies typically sell more and earn more profit. Since owning stock means you own a piece of that company’s profits, stock prices usually go up when earnings grow.

This is true not just for individual companies but for the entire stock market. The chart above shows that stock prices tend to follow earnings over the long term. The steady growth of the U.S. economy is a major reason why the stock market has risen over time.

So far, about 13% of S&P 500 companies have reported fourth quarter 2025 results, and 75% exceeded expectations, according to FactSet data.1 Analysts expect earnings-per-share could grow by 8.2% across S&P 500 companies, which would be the 10th straight quarter of growth. For all of 2025, LSEG figures suggest earnings grew by 13% and could grow around 15% in 2026 and 2027. These rates are above the historical average of 7.7%, which would support portfolio growth if they continue.

Stock valuations can improve with earnings growth

|

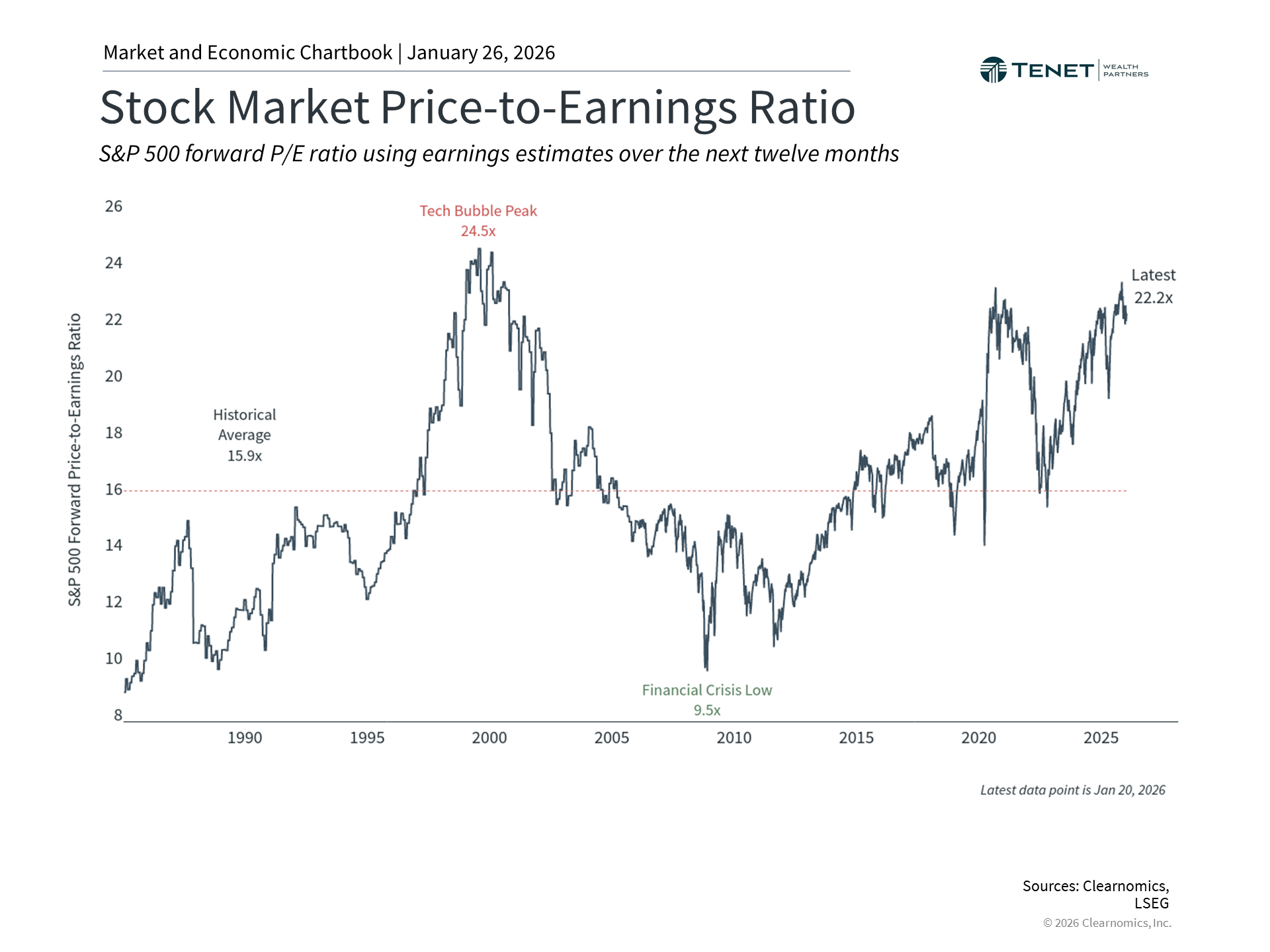

Earnings season also helps us understand stock valuations—whether stocks are priced fairly compared to company profits. The price-to-earnings ratio shows how much investors pay for each dollar of company earnings.

Today, the S&P 500 price-to-earnings ratio is 22.2x, higher than the historical average of 15.9x. While this is elevated, it’s supported by strong earnings growth, unlike periods when investors ignored profitability altogether.

Looking at 2025, the S&P 500 rose 16.4%. If earnings grew 13% over the full year, then earnings contributed about 80% of that return while higher valuations contributed about 20%. This means portfolios did well mainly because companies performed better, not just because investors were willing to pay more for stocks.

However, high valuations mean there’s less room for disappointment, which can lead to bigger price swings during uncertain times. This doesn’t mean avoiding stocks, but it does highlight the importance of managing risk in your portfolio.

AI investment continues to drive spending

|

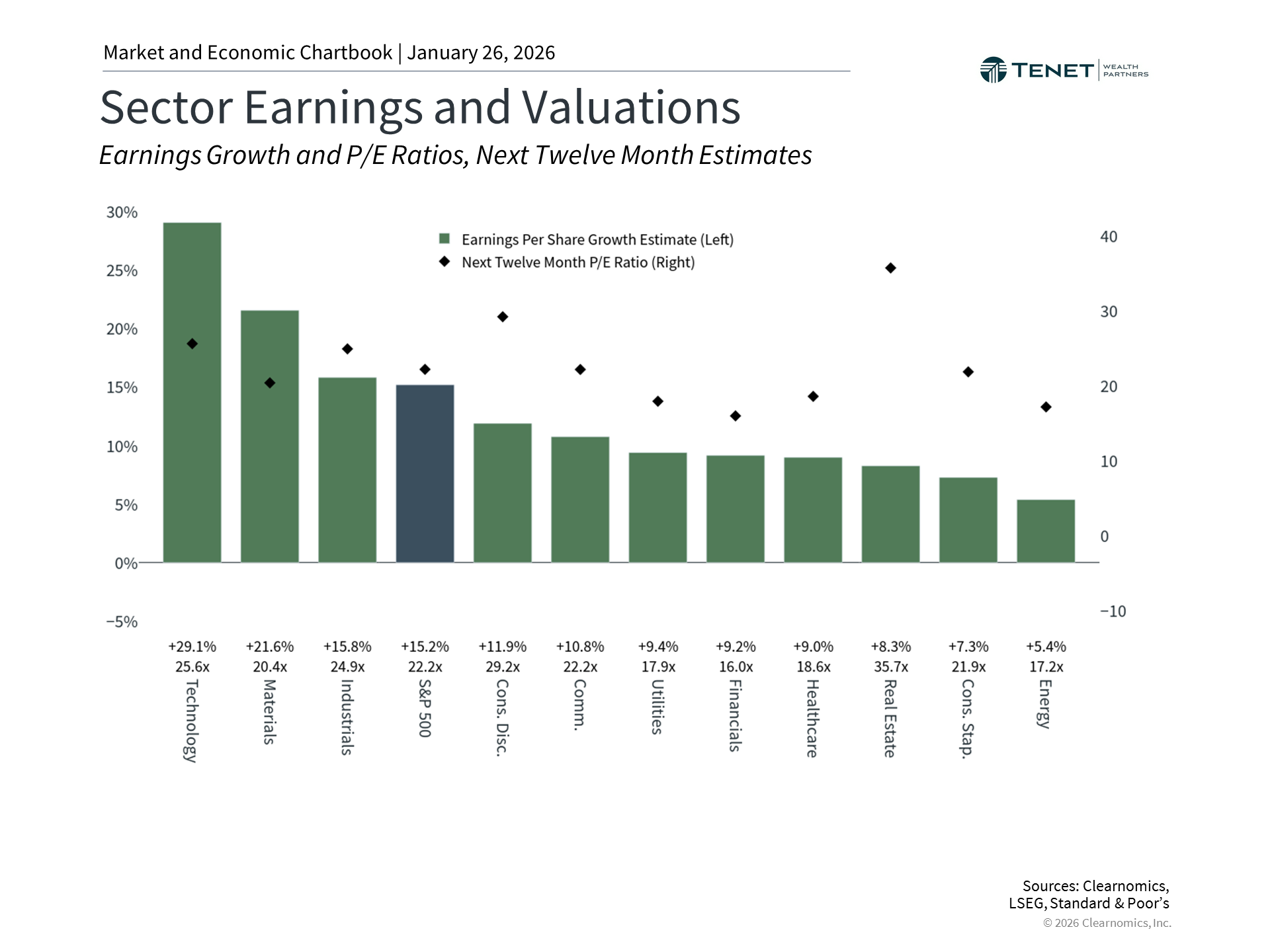

The stock market looks forward, so what company executives say about future plans matters a lot, especially regarding trends like AI spending. Companies are investing heavily in AI infrastructure, including data centers and computing equipment. This investment is changing not just the technology sector but the broader economy.

The chart above shows that earnings growth expectations vary by sector, with Information Technology expecting the highest growth. Companies making large AI investments are betting on continued growth in AI adoption. If these bets pay off, they could drive strong earnings growth for years. However, the full impact of AI on productivity and economic growth will take time to develop. Patient, long-term investors are better positioned to benefit from these trends than those focused on short-term results.

The bottom line? Strong company earnings have supported the stock market. With ongoing uncertainty and high valuations, investors should focus on keeping their portfolios balanced to manage risk while working toward their financial goals.

References

1. https://advantage.factset.com/hubfs/Website/Resources%20Section/Research%20Desk/Earnings%20Insight/EarningsInsight_012326.pdf

Registered Representative of Sanctuary Securities Inc. and Investment Advisor Representative of Sanctuary Advisors, LLC. Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. Advisory services offered through Sanctuary Advisors, LLC., a SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice.

This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.

Copyright (c) 2026 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.