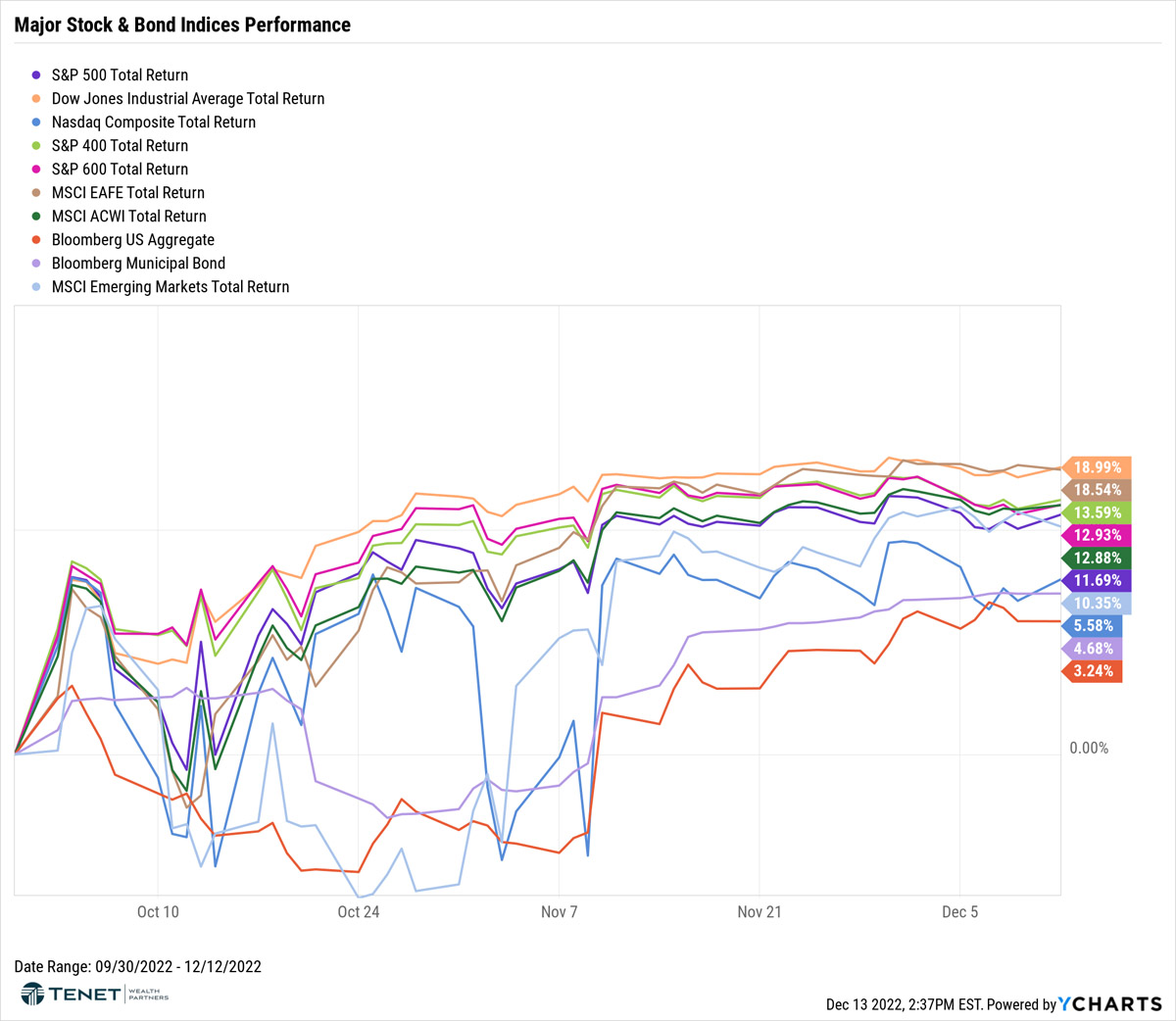

Volatility Persists Yet Q4 Returns Have Remained Positive

While we have seen more volatility in December, major indices are still up significantly since the start of Q4. Even with many prominent CEOs and investors predicting a recession in 2023, investors have become more optimistic due to easing inflation and the Federal Reserve hinting at a slower pace of rate hikes. Since the start of the 4th quarter, nearly all major US stock indices are up double-digits. The Dow and Developed International stocks (MSCI EAFE) have led the way with returns over 18%, while Mid Cap stock (S&P 400) and Small Cap stocks (S&P 600) were next in line with returns of 13.59% and 12.93%, respectively. Even bonds have posted positive returns with Municipals up 4.68% and Aggregate Bonds posting 3.24%.

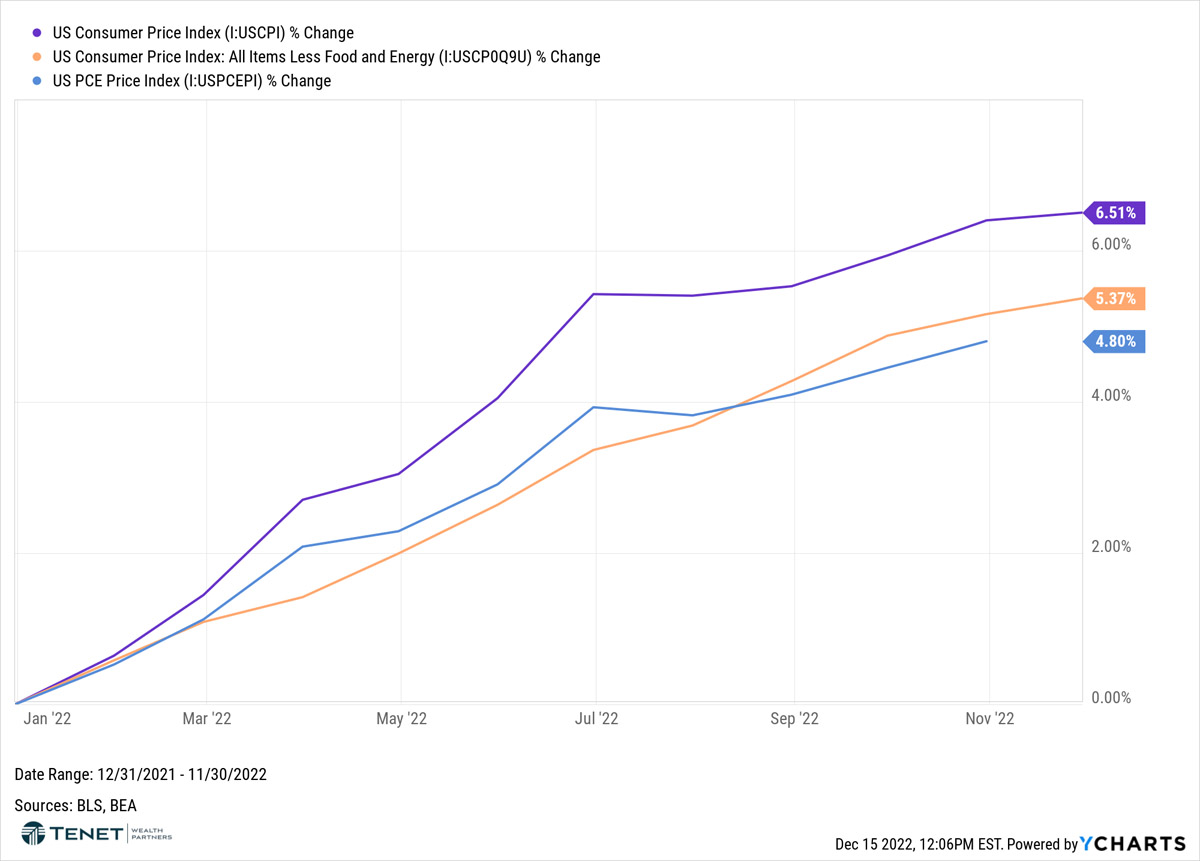

Inflation Slowing More than Expected – Is a Trend Forming?

Inflation continues to be the bugaboo for investors across the board. Many are on pins and needles each month in anticipation of what the CPI reading may look like, and the expectation for most of the year has been “higher and higher.” However, it appears that a trend of slower price increases may be starting to form. For the second month in a row, the November CPI report showed a slower than expected increase of 0.1% from the prior month and 7.1% from a year ago. This is compared to the expected readings of 0.3% and 7.3%, respectively. The Fed’s favorite gauge of measuring inflation, the Personal Consumption Expenditures price index (PCE), also fell from the prior month with a reading of 6% for October, down from the 6.3% September reading. Investors breathed a sigh of relief with this good news and boosted hopes that a downshift in the central bank’s interest rate increases could be imminent. This came to fruition recently as the Fed raised rates by a lower mark of 0.50%. Nevertheless, Powell has remained steadfast that inflation is still “far too high,” and he continues to have a hawkish tone of fighting inflation “until the job is done.”

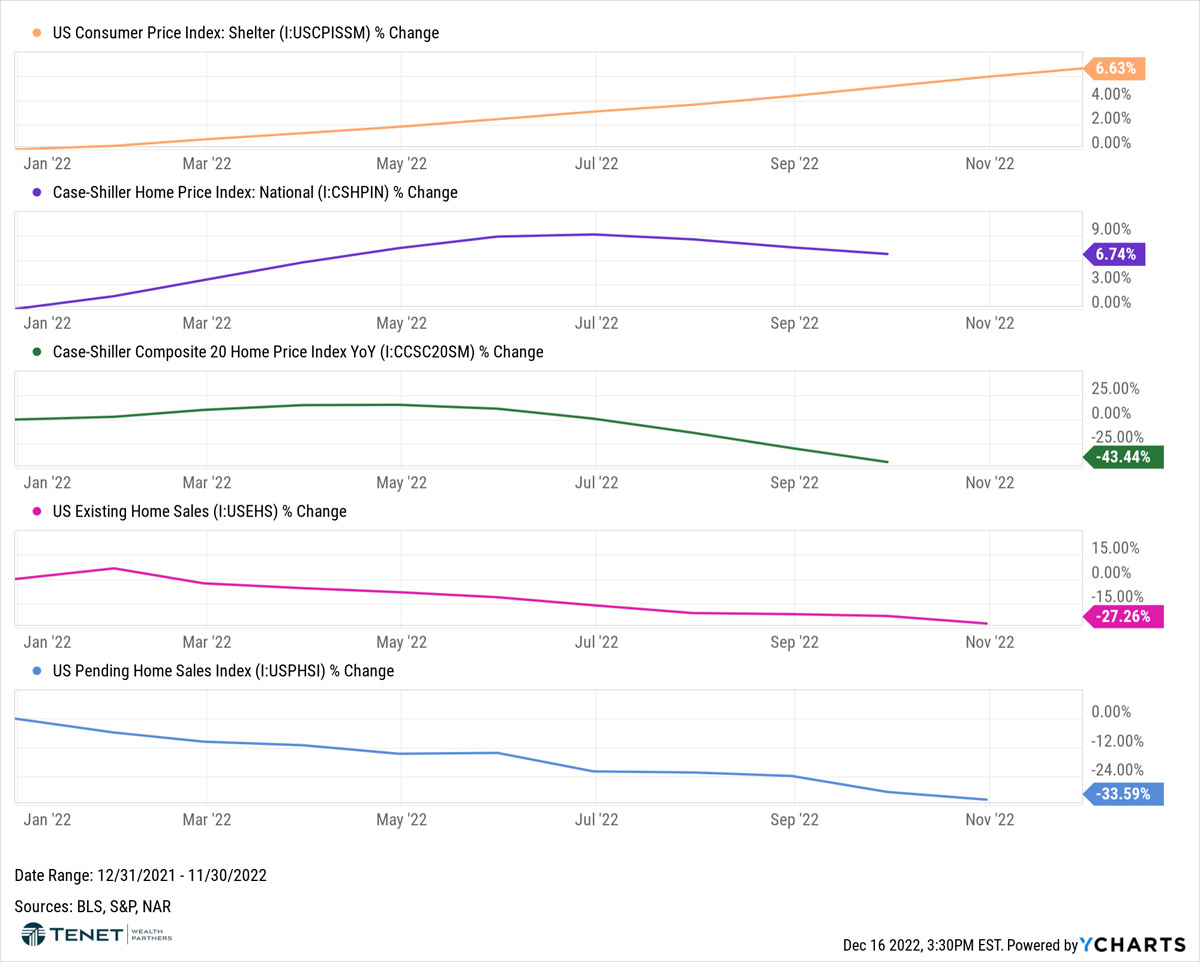

Shelter Costs Are Peaking on Paper But Falling Faster in Real-time

“As shelter costs go, so goes CPI overall.” This should be the motto of why inflation has remained stubbornly high. Shelter costs make up over 40% of Core CPI, and both home prices and rents have skyrocketed over the last year. However, there are two pieces of good news: (1) we are starting to see a plateau of these price increases on the CPI report print, but then (2) we are starting to see more real-time decreases that should eventually show in the CPI print next year. On the most recent CPI report for November, shelter costs rose 7.1% annualized and 0.6% for the month. While this reading is still considered high, it has begun to steady and slightly drop over the last two months. Additionally, as evidenced by the first set of charts below, both existing home sales and pending home sales have fallen sharply at rates of 27% and 34%, respectively. Average home prices in 20 of the largest US cities have also seen a steep drop of over 40% from last year. Of course, there is a lag between real-time data and when they show up in CPI, so these numbers haven’t been fully reflected yet.

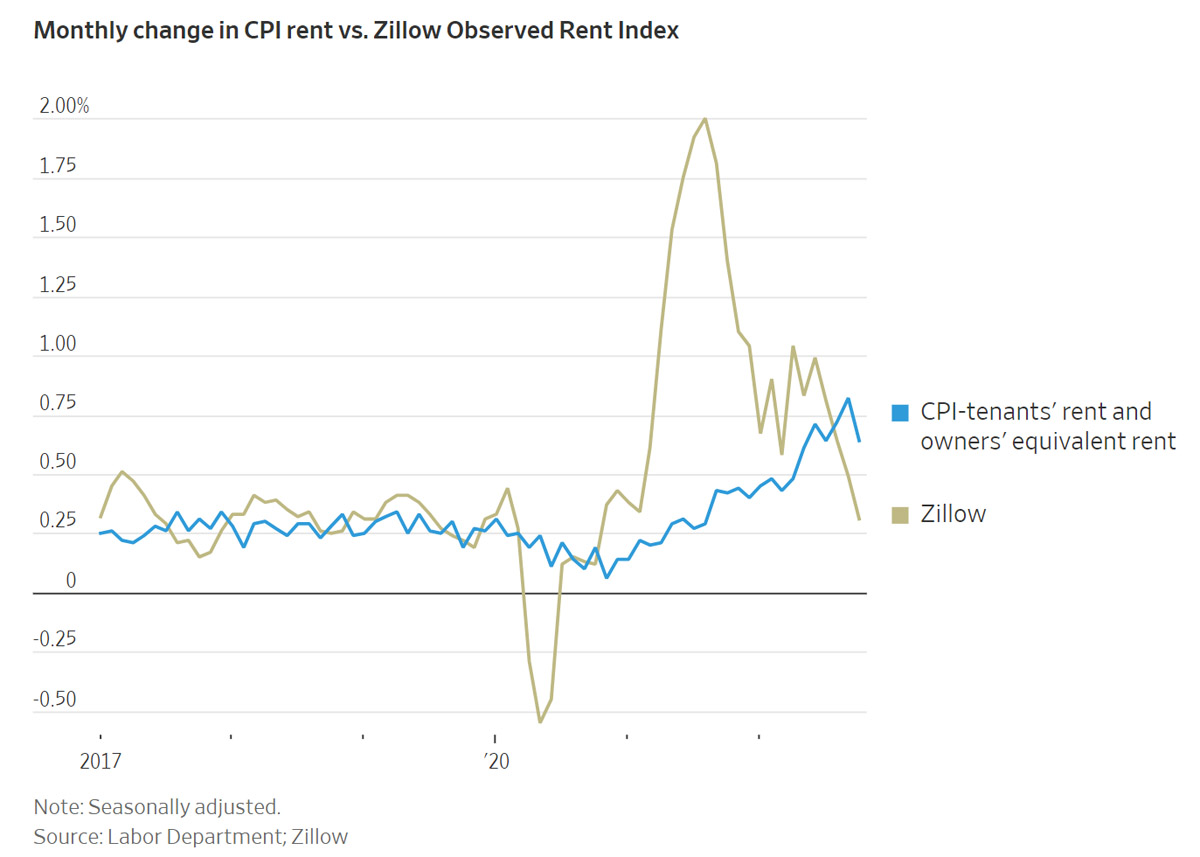

The lag is even more pronounced when it comes to rent prices. As most tenants change leases just once per year, rent costs remained at a consistently high level all year long. Yet, when looking at private-sector indexes such as the Zillow Observed Rent Index, we see a more optimistic story playing out. As evidenced by the second chart below, Zillow’s measure rose just 0.3% for October and 3.7% annualized, which is slightly less than the monthly average we saw three years prior to the pandemic. The monthly increase has also been falling sharply since June, while the CPI print has shown a steady increase. Given the lag, this real-time drop in market rents indicates a coming slowdown in CPI rent metrics. This is good news for investors, but it requires just a bit more patience!

Image Source: Wall Street Journal (“Housing Costs, Inflation’s Biggest Component, Are Poised to Ease” on 12/6/22)

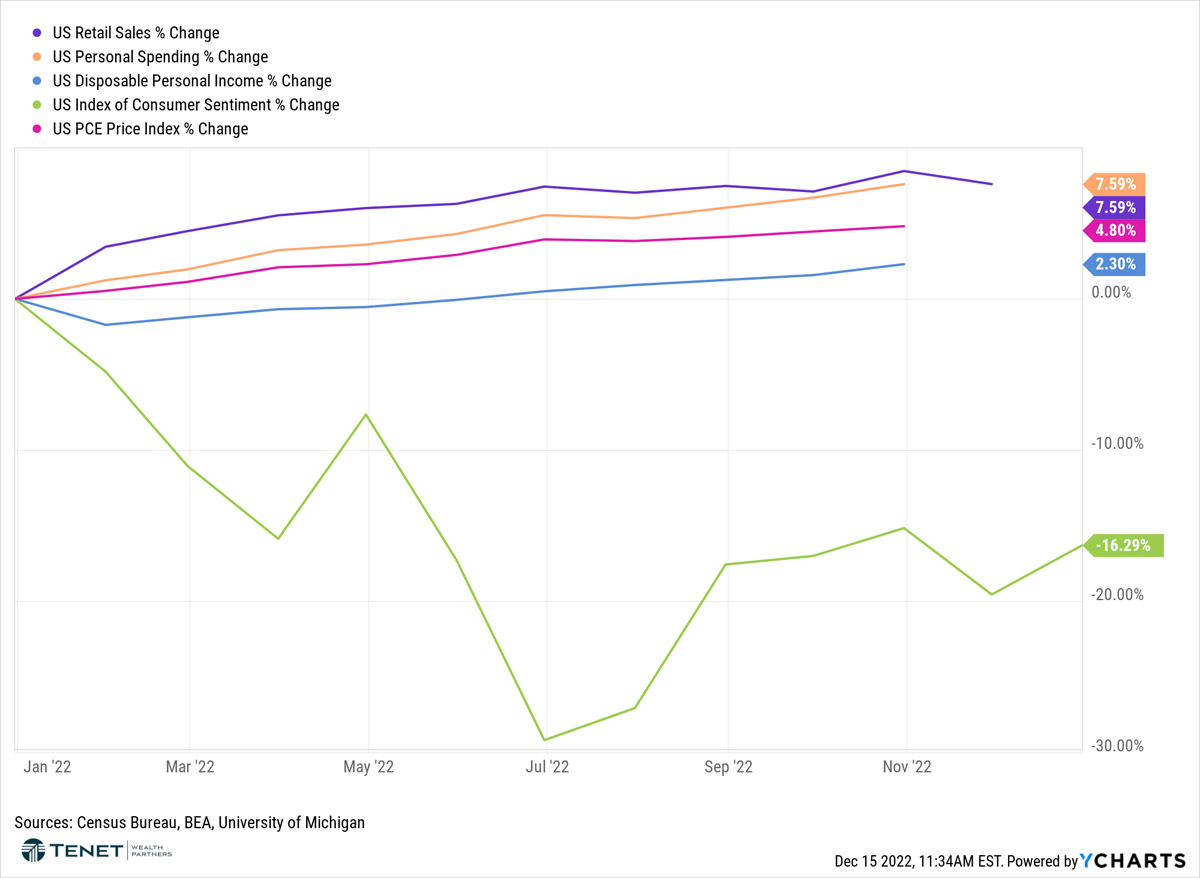

The (Resilient) Consumer….For Now

American consumers continue to show resiliency with their spending habits in the face of persistently high inflation. US consumers spent more in October than they did the prior month while the Federal Reserve’s preferred inflation measure (PCE Price Index) rose less than expected. Personal spending and disposable income have increased as wages have also increased. With that being said, there are signs that consumers may be starting to slow their spending as the most recent retail sales report for November showed a 0.6% drop, which was higher than the estimated 0.3% decline. This was also the biggest drop in almost a year, so consumer spending bears watching as we enter 2023.

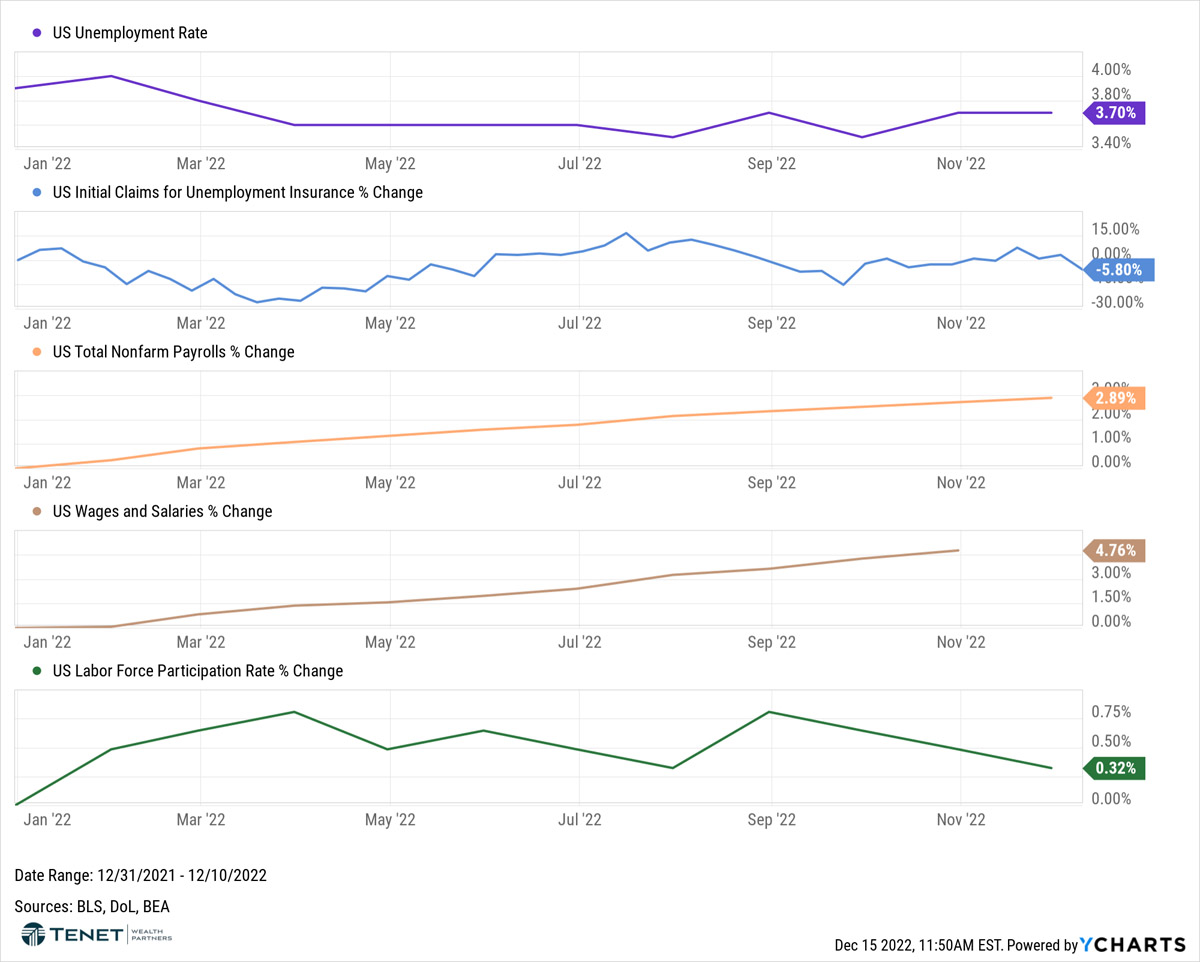

Job Market Strength Continues

Nonfarm payrolls for November increased by 263,000, well above an expected increase of 200,000 jobs. The private sector itself gained 221,000 jobs in November, surpassing the expected increase of 188,000. Additionally, the unemployment rate held steady at 3.7% in October, as expected. However, we are continuing to see heightened wage inflation as hourly earnings rose by 0.6% for the month (faster than the 0.3% gain expected) and 5.1% annualized (versus 4.6% expected). While wage inflation has proven to be “sticky” thus far, we are starting to see signs that the pace of growth is slowing.

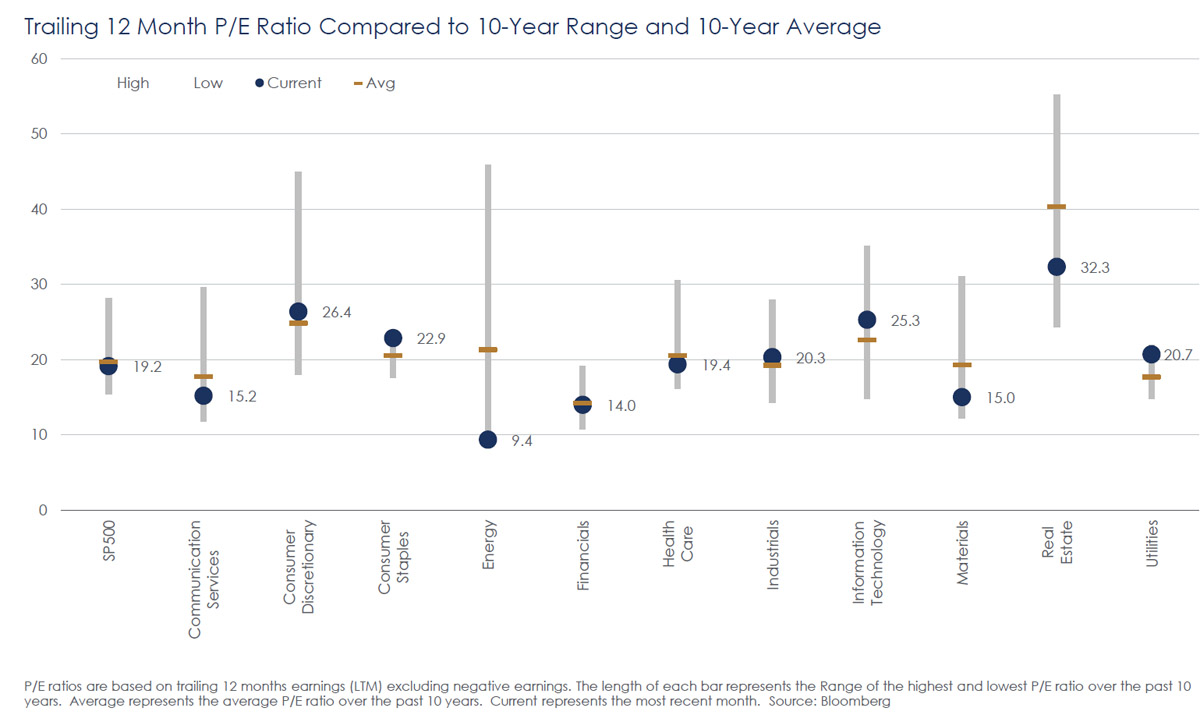

Equity Valuations are Becoming More Attractive…

While many analysts expect a coming decrease in corporate earnings, one positive element that should be noted is that stock valuations have started to become attractive. Prices have come down this year, but earnings have held steady for most major sectors. In fact, according to FactSet, analysts expect the S&P 500 to post a 5.1% earnings growth rate for 2022…not bad given what has transpired this year! The result of this combination: more attractive valuations. As an investor, this can create opportunities to invest, especially after valuations have been elevated over the last few years. As shown in the chart below, seven of the twelve S&P 500 sectors are either fairly-valued or discounted compared to the 10-year average.

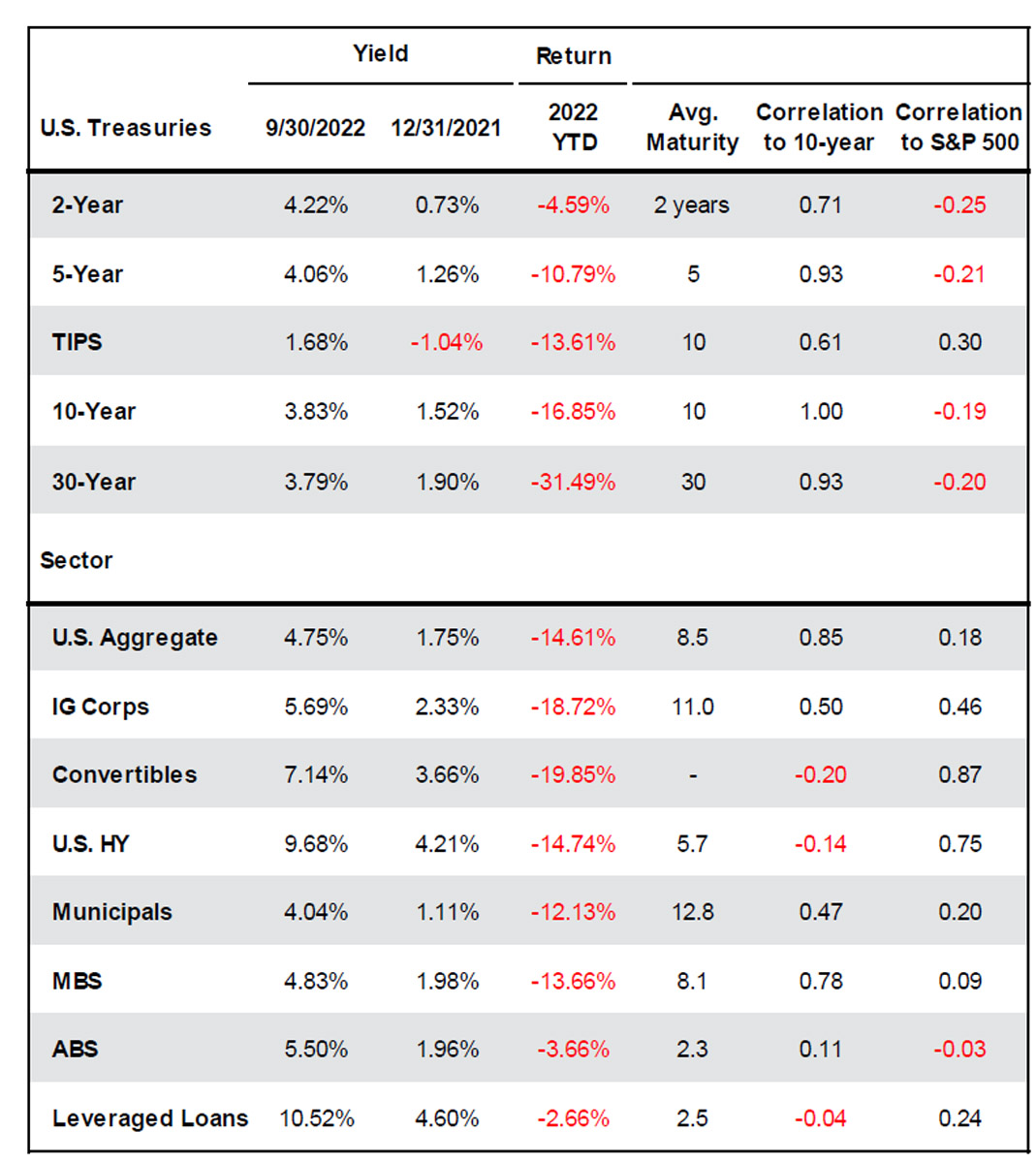

….and Bonds are Back

Finally, we have to give some love to the previous “black sheep” of investors over the last several years: bonds! Until this year, bonds did provide diversification and capital preservation benefits, but they paid very little interest income. As an investor, having the dual benefit of income plus principal protection can be a powerful combination, especially for those seeking a steady income stream in retirement. Many investment-grade bonds are now paying north of 4%, and most have short-intermediate maturities of less than 5 years. This can provide investors with a lot of flexibility in addition to productive income. Additionally, as the Fed continues to hike rates, the values of existing bonds have fallen. While this does not look good on paper for existing bond holdings, it does present an opportunity for investors to buy new bonds at discounted prices.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.