Tenet Wealth Partners Approach

Our Investment Philosophy as Fiduciary Financial Advisors

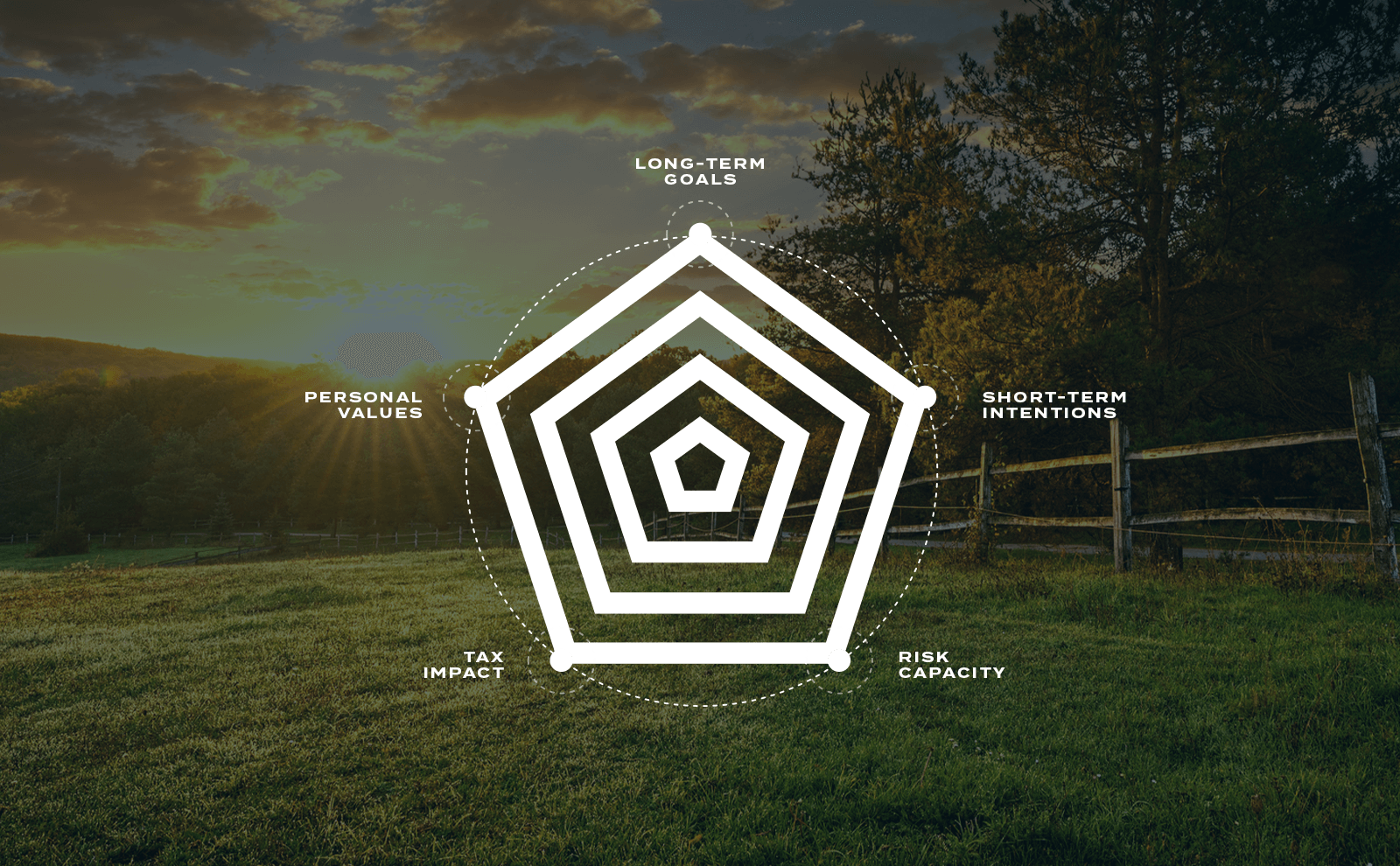

Our investment philosophy is founded upon Modern Portfolio Theory, emphasizing diversification to mitigate risk while optimizing returns. Asset allocation is the most impactful decision an investor will make, and therefore our portfolio strategies are tailored to each client, based on the following factors:

Investment Approach

We believe in a dynamic, hybrid approach to asset allocation and portfolio management, blending strategic and tactical investments to enhance risk management and return potential.

TAX & COST MANAGEMENT

A critical component of our investment approach is our rigorous focus on tax minimization and expense control, with the goal of optimizing the returns our clients can achieve.

TACTICAL

The tactical allocation consists of diversifying asset classes, including but not limited to Emerging Markets, Real Estate, and Global Small Cap. This component enhances risk mitigation while providing opportunities for differentiated risk-adjusted returns. Tactical shifts are driven by both current and forward-looking market and economic conditions. Given the greater degree of inefficiencies in these markets, an actively managed approach is typically employed

STRATEGIC

The strategic component serves as the foundation of the portfolio, consisting of high-quality Global Equities and US Investment Grade Bonds. Given the high degree of efficiency in these markets, we take a passive, indexed approach. This approach supports and aligns with each client’s core, long-term goals and intentions. Tax management and efficiencies are employed according to the specific client’s tax situation.