The stock market appears poised to achieve double-digit gains for the sixth time in seven years. Apart from the inflation-induced decline of 2022, this impressive run has placed numerous investors in favorable financial circumstances.

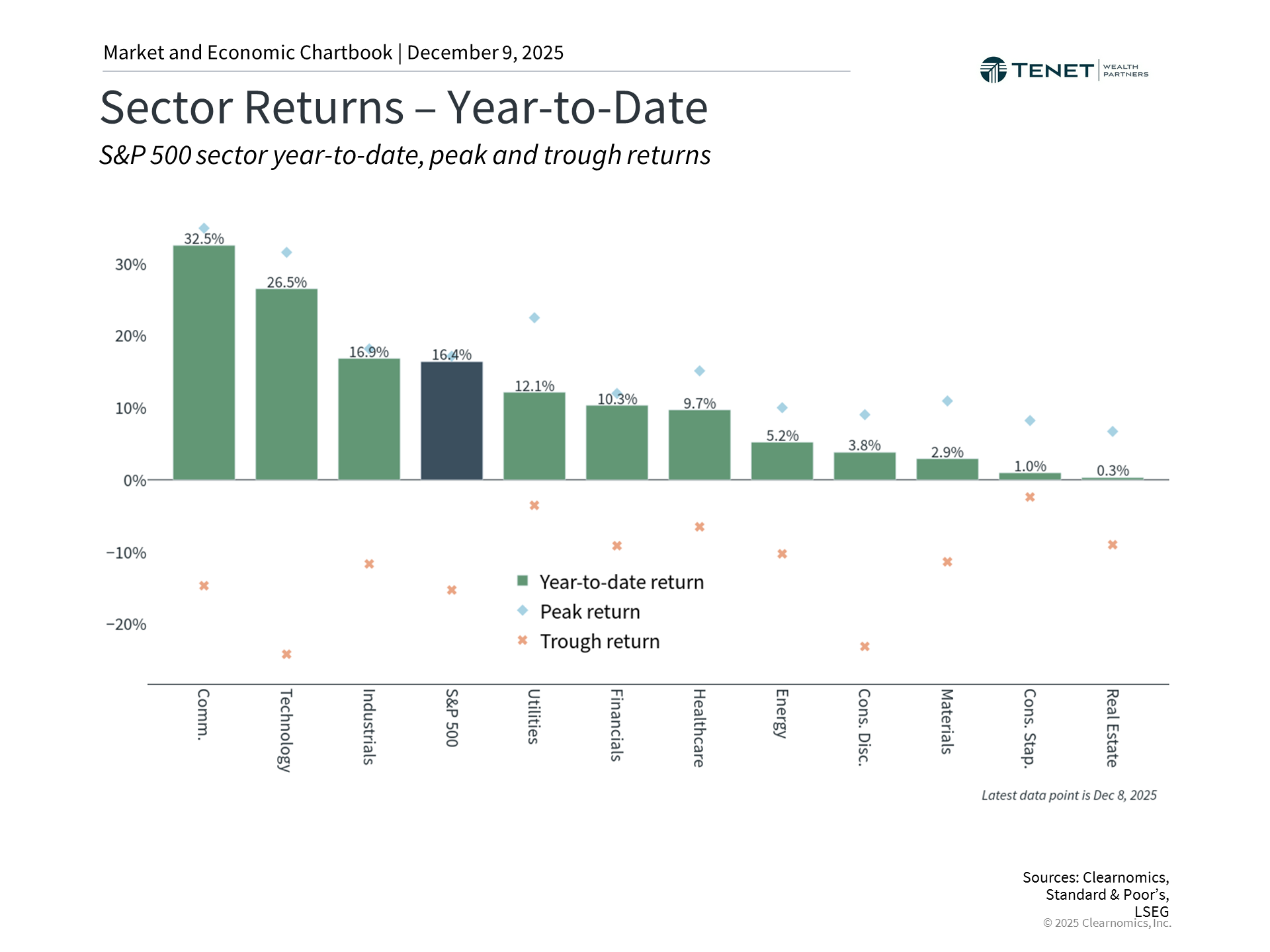

There’s a common saying that “anticipation exceeds reality.” While investors naturally welcome robust returns that benefit portfolios and financial objectives, such gains can paradoxically trigger anxiety. This is particularly evident as market breadth extends beyond technology stocks focused on artificial intelligence, global markets show renewed strength, and bonds contribute positively to overall portfolio performance. Yet with major indices trading near record highs and valuations nearing levels last seen during the dot-com era, unease has emerged among market participants.

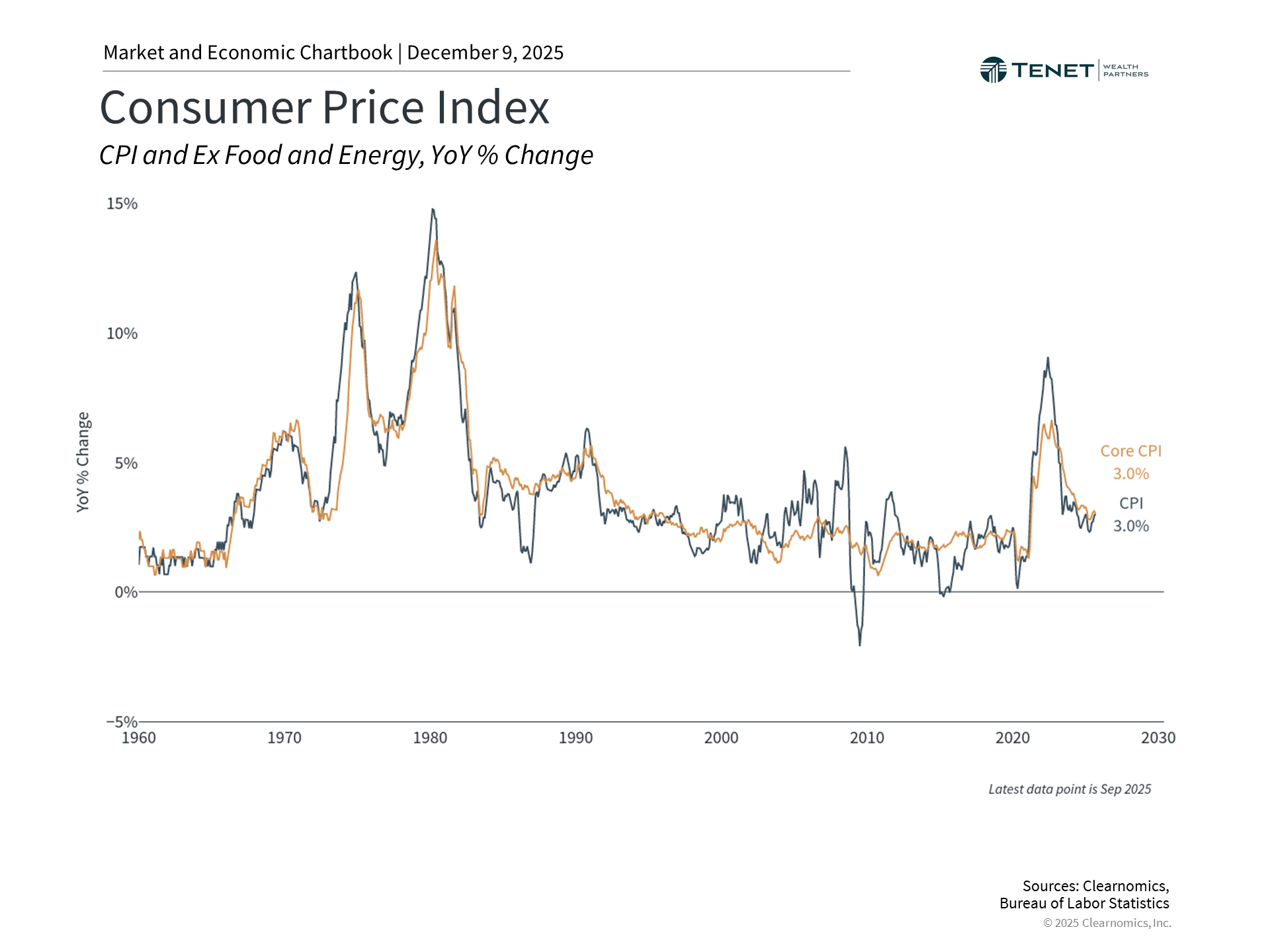

Throughout 2025, several persistent investor concerns reached inflection points. Inflation, though still impacting household budgets, has stabilized near 3%. Trade policies, while elevated compared to historical norms and generating market volatility throughout 2025, have not triggered the widespread economic disruption some anticipated. The Federal Reserve has maintained its rate-cutting trajectory, and economic expansion has proceeded at a solid pace.

Taking a broader view, perhaps the most valuable insight heading into the new year is recognizing that anticipated catastrophes rarely occur. The recession many predicted since 2022 never materialized. Historical patterns reveal that for each genuine crisis—such as the 2020 pandemic or 2008 financial meltdown—countless feared “black swans” (unexpected, high-impact events) fail to emerge. The essential skill for long-term investors isn’t forecasting which scenarios will unfold, but rather maintaining composure and consistency through varying market environments.

Looking toward 2026, the investment environment presents a mix of prospects and obstacles. Expected headline topics include midterm elections, Federal Reserve leadership transitions and potential interest rate decisions, artificial intelligence developments, credit market concerns, currency movements, and more. The crucial question isn’t whether investors can anticipate every development, but whether portfolios are structured to handle uncertainty while capturing long-term appreciation. This is why our team of fiduciary financial advisors at Tenet place an intense focus on creating a well-diversified structure and foundation that is not only aligned with our client’s goals and objectives but to also be better prepared for different environments that may arise in the future.

Looking ahead to next year, here are seven themes that can help frame your thinking and considerations for 2026:

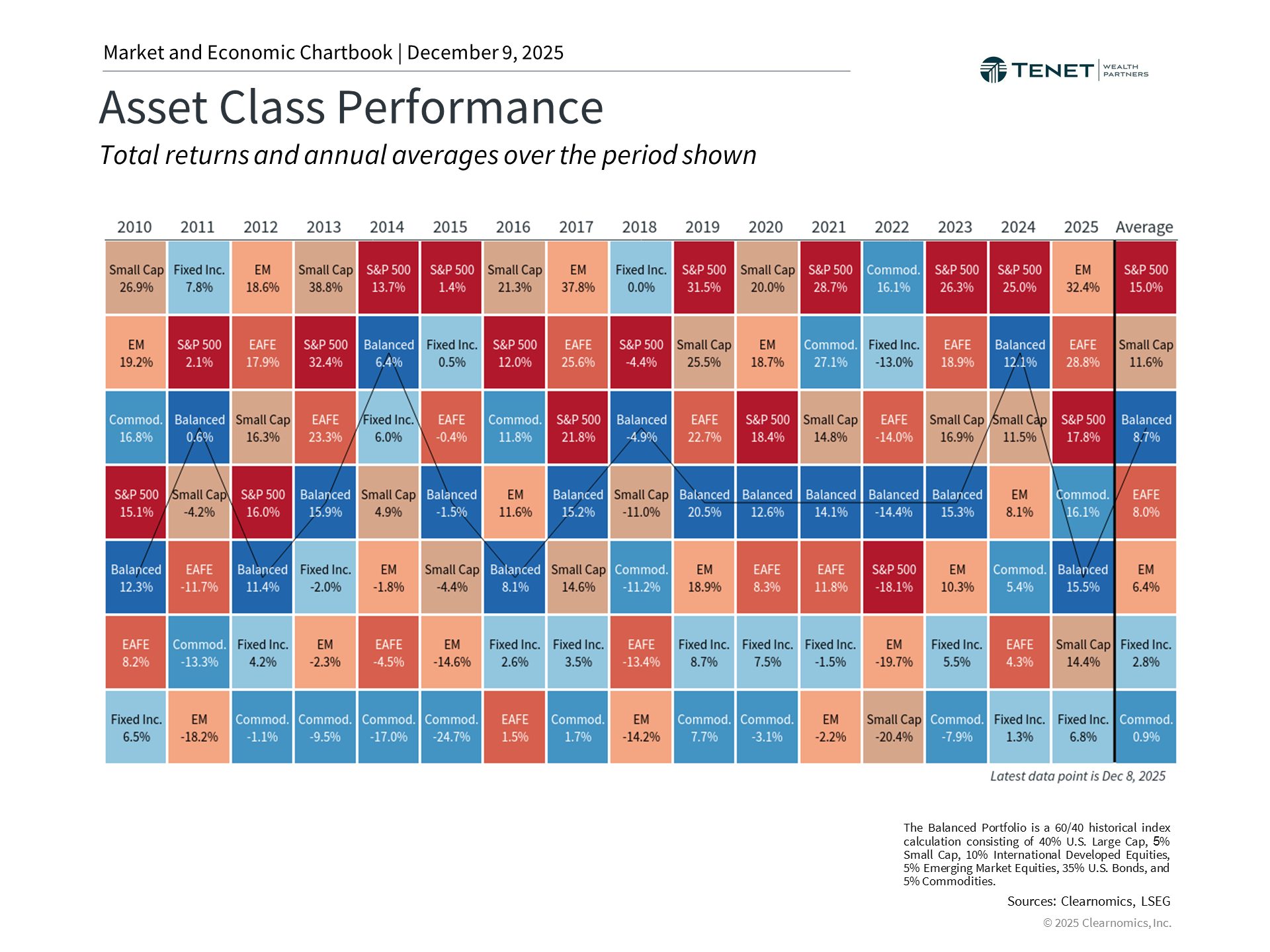

1. Multiple asset classes are contributing to portfolio performance heading into 2026

|

A significant development for investors is that multiple asset classes are enhancing portfolio results as 2026 approaches. This marks a shift from much of the previous decade when U.S. equities dominated global performance. Throughout 2025, international equities have exceeded U.S. market returns, with developed international stocks (MSCI EAFE) and emerging market equities (MSCI EM) each advancing approximately 30% in dollar terms. Two primary drivers explain this performance: enhanced growth projections across various economies and dollar weakness, which amplifies returns for U.S.-based investors.

Bond markets are also fulfilling an essential portfolio stabilization function. The Bloomberg U.S. Aggregate Bond Index has advanced 7% year-to-date as the Federal Reserve continues its rate-cutting campaign and inflation remains contained. High-quality bonds have delivered on their intended purpose by generating income and moderating equity market volatility during periods of uncertainty.

Looking ahead, these developments emphasize the value of balance and diversification. Though responding to headlines with abrupt portfolio adjustments may seem appealing, investors who maintain alignment with their financial strategies are more likely to achieve favorable outcomes.

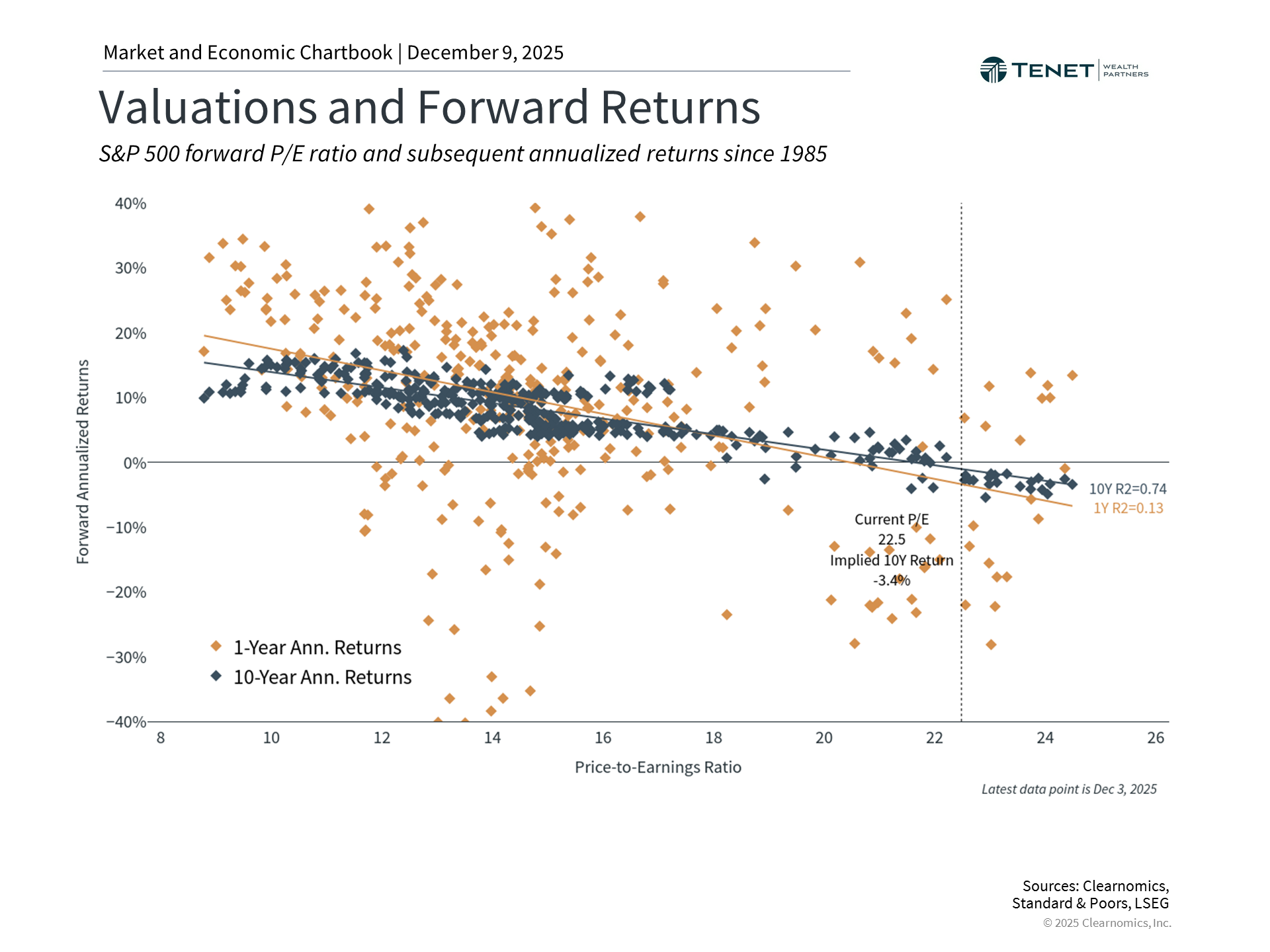

2. Current market valuations remain elevated – but corporate fundamentals are healthy

|

Recent years of substantial gains have pushed equity valuations higher. The S&P 500 currently trades at a price-to-earnings multiple of 22.5x, approaching the record 24.5x reached during the dot-com bubble. This means investors are paying more for each dollar of anticipated future profits than in recent memory.

Valuation concerns typically arise when prices become detached from underlying business fundamentals. During the dot-com bubble, for instance, valuations reached extraordinary levels that far exceeded revenue and profit generation, as investors rewarded any company associated with the “new economy.” Today’s elevated valuations stem from optimism surrounding AI and sustained economic growth, yet corporate fundamentals remain robust. Earnings have expanded at a healthy rate, with consensus estimates from LSEG suggesting this trajectory could continue.

Understanding what elevated valuations indicate—and what they don’t—is important. High valuations don’t necessarily signal imminent market corrections, as markets can sustain expensive levels for prolonged periods. While some express concern about an “AI bubble,” history shows not all bubbles burst dramatically. Some deflate gradually as fundamentals catch up to expectations. This distinguishes the dot-com collapse of the late 1990s and early 2000s from the steady growth of cloud computing over the past decade.

Nevertheless, elevated valuations suggest potentially more moderate future returns, as markets have already priced in expected growth. This can also heighten market sensitivity to disappointments. Markets trading at these levels are often described as “priced for perfection,” meaning even slight earnings misses or economic data shortfalls can trigger volatility. Consequently, maintaining selectivity and balance across various market segments—including asset classes, sectors, capitalizations, styles, and more—becomes increasingly critical.

3. Artificial intelligence continues driving economic expansion and investment returns

|

Few developments have captured investor focus more than artificial intelligence. AI infrastructure spending reached remarkable levels in 2025, with aggregate investment easily surpassing trillions of dollars. This encompasses data center construction, equipment purchases including GPUs, and AI researcher hiring.

Certain investments involve arrangements that appear circular. For instance, Nvidia committed up to $100 billion to OpenAI, which subsequently purchases millions of Nvidia chips. These interconnected relationships have sparked questions about whether the AI ecosystem remains sustainable if enthusiasm diminishes.

These patterns reflect the substantial infrastructure requirements that few companies can finance independently. The critical question is whether the technology ultimately generates sufficient value to justify the massive expenditures. Currently, AI investment represents a substantial contributor to overall economic activity.

Survey data indicates businesses are increasingly incorporating AI into operations. According to the Census Bureau’s Business Trend and Outlook Survey, the proportion of businesses reporting AI usage more than doubled from 4% in September 2023 to 10% in September 2025. The share anticipating AI adoption within six months rose similarly, from 6% to 14% over the same timeframe.1 While these figures have jumped, substantial room for expansion remains.

For investors, AI represents both opportunity and risk. The Magnificent 7 technology companies continue driving market gains, powered by infrastructure investments and expanding AI tool adoption. However, this concentration creates potential vulnerability. These companies now comprise approximately one-third of the S&P 500, meaning most investors maintain substantial exposure, whether recognized or not.

The question isn’t whether AI will reshape the economy—that appears certain. Rather, it’s whether current valuations appropriately reflect realistic timeframes for returns on these enormous investments. Historical precedents from the 1860s railroad expansion to the 1990s dot-com era demonstrate that transformative technologies typically follow similar trajectories: initial doubt, rapid implementation, market excitement, and eventual economic integration.

The essential insight is that markets frequently overestimate profit generation speed. Most investors likely maintain AI exposure either directly or through major indices, making awareness of this concentration vital. Adhering to an appropriate asset allocation aligned with long-term objectives will prove essential in the coming year.

4. Economic expansion continues despite deceleration

|

Economic growth has moderated yet remains more resilient than many anticipated. U.S. GDP experienced a modest first-quarter 2025 contraction, though this quickly reversed as tariff uncertainty subsided. The 3.8% second-quarter growth rate not only surpassed expectations but represents among the strongest quarterly performances in years.

Regarding global GDP, the International Monetary Fund forecasts growth could ease marginally from 3.2% in 2024 to 3.1% in 2026. Advanced economies are projected to expand around 1.5%, while emerging markets are expected to sustain growth exceeding 4%.2

While positive overall, economic expansion has been inconsistent across income segments and sectors. This phenomenon is frequently described as a “two-speed” or “K-shaped” economy, as some experience prosperity while others face challenges.

In today’s environment, this divergence primarily stems from technology developments, as those positioned to capitalize on AI growth may encounter superior employment prospects compared to traditional industry participants. Beyond AI, factors such as consumer debt and auto loan delinquencies affect whether individuals benefit from economic expansion.

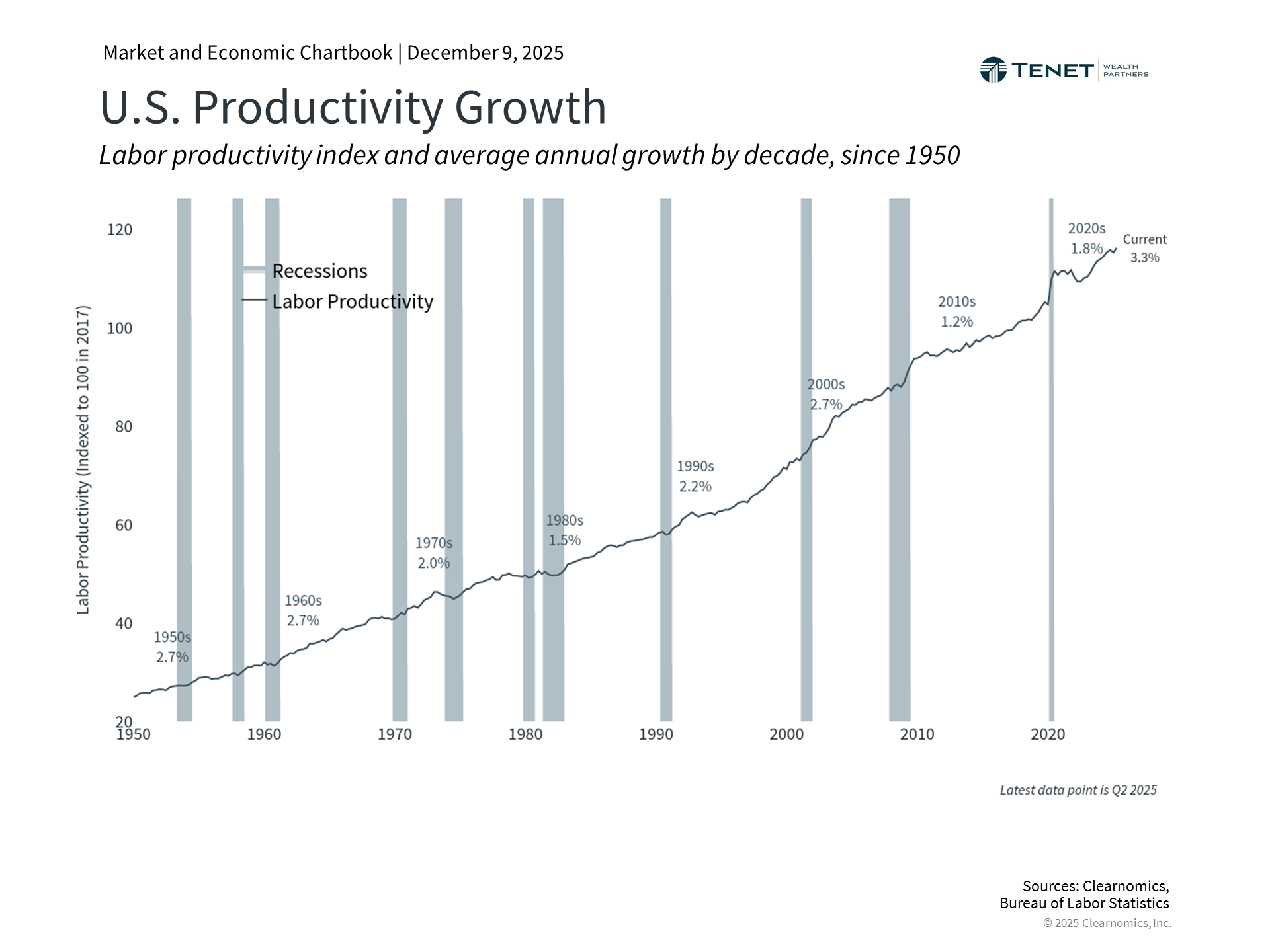

Concerning long-term economic prospects, perhaps the most significant question is whether productivity will accelerate due to recent technological progress. Productivity measures output—in quality or quantity—a worker can generate within a given timeframe. Historically, improved equipment, training, and education have driven enhanced productivity, which fuels genuine economic growth.

As illustrated above, productivity growth averaged merely 1.2% annually during the 2010s. The promise of AI and emerging technologies is enhanced worker output. However, such improvements typically materialize more slowly than expected and won’t necessarily benefit everyone uniformly. For investors, the prospect of increased productivity suggests profit margins could improve, supporting the broader economy and investment portfolios.

5. Trade policy effects remain unclear

|

Though tariffs drove primary stock market volatility throughout 2025, their economic consequences have been mixed. Indeed, one continuing puzzle is the limited immediate impact tariffs have exerted on inflation and growth. Despite tariff costs increasing tenfold compared to prior-year averages, measures including the Consumer Price Index have risen only marginally.

Several explanations exist for tariffs’ muted effects. First, many announced tariffs were promptly suspended or reduced. Second, numerous companies absorbed initial tariff costs by maintaining stable prices and importing goods ahead of tariff implementations. Finally, robust consumer spending, fiscal support, and strong AI-sector growth helped counterbalance any negative growth impact. Additionally, the Supreme Court may rule in 2026 on the legality of economic justifications underlying these tariffs.

For long-term investors, recent developments alongside 2018’s initial trade negotiations highlight that tariffs represent established policy tools. Rather than interpreting tariffs as fundamental shifts in global order, they instead constitute instruments for advancing broader policy objectives. While tariffs will persist, their influence on daily market activity may diminish.

6. Midterm elections and fiscal concerns will dominate 2026 discussions

Beyond trade policy shifts, 2025 featured a historic 43-day government shutdown and persistent budget deficit concerns. Simultaneously, the recently enacted One Big Beautiful Bill Act (OBBBA) tax legislation has provided increased clarity for investors and taxpayers.

The new year begins with renewed Washington uncertainty as short-term funding legislation expires at January’s end. This creates potential for additional negotiations that could trigger another government shutdown. Subsequently, some investors anticipate households and businesses will benefit from enhanced tax refunds due to OBBBA provisions including full research and development expense deductions.

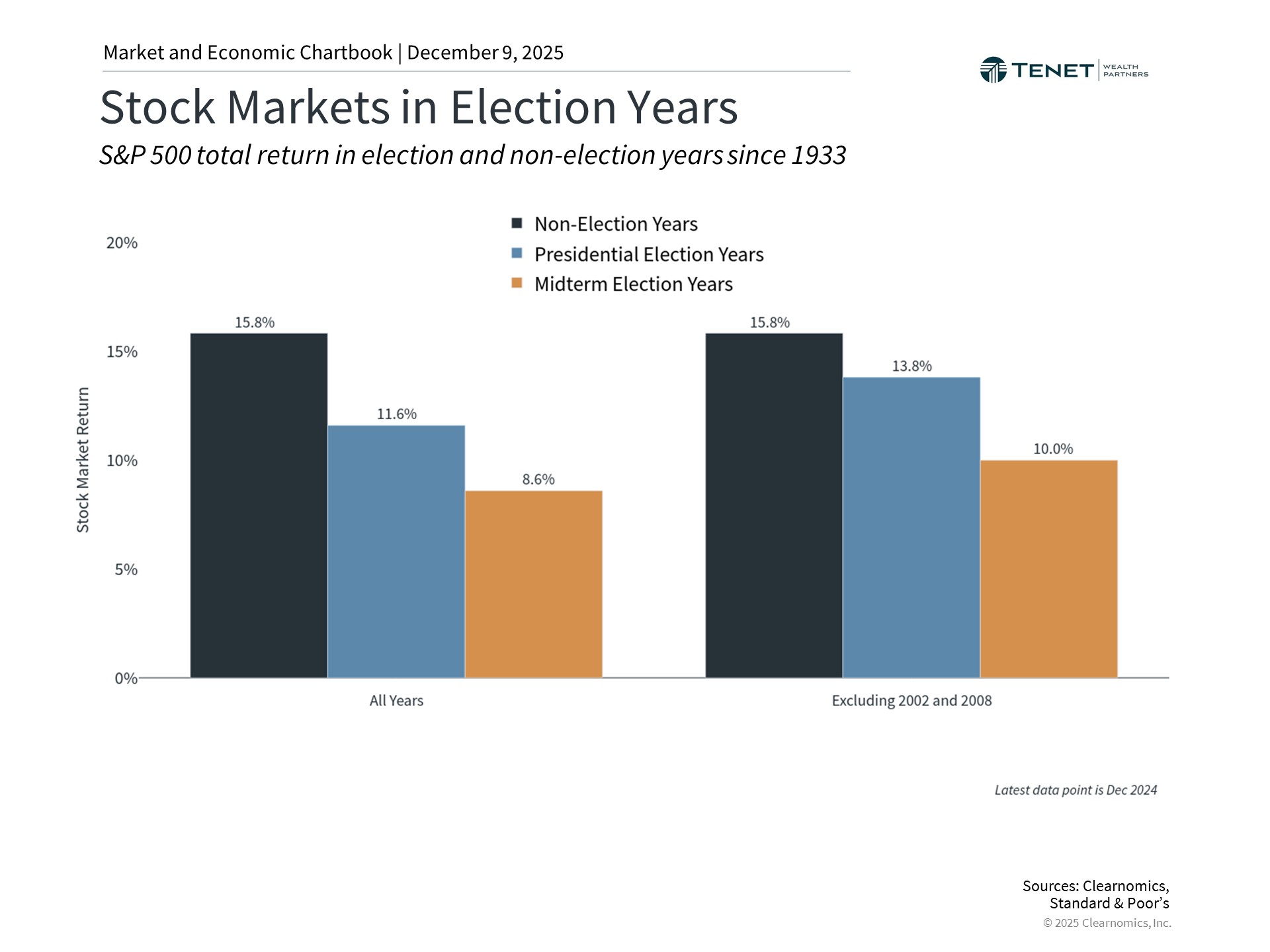

Looking further ahead, investor attention will likely shift toward midterm elections and implications for trade policy, regulation, government expenditure, and more. Historical data shows midterm election years have delivered healthy returns, averaging 8.6% since 1933, though slightly trailing non-election and presidential election years.

Nevertheless, the expanding national debt remains a primary concern for many investors. The reality is that historically elevated national debt—hovering near 120% of GDP for total debt, exceeding $36 trillion—is unlikely to be resolved soon. Estimates suggest the OBBBA could increase national debt by over $4 trillion within the next decade. Currently, national debt amounts to over $106,000 per American.

For long-term investors, distinguishing between controllable and uncontrollable factors proves essential. The national debt has presented challenges for decades, yet investment decisions based on these concerns would have resulted in suboptimal portfolio positioning. While U.S. federal debt sustainability may influence economic growth and interest rates, history demonstrates this shouldn’t primarily drive portfolio construction.

Instead, what investors can control near-term is understanding key tax legislation changes and their planning implications. These include permanent lower Tax Cuts and Jobs Act rates, sustained higher estate tax exemption levels, increased SALT deduction caps, and numerous other provisions. This represents an ideal opportunity to review tax planning strategies ensuring full advantage of these new regulations.

7. Federal Reserve policy will continue impacting economic activity and financial markets

|

The Fed resumed rate reductions in September following an earlier pause. Entering 2026, monetary policy direction could become less predictable. This reflects that runaway inflation risk may no longer be the primary consideration as labor market softening has gained importance. This requires policy rate adjustments rather than dramatic interventions like those witnessed in 2022.

An additional complication involves Fed Chair Jerome Powell’s term concluding May 15, 2026, creating opportunity for new Federal Reserve leadership. The White House is expected to nominate a successor potentially favoring additional rate cuts supporting the administration’s economic agenda of lower interest rates.

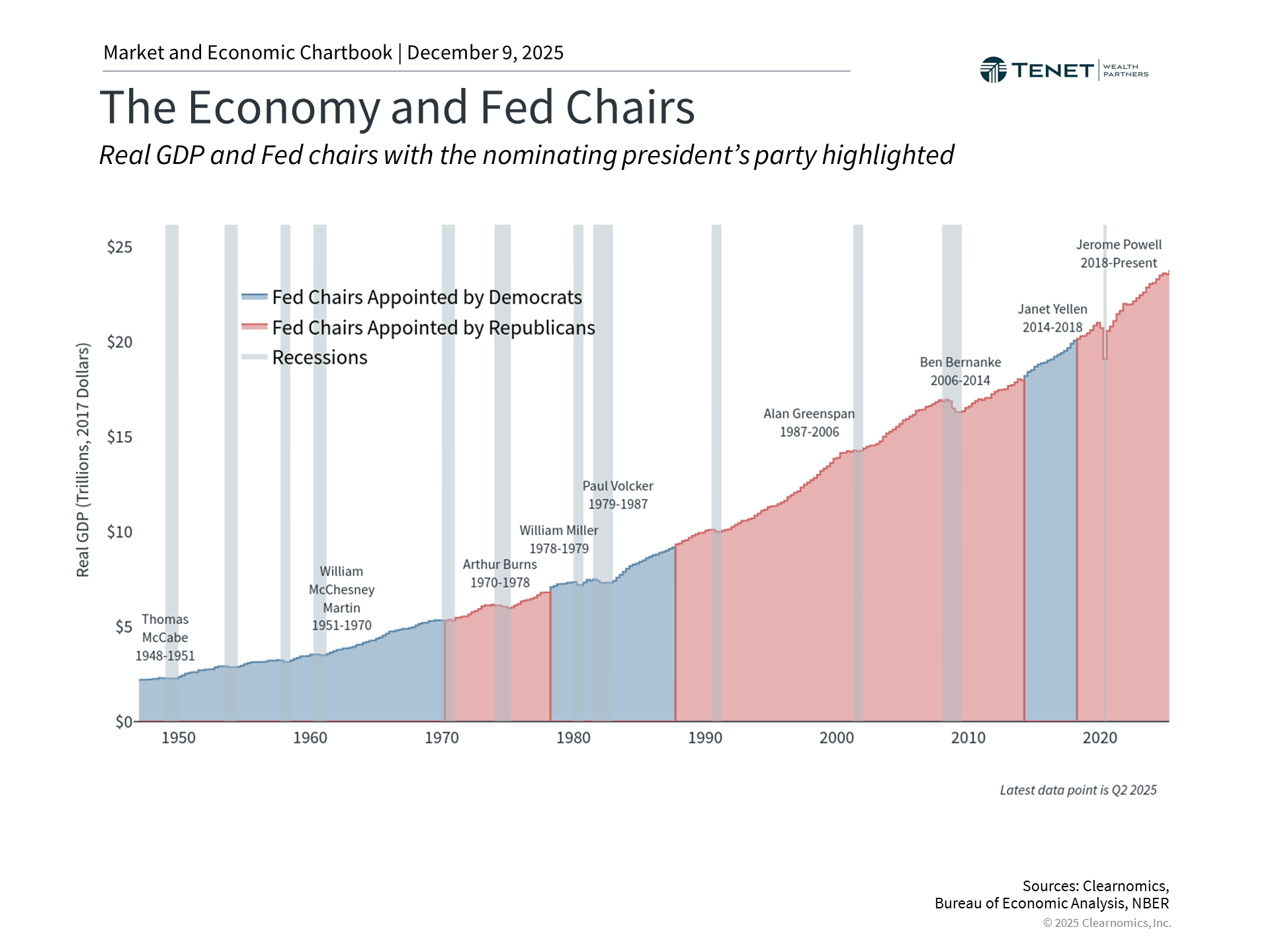

Historical data demonstrates the economy has performed well across Fed Chairs appointed by both parties. Importantly, the Fed controls only the “short end” of the yield curve—interest rates closely tied to the federal funds rate. Long-term interest rates depend on numerous other factors including economic growth, inflation, and productivity. Consequently, rather than scrutinizing the Fed’s every action and parsing each statement, investors should maintain focus on longer-term trends understanding their impact on interest rates and bonds.

Keeping perspective throughout 2026

Entering 2026, investors confront a familiar challenge: reconciling concerns with the historical reality that markets have consistently rewarded patient, disciplined investors over extended periods. While the list of potential worries remains extensive, history indicates that for every crisis disrupting markets, many more feared events never materialized. What distinguishes successful long-term investors isn’t predicting which concerns prove most significant, but maintaining balance throughout all market cycle phases. If you have questions on how to properly structure your portfolio for 2026 while aligning with you goals, contact us or schedule a consultation.

The bottom line? While markets have generated substantial returns, elevated valuations and moderating global growth warrant more tempered 2026 expectations. Rather than attempting to time markets based on any single concern, investors should prioritize maintaining balanced portfolios positioned for multiple potential outcomes.

References

1. https://www.census.gov/hfp/btos/data_downloads

2. https://www.imf.org/en/publications/weo/issues/2025/10/14/world-economic-outlook-october-2025

Registered Representative of Sanctuary Securities Inc. and Investment Advisor Representative of Sanctuary Advisors, LLC. Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. Advisory services offered through Sanctuary Advisors, LLC., a SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice.

This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.