A balance sheet is a snapshot in time of a person’s assets, liabilities, and their net worth. It captures the readily observable elements of your financial picture such as your bank accounts, investments, value of your home or a business, as well as the liabilities such as a home mortgage, student loans, etc. It can be eye-opening to see all of your assets and liabilities listed on one page and to see the grand total of your net worth. The traditional balance sheet, however, doesn’t tell the full and complete story of your financial position. There are intangible elements of your financial life that aren’t captured in traditional financial planning, but that can have a profound impact on your wealth and wellbeing over time.

Today we are highlighting the value of work. While it is tempting to view total wealth as just those assets that we can measure today, during our working years a person’s most valuable asset is often their ability to earn future income. Decisions that you make today to maximize your earnings potential can have a huge impact on your bottom line for years to come. The ability to earn an income is your superpower and the fuel to your wealth-building engine. In finance, we call this phenomenon “human capital” or the present value of expected future income. Let’s take a look at an example:

Example: Emily is a 23-year-old college graduate with a degree in Business Administration. She just accepted an entry-level position at ABC Corporation with a starting salary of $65,000. Emily plans to save 10% of her salary each year for her retirement goals and expects an annualized average rate of return of 6% on her investments. She plans to work until she is 65 years old, earning a 2.5% salary increase each year keeping pace with her inflation expectations.

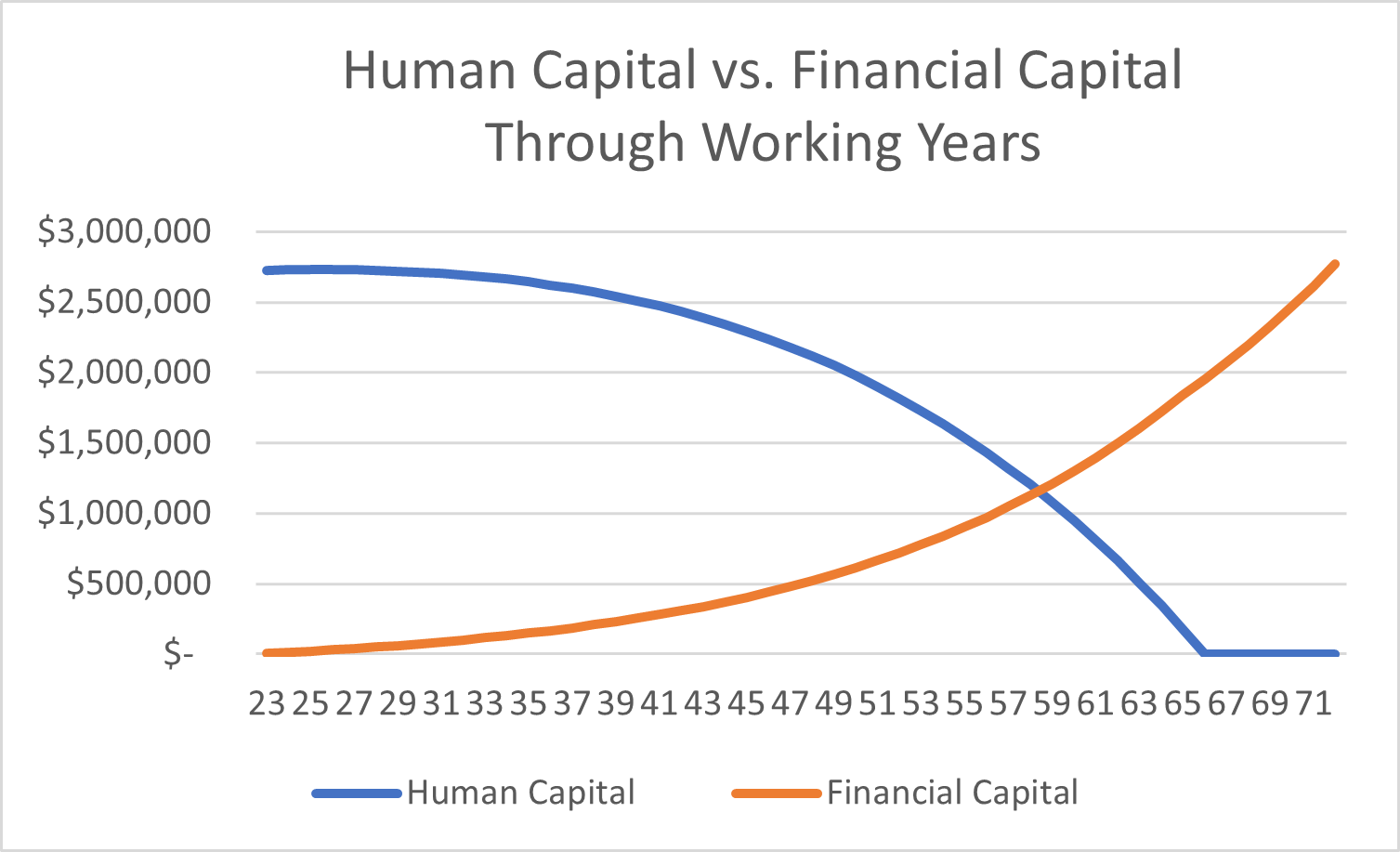

As demonstrated in the chart above, early in Emily’s career the value of her human capital far exceeds that of her financial capital. In fact, Emily’s net worth on a traditional balance sheet at the beginning of her career is zero. But luckily for Emily, the balance sheet doesn’t tell the full story of her financial potential. With 43 years of expected income ahead of her, the present value of Emily’s human capital is over $2.7 million. As she progresses through her working years and invests a percentage of her income each year, the value of Emily’s financial capital eventually replaces that of her human capital as she approaches retirement.

In this scenario we assumed Emily’s salary remained relatively stagnant over her career with modest annual raises to keep pace with inflation. What happens if Emily negotiated a slightly higher starting salary? If Emily was able to increase her starting salary by just $3,250 (or 5%), she would enjoy nearly $250,000 more income over her career. Seemingly small salary increases can have dramatic effects when you add time and compounding.

If Emily can turn $3,250 into $250,000 by simply negotiating her starting salary, imagine what can happen if she advocates for and invests in her advancement throughout her career. Consider what would happen if Emily went back to school to earn an MBA and advanced throughout her career through promotions, pay raises, and proactively seeking opportunities. Not only can advocating and investing in her career payoff in higher income, but it may also increase the value of her financial capital as she continues to save and invest a percentage of her income each year.

Being intentional and focused on long-term earnings growth can have a significant effect on a person’s overall financial position. Of course, there are a million and one different ways our career paths can unfold. Some individuals earn a stable salary like our example, while others may have more variable income, own a business, or choose a different retirement age. But the common theme among all these scenarios is that your future income is a valuable asset whether or not it is counted on your balance sheet. We encourage our clients to consider themselves their greatest investment and recommend several ways to maximize their lifetime earnings and career contentment.

Ways to increase your earnings potential and human capital:

Invest in your education and skills.

Skills, experiences, and deepening your knowledge can increase your earnings potential as well as the value you bring to an employer or to your own business. While going back to school or hiring a career coach may add a cost today, consider what benefits it may add to your lifetime earnings potential.

Document your successes as they occur in a “highlight reel”.

Set aside time on a weekly basis to write down what is going well and positive feedback you have received on the job from customers, colleagues, and higher-ups. Not only will this document save you time when preparing for a review or salary negotiation, it will also make you feel great as you reflect on your positive achievements.

Advocate for yourself.

Did you know that 54% of American workers reported that they have never, I repeat never, negotiated their salary?[1] The statistics are even more dramatic for American women, 57% of whom reported that they have never negotiated pay compared to 51% of American men. As we saw from Emily’s example above, if you don’t advocate for your worth throughout your career, you may be leaving money on the table. Many people report feeling uncomfortable negotiating their salary, but keep this statistic in mind – 70% of managers actually expect you to negotiate your salary.[2] While we always want to advocate for our financial worth in our jobs, the value of other workplace benefits can have a big impact on our lives, as well. For example, consider negotiating for paid time off, flexible work arrangements, and education or career training.

Network Develop and cultivate your professional network.

Having a professional network increases your human capital as your network can be a resource for future career opportunities. Consider developing both a broad network as well as a smaller more intimate group of colleagues with whom you can share advice and support.

Have a positive mindset. The working world is not a zero-sum game. Research suggests that having a positive mindset can increase one’s ability to succeed at and enjoy your work.[3]

Be flexible and keep your eyes open. Be knowledgeable about career opportunities within your field of expertise. Keep abreast of industry trends and news by keeping up with your professional network, attending conferences, and reading news and posts related to your line of work.

Seek a fulfilling career for a fulfilling life.

While we often focus on the financial implications of work, the intrinsic satisfaction that comes from a fulfilling career has immeasurable value. Let’s face it, many of us spend more time working than any other single activity. How well does your career align with your core values, skills, talents, and passions? Does it provide you with an ability to balance your career with your personal needs and aspirations? Research shows that people who are happy and content in their careers tend to do better financially, are more productive, have better health, and rate higher satisfaction in their lives.[4]

At Tenet Wealth Partners, we strive to serve as a steadfast advocate for our client’s financial well-being and to help them align and maximize their resources with a life that they value. While traditional financial planning may focus exclusively on what is measurable, we understand that there is so much value to be gained by looking within and beyond the balance sheet to help clients explore and live a life that is meaningful to them. We invite you to reach out to us to learn more about our unique approach to financial planning and wealth management.

Registered Representative of Sanctuary Securities Inc. and Investment Advisor Representative of Sanctuary Advisors, LLC. Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. Advisory services offered through Sanctuary Advisors, LLC., a SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.

References:

[1]Randstad North America. (2021). “Salary and Compensation Statistics on the Impact of COVID-19.” Randstad. North America. https://rlc.randstadusa.com/for-business/learning-center/future-workplace-trends/randstad-2020-compensation-insights

[2] Robert Half. (2019, February 13). “Salary Negotiation.” Robert Half International, Inc. https://www.roberthalf.com/blog/compensation-and-benefits/salary-negotiation

[3] Indeed Editorial Team. (2021, March 5). “Positive Thinking in the Workplace: Benefits and Tips”. Indeed. https://www.indeed.com/career-advice/career-development/positive-thinking-in-your-career.

[4] Achor, Shawn. (2011, June 23). “The Happiness Dividend”. Harvard Business Review. https://hbr.org/2011/06/the-happiness-dividend