Tenet’s Monthly Investment Insights: November 2023

As we delve into the intricate world of investments, our Monthly Investment Commentary provides you with a comprehensive overview of the current market trends, economic indicators, and potential opportunities. Our team of experts analyzes the ever-evolving financial landscape to keep you informed and empowered in making strategic decisions for your financial well-being.

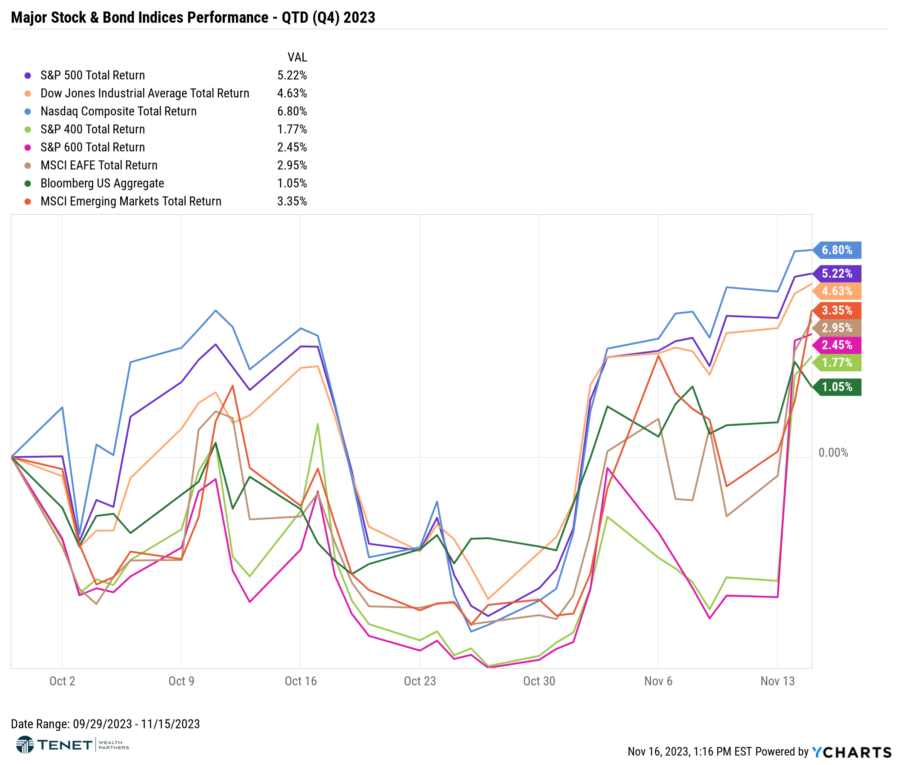

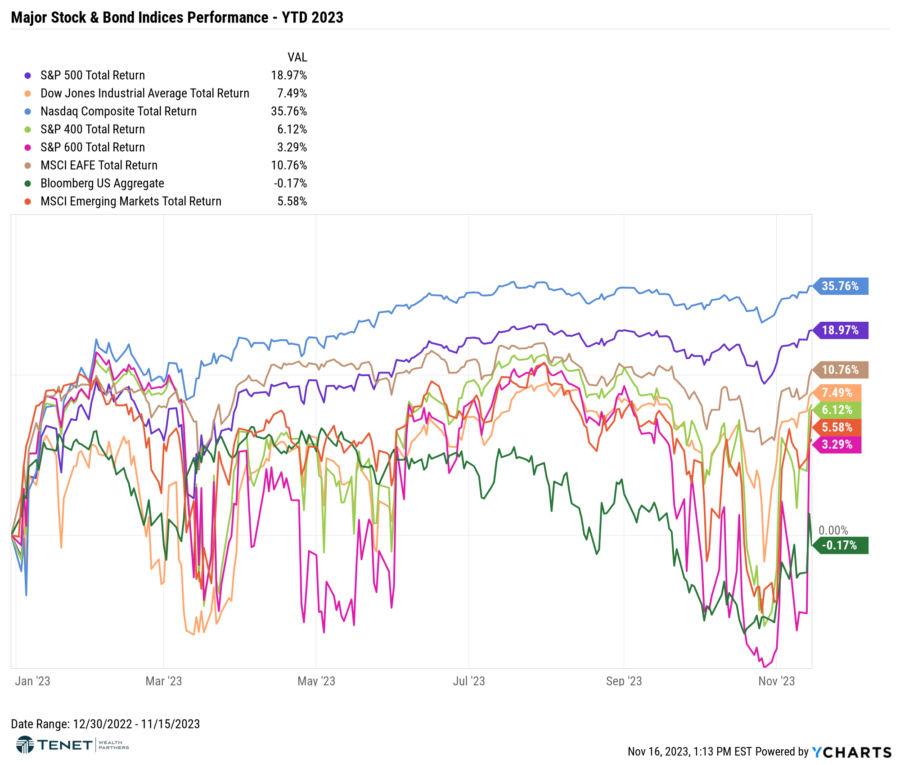

Major Index Returns – QTD & YTD 2023

Fourth quarter began with a rocky start as stocks fell globally given the prospect of “higher for longer” rates and the Israel-Hamas conflict, both of which dampened risk appetite. The best performing major equity market in October was the S&P 500 Index, down 2.1% on the month, but still up 10.7% year to date. International stocks (MSCI EAFE Index) were also down -4.3% in October.

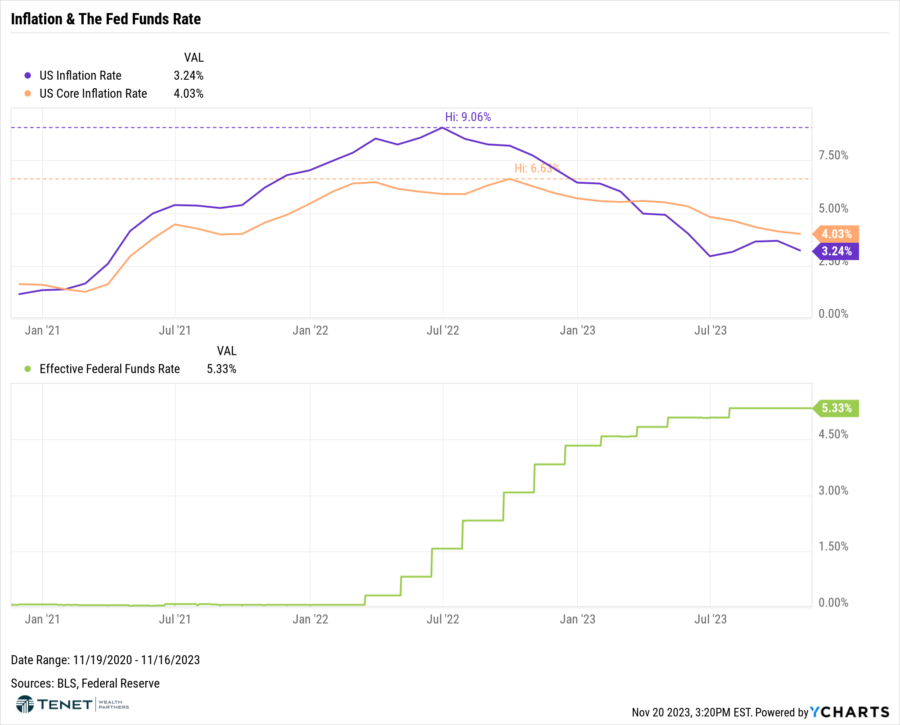

Since then, the stock market has come roaring back over the last few weeks. As of 11/15, the S&P 500 and NASDAQ are both up 5.2% and 6.8% respectively since the start of the quarter. Small and Mid Cap stocks in the U.S. (S&P 600 and S&P 400) have also seen a 2.5% and 1.8% increase, respectively. International stocks (MSCI EAFE and Emerging Markets) have jumped approximately 3% as well. Even bonds are now positive for the quarter with a 1% return since 10/1. The big jump in returns recently has mainly been driven by cooling inflation, better-than-expected corporate earnings, and softening economic data. The hope with inflation is that it continues to trend lower so that the Federal Reserve can indeed stop hiking for good (and possibly even begin cutting rates gradually sometime next year). Part of these hopes are bolstered by softer consumer spending and jobs data. This is a “bad news is good news” situation where investors see these data points as encouraging the Fed that prior rate hikes are working and further action may not be needed.

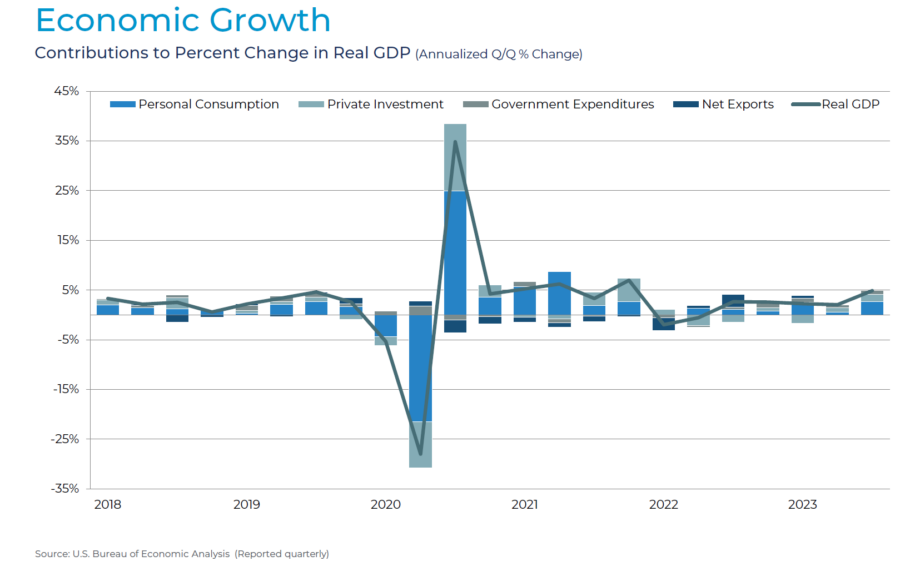

U.S. Economic Growth

The U.S. economy grew at an annualized rate of 4.9% in the third quarter as higher wages helped fuel consumer spending and businesses restocked at a brisk clip to meet the strong demand. Growth in consumer spending, which accounts for more than two-thirds of U.S. economic activity, accelerated at a 4.0% rate and added 2.7 percentage points to GDP growth, and was driven by spending on both goods and services. Though the blockbuster performance over the summer is likely not sustainable, it showcased the economy’s stamina despite aggressive interest rate increases from the Federal Reserve. Growth could slow in the fourth quarter because of the United Auto Workers’ strikes, the resumption of student loan repayments by millions of Americans and the lagged effects of the rate hikes.

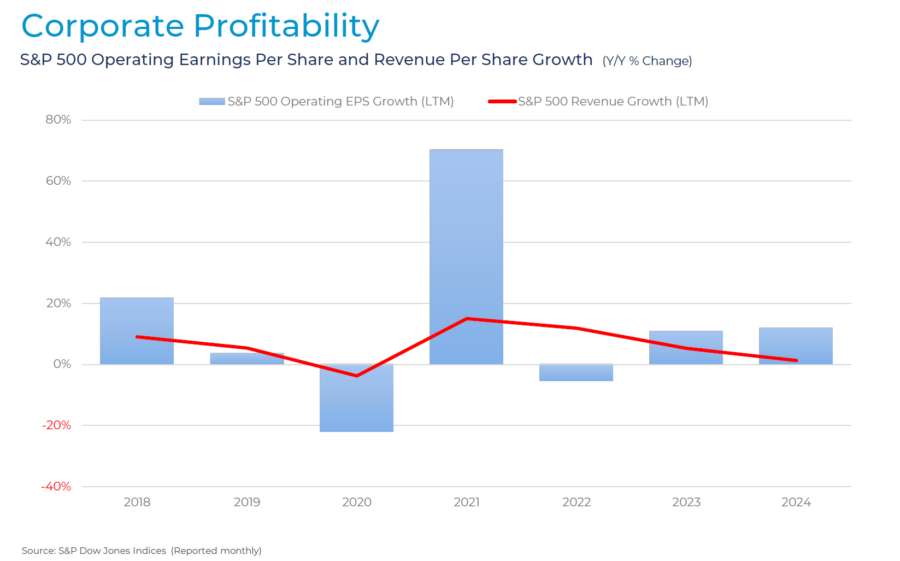

Corporate Profitability

According to FactSet, 81% of S&P 500 companies have reported a positive EPS surprise in Q3 2023 while 61% of S&P 500 companies have reported a positive revenue surprise (with 92% of S&P 500 companies reporting actual results thus far). Also for Q3 2023, the blended (year-over-year) earnings growth rate for the S&P 500 is 4.1%. If 4.1% is the actual growth rate for the quarter, it will mark the first quarter of year-over-year earnings growth reported by the index since Q3 2022. In aggregate, companies are reporting earnings that are 7.1% above expectations. This surprise percentage is above the 1-year average (+4.4%), below the 5-year average (+8.5%), and above the 10-year average (6.6%).

Looking ahead, analysts expect (year-over-year) earnings growth of 3.2% for Q4 2023, which is below the estimate of 8.0% on September 30. Thus far, 89 companies in the index have issued EPS guidance for Q4 2023 with 59 S&P 500 companies having issued negative EPS guidance and 30 S&P 500 companies having issued positive EPS guidance. For calendar year 2023, analysts predict (year-over-year) earnings growth of 0.6%, which is below the estimate of 0.8% on September 30. In 2024, analysts are calling for (year-over-year) earnings growth of 11.6%.

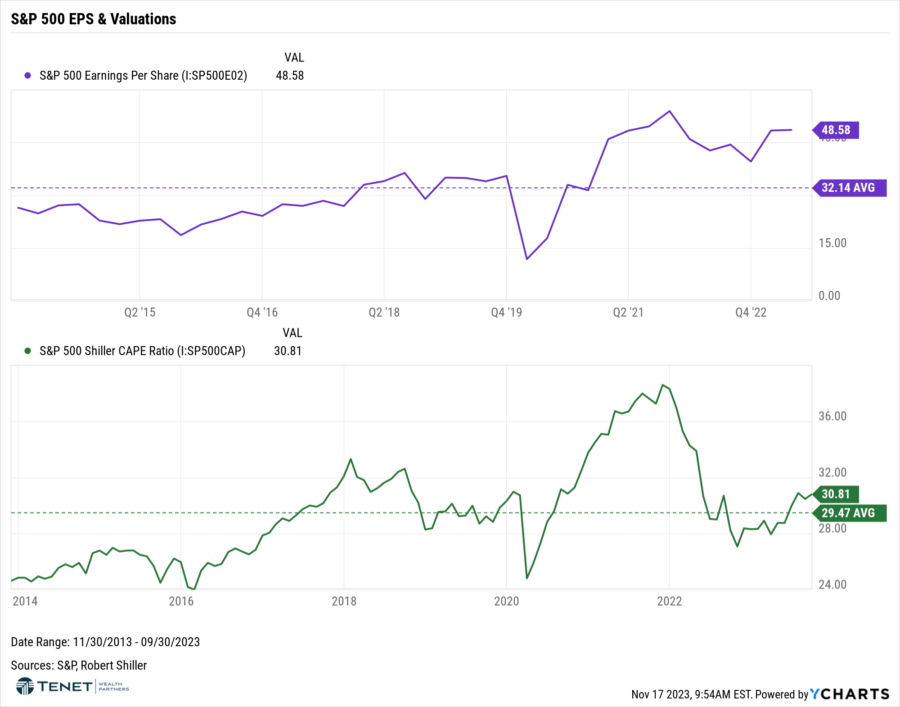

US Stock Valuations

Stock valuations have climbed back up with the recent jump in equity prices. However, the current S&P 500 Shiller CAPE ratio is only marginally higher than the 10-year average (30.81 vs. 29.47 average) while EPS is significantly higher (48.58 vs. 32.14 average). While many talk about a hot and overpriced stock market, these numbers show that we are not seeing the type of overinflated valuations that we saw in other time periods, such as the early 2000s or as recent as late 2021.

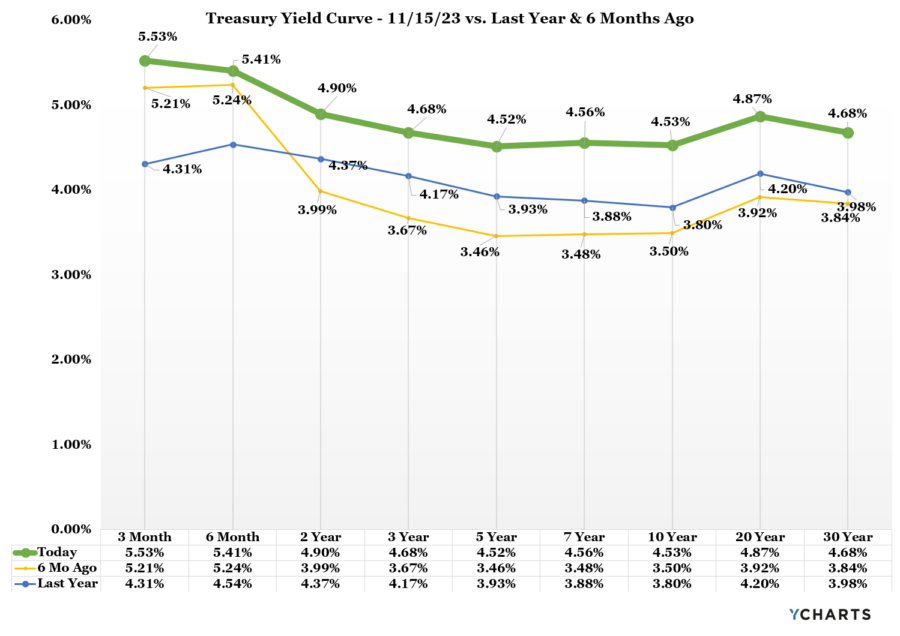

Bond Market & Yields

The rout in the bond market continued in October, with U.S. bonds down 1.6% over the month. The U.S. 10-year Treasury yield pushed above 5% for the first time since 2007, driven by a combination of buoyant economic data making ‘higher for longer’ rates look more likely, and concerns around the sustainability of government finances. A move higher in yields was seen throughout the global government bond market and in credit, widening spreads dented monthly returns for both investment grade and high yield bond markets. High yield bond markets remained the top fixed income performers year to date, with the U.S. benchmark returning 4.6% in 2023.

However, yields have fallen across the board since the start of November, with the 10-year now near 4.5%. The drop on rates can be attributed the softer than expected inflation data as well as weaker economic data. Many are now expecting the Fed to cut rates as soon as mid-2024.

Inflation Outlook

After a small jump higher in September CPI, the October inflation data came in better than expected. Headline inflation was flat while many expected a slight increase for the month. Energy prices declined 2.5% for the month, offsetting a 0.3% increase in the food index. On a more positive note, core inflation (which excludes volatile food and energy) continued to trend down, which is the preferred gauge and most often referenced by the Federal Reserve. Core CPI rose 0.2% for the month and 4% year-over-year, against the forecast of 0.3% and 4.1%, respectively. The annual rate was the smallest increase since September 2021.

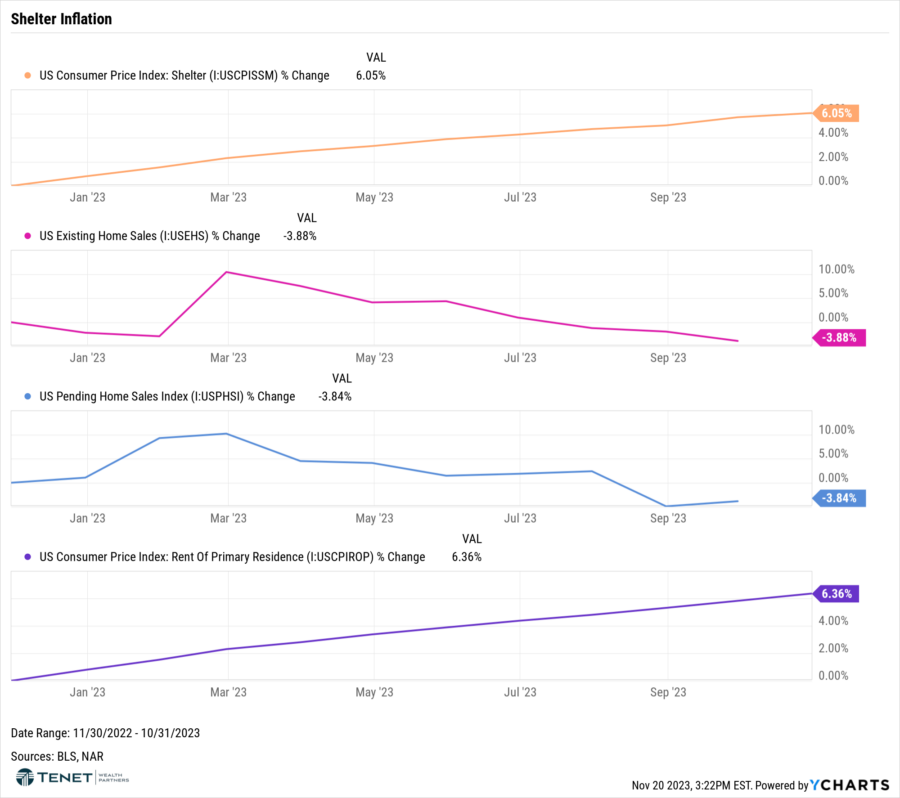

While Shelter Costs, a key component accounting for more than 40% of CPI, rose 0.3% in October, this represented half the gain that we saw in September as the year-over-year increase eased to 6.7%. Within this category, owners equivalent rent, which measures what property owners could command for rent from tenants, increased 0.4%. Given this data, it appears that rent prices, and shelter overall, are normalizing, and we should begin to see more positive momentum reflected in the CPI in the coming months as a result.

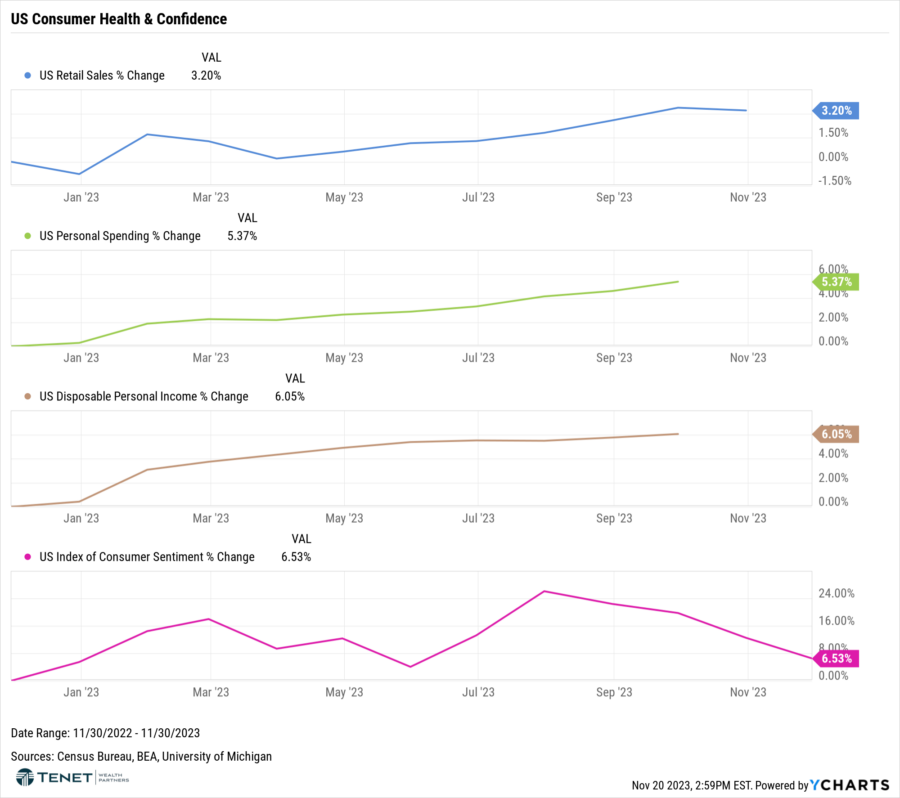

Consumer Health & Outlook

Consumer sentiment fell again in November, marking four consecutive months of decline. Survey responses showed that consumers continued to be preoccupied with rising prices in general, and for grocery and gasoline prices in particular. Consumers also expressed concerns about the political situation and higher interest rates. Worries around war/conflicts also rose, amid the recent turmoil in the Middle East. The decline in consumer confidence was evident across householders aged 35 and up, and not limited to any one income group. Retail sales also dipped 0.1% last month, which was less than the expected 0.3% drop but still the first drop since March of this year.

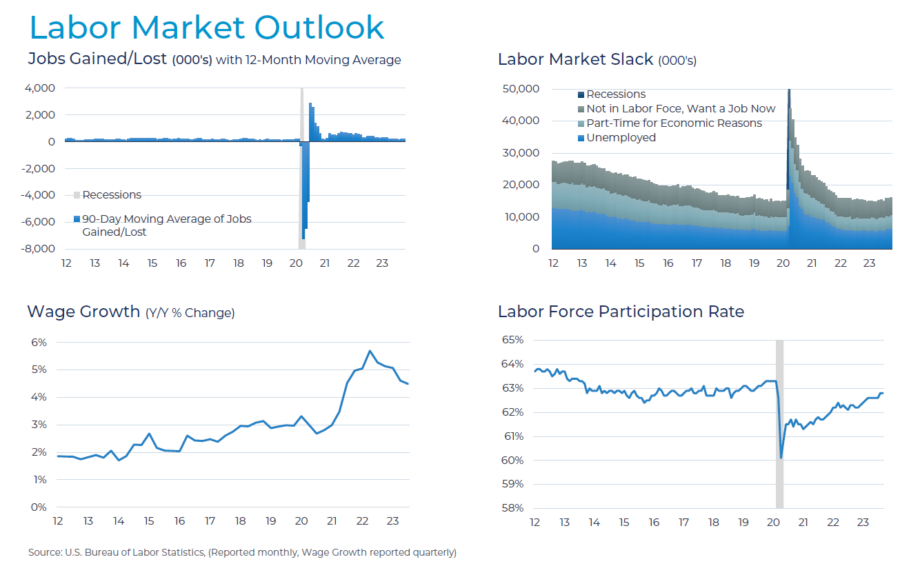

Job Market Outlook

After a surge in September, U.S. job growth slowed in October in part as strikes by the United Auto Workers (UAW) union against Detroit’s “Big Three” car makers depressed manufacturing payrolls, and the increase in annual wages was the smallest in nearly 2-1/2 years, pointing to an easing in labor market conditions. The Labor Department’s report also showed the unemployment rate rising to 3.9% last month, the highest level since January 2022. The report strengthened financial market expectations that the Federal Reserve is done raising interest rates for the current cycle and improved the chances of the U.S. central bank engineering a “soft-landing” for the economy rather than plunging it into recession as some economists had feared.

Are Bonds Poised for Take Off?

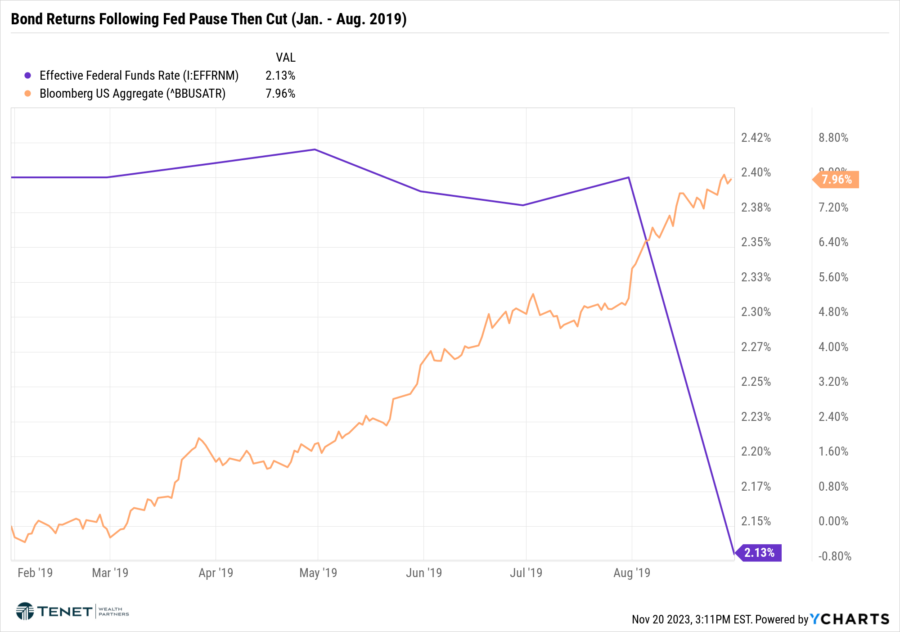

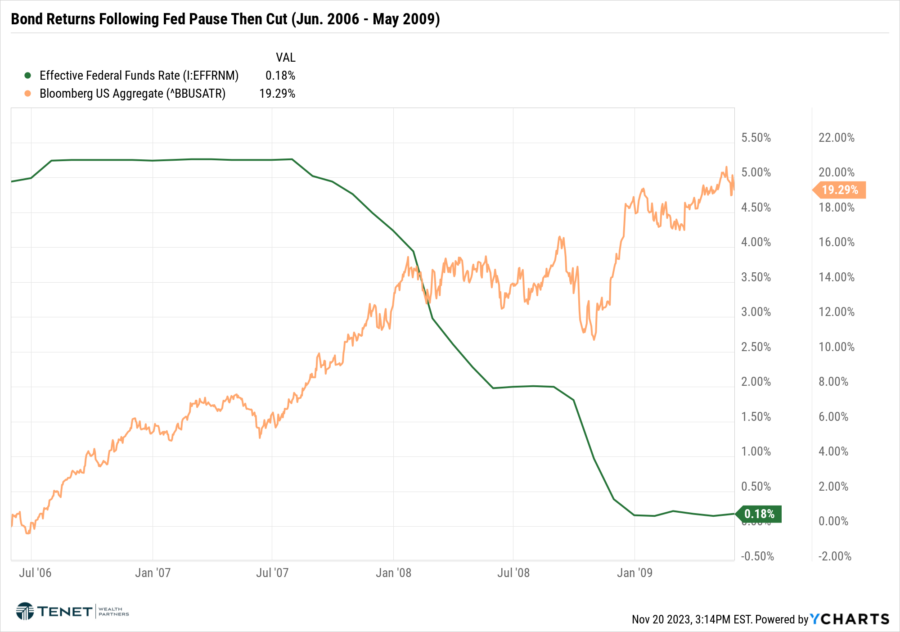

With “lukewarm” economic data increasing the probability of a soft landing, the Fed may soon be done with hiking rates, and as referenced earlier, may eventually cut rates as soon as mid-2024. Given the inverse relationship between interest rates and bond prices, a drop in rates would mean in increase in bond values. For bond fund investors, this could mean positive price performance in the near term, while investors in individual bonds could benefit from both this price performance as well as locking in attractive yields until maturity.

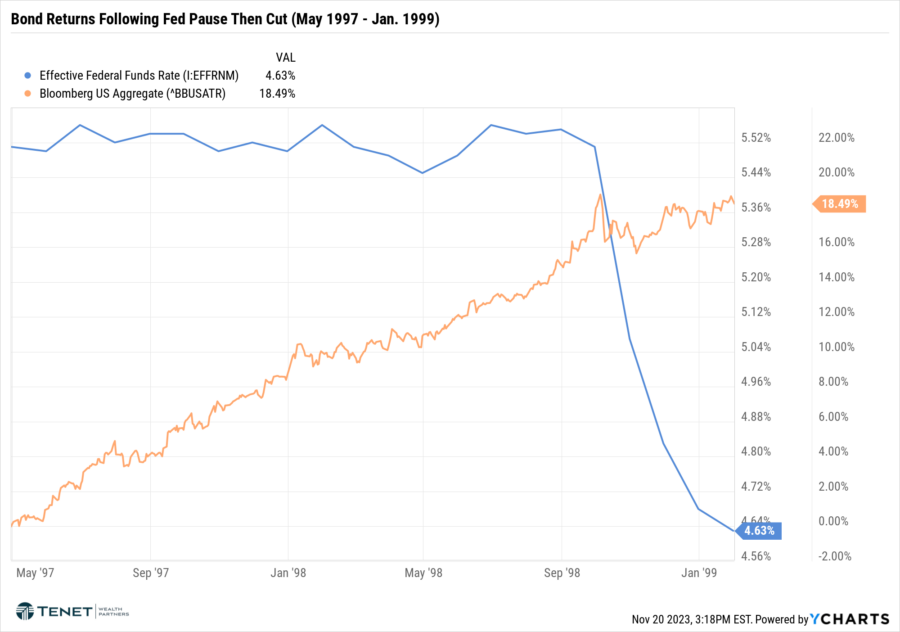

Looking back at past Fed pauses and subsequent rate cuts, there is historical precedent for bonds to potentially perform well once again in this environment:

As we head towards the final month of 2023, we will continue to keep a watchful eye on new developments, risks, and opportunities that may arise. Until then, Happy Thanksgiving, and please don’t hesitate to contact us if you have any questions!

Registered Representative of Sanctuary Securities Inc. and Investment Advisor Representative of Sanctuary Advisors, LLC. Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. Advisory services offered through Sanctuary Advisors, LLC., a SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice.

This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.