A Boost for Couples’ Financial Well-being

In a world where healthcare costs continue to rise, it’s crucial for individuals and families to have access to robust financial tools that can help them navigate these expenses. Health Savings Accounts (HSAs) have long been recognized as a valuable tool for managing medical costs, and recent developments have made them even more appealing. A recent Wall Street Journal article sheds light on the new changes that allow couples to contribute significantly higher amounts to their HSAs. This development not only offers financial relief to families but also underscores the growing importance of these accounts in securing a healthy future.

Unpacking the Changes

According to the Wall Street Journal article, the Treasury Department and Internal Revenue Service have recently revised the rules governing Health Savings Accounts to enable married couples to contribute more than $10,000 per year. Previously, the limit was set at $7,200 for families, making the increased threshold a welcome change for couples seeking to take advantage of the tax advantages provided by HSAs.

The Significance of Expanded Contributions

Enhanced Financial Security: Higher contribution limits mean that couples can now set aside more money to cover current and future healthcare expenses. As medical costs continue to soar, having a larger HSA balance provides an added layer of financial security and peace of mind.

Tax Advantages: HSAs offer a unique triple tax advantage: contributions are tax-deductible, the funds grow tax-free, and withdrawals for qualified medical expenses are tax-free. By increasing the contribution limit, couples can maximize these tax benefits and potentially save a significant amount of money on their healthcare expenses.

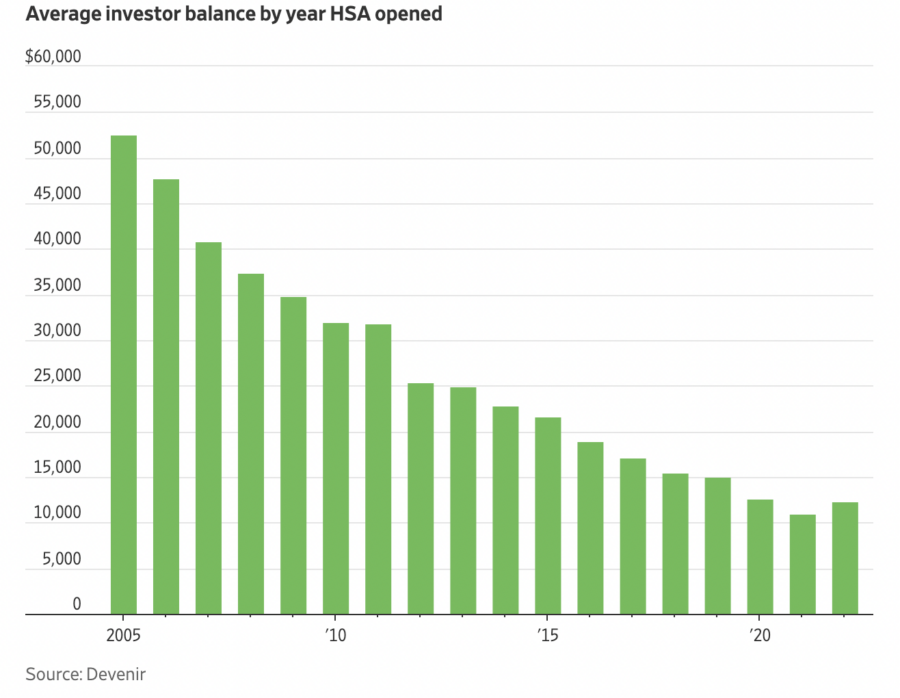

Long-Term Planning: The expanded HSA contributions can serve as a valuable tool for long-term planning. The funds accumulated in an HSA can be invested and grow over time, providing a nest egg for future healthcare needs, including retirement medical costs. This added flexibility and potential for growth make HSAs an attractive option for couples looking to secure their financial well-being.

Considerations and Potential Challenges

Eligibility: To open an HSA, couples must be enrolled in a high-deductible health insurance plan. While these plans often come with lower premiums, they require individuals to pay higher out-of-pocket costs before insurance coverage kicks in. It’s essential for couples to evaluate their healthcare needs and financial situation to determine if an HSA aligns with their requirements.

Budgeting: Contributing a higher amount to an HSA requires careful budgeting and financial planning. Couples should assess their income, expenses, and other financial goals to determine the optimal amount to contribute without compromising their overall financial well-being.

Changing Regulations: Healthcare regulations are subject to change, and while the current rules allow for increased contributions, future alterations may impact the benefits associated with HSAs. Couples should stay informed about any updates or potential changes to make informed decisions about their healthcare savings strategy.

The expanded contribution limits for Health Savings Accounts represent a significant step forward in providing couples with a powerful financial tool to tackle rising healthcare costs. By enabling couples to set aside more money for medical expenses while enjoying the tax advantages provided by HSAs, the revised rules offer enhanced financial security and long-term planning opportunities. However, it’s important for couples to carefully assess their needs, eligibility, and budgeting capabilities to make the most of these benefits. As healthcare continues to be a critical aspect of our lives, Health Savings Accounts are emerging as an indispensable tool for couples to proactively manage their financial well-being while prioritizing their health.

To learn more about tax-advantaged accounts like Health Savings Accounts and whether they would be beneficial to your financial situation, please contact us at Tenet Wealth Partners.

Investment advisory services offered through Tenet Wealth Partners, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third-party sources and is believed to be reliable.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice. This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.