Corporate earnings reports typically offer valuable insights into business performance, but this earnings cycle holds particular significance given ongoing tariff policies. Despite major equity indices hitting record levels amid more stable trade relations, questions remain about how tariffs will ultimately impact both consumers and corporations. Encouragingly, new trade partnerships are emerging while companies continue delivering results that surpass analyst projections.

Recent data indicates consumer expenditure remains robust while corporate profit growth keeps outpacing forecasts. Yale Budget Lab data shows consumers currently face an average effective tariff rate of 20.2% as of July 23, marking the highest level since 1911.1 The absence of this impact in consumer spending patterns suggests many companies are absorbing tariff costs rather than immediately transferring them to customers. This appears feasible for businesses due to solid earnings momentum and robust profit margins.

More precisely, among the roughly one-third of S&P 500 firms that have disclosed second-quarter results, 80% delivered earnings-per-share beats, with the combined earnings growth rate of 6.4% surpassing the anticipated 4.9%, per FactSet data.2 Though this expansion pace trails recent quarters, it indicates an “earnings recession” – meaning a steep decline in corporate profits like those seen in 2020 or 2022 – appears less probable than initially anticipated.

Corporate earnings are beating expectations so far

|

What is the mechanism behind tariff payments, and how might they appear in financial results? While tariffs generate government revenue, the actual burden falls either on U.S. exporters or on American consumers and businesses through elevated prices. The distribution between these groups hinges on their respective “pricing power.”

For example, consider rare earth metals essential for electronic components, which the U.S. imports almost exclusively. Given limited alternative suppliers, tariffs would likely flow directly to end users in this case. This explains why the administration has pursued expanded rare earth metal import agreements with China and encouraged domestic production capabilities.

On the flip side, the automotive sector features intense competition among domestic manufacturers and numerous countries seeking U.S. market access. When tariffs target vehicles from specific nations, those producers might absorb portions of the costs to maintain competitiveness against alternatives from other regions and local manufacturers.

Therefore, short-term tariff effects depend on variables like industry competition levels and available alternatives for consumers and businesses. Over longer periods, supply chains can adjust to new circumstances and exchange rates may shift accordingly.

Consequently, tariff impacts on earnings and corporate responses differ significantly across industries. General Motors, for example, reported $1.1 billion in tariff-related profit losses during the second quarter, with margins dropping from 9% to 6.1%.3 Meanwhile, Cleveland-Cliffs, a domestic flat-rolled steel producer, announced second-quarter earnings that exceeded expectations, gaining from tariffs that curtailed steel imports.4

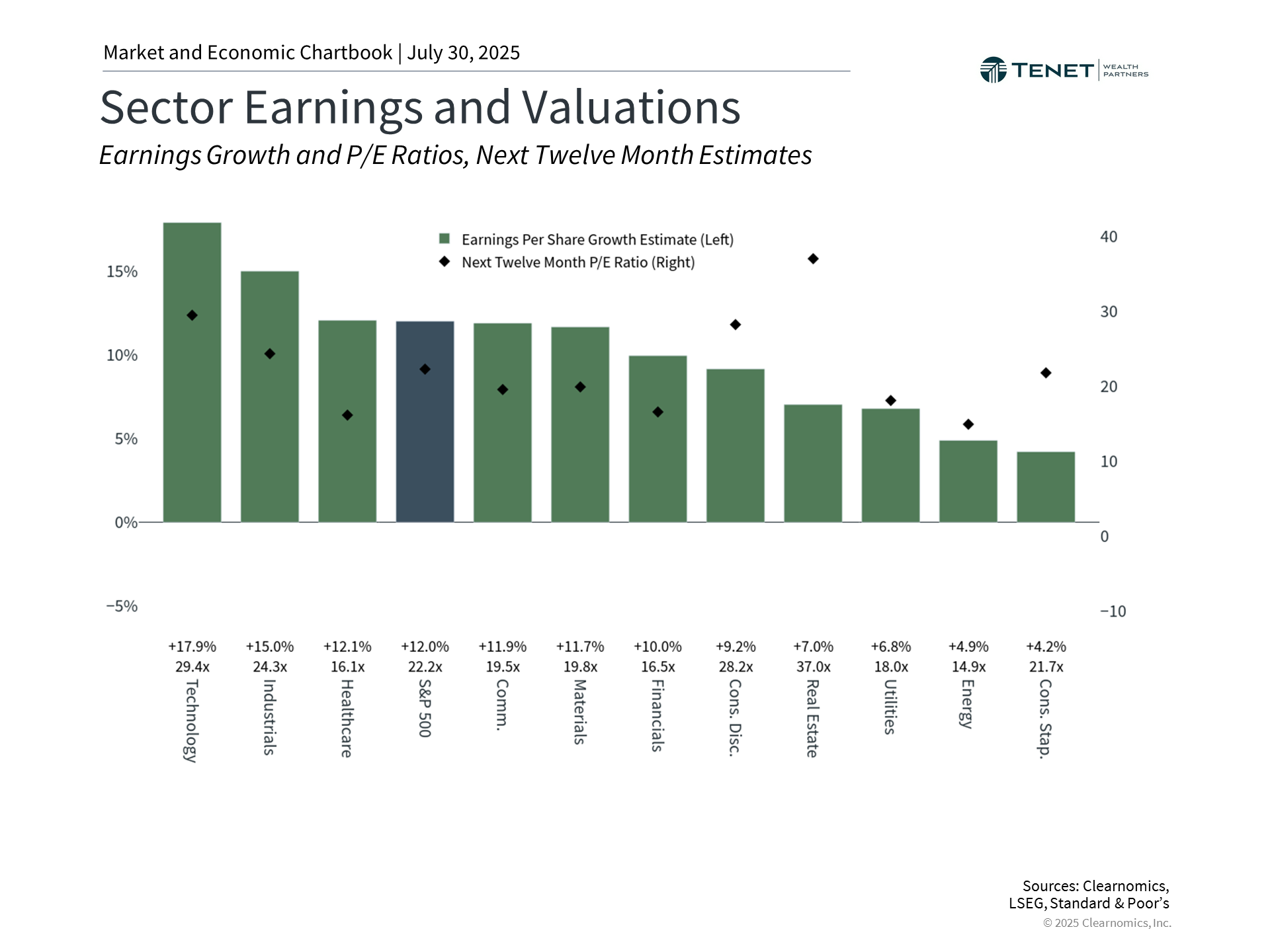

The above chart demonstrates how earnings projections vary considerably across sectors, partially reflecting trade policy impacts. Understanding tariffs’ complete effects on companies may require several quarters, particularly as new trade arrangements emerge.

Multiple nations have reached new agreements, some featuring substantially reduced tariffs compared to the April 2 announcements. Recent developments include 15% tariffs for European Union and Japanese exports to the U.S., while Indonesia and the Philippines face 19% rates. Negotiations with China continue following earlier trade truce progress.

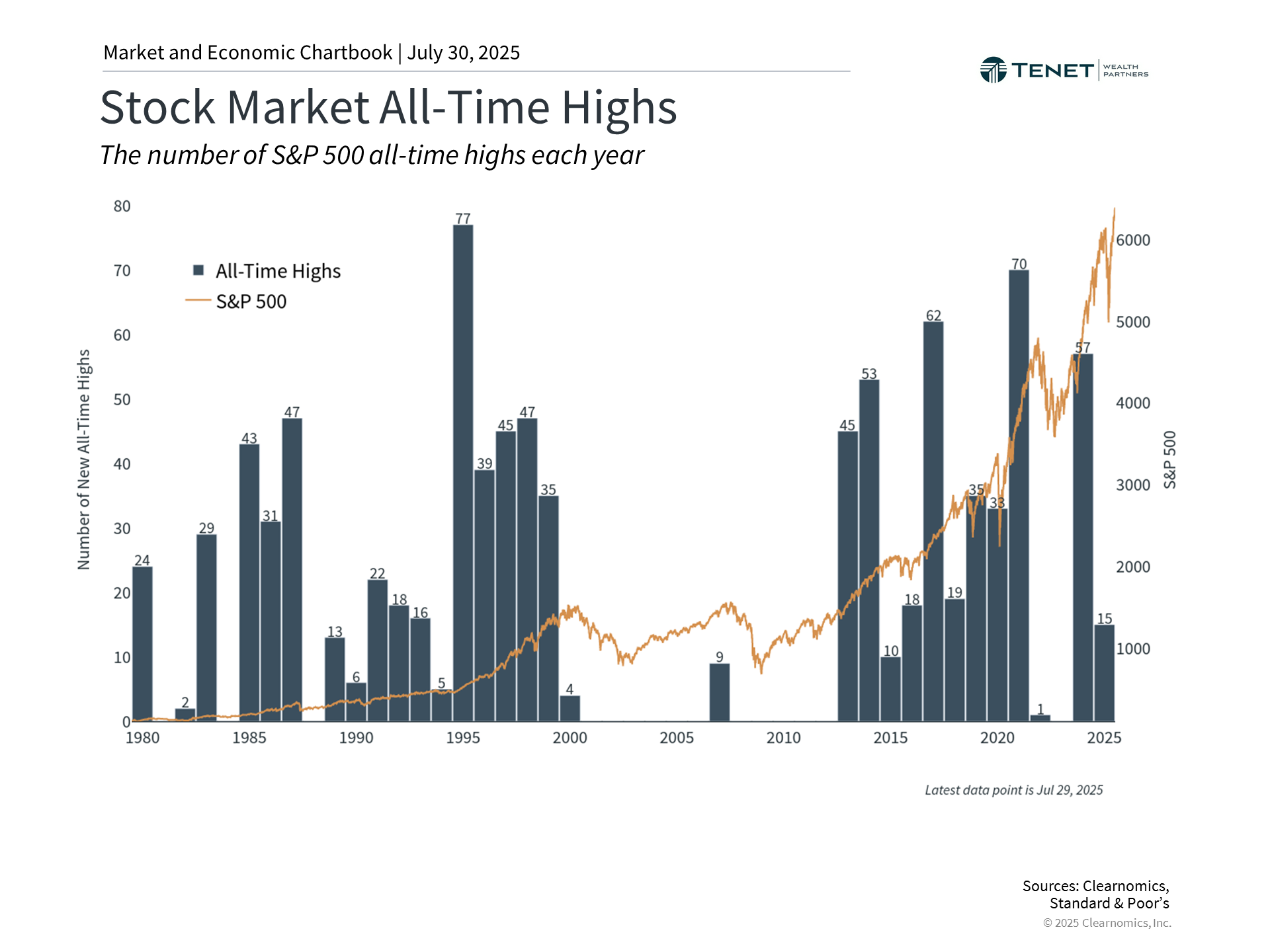

Markets continue to reach new all-time highs

|

Financial markets have maintained their record-setting trajectory as companies report earnings beats and new trade agreements take shape. The accompanying chart shows the S&P 500 achieving over twelve new peaks this year, with most occurring in recent weeks. The Nasdaq has similarly reached historic levels, surpassing its December record, while the Dow approaches new territory. Though elevated market levels may concern some investors, major indices frequently establish numerous records annually during expansion phases.

While markets perform strongly, tariff-related economic concerns persist. Various economic projections, including Federal Reserve assessments, indicate potentially higher inflation and moderately slower growth. Industry-specific impacts will reflect input cost structures, with import-dependent sectors facing compressed margins. However, these projections must be balanced against domestic investment benefits and companies’ capacity for adaptive innovation and efficiency improvements.

Though tariffs stand at historically elevated levels, predictability matters more than absolute rates, as stable business environments enable more effective operational and supply chain adaptations. Looking ahead, Wall Street consensus projects S&P 500 earnings growing at a 9.5% annual rate. These forecasts anticipate accelerating growth over the coming two years as global trade stabilizes, though significant changes remain possible.

Earnings are an important long-term driver of returns

|

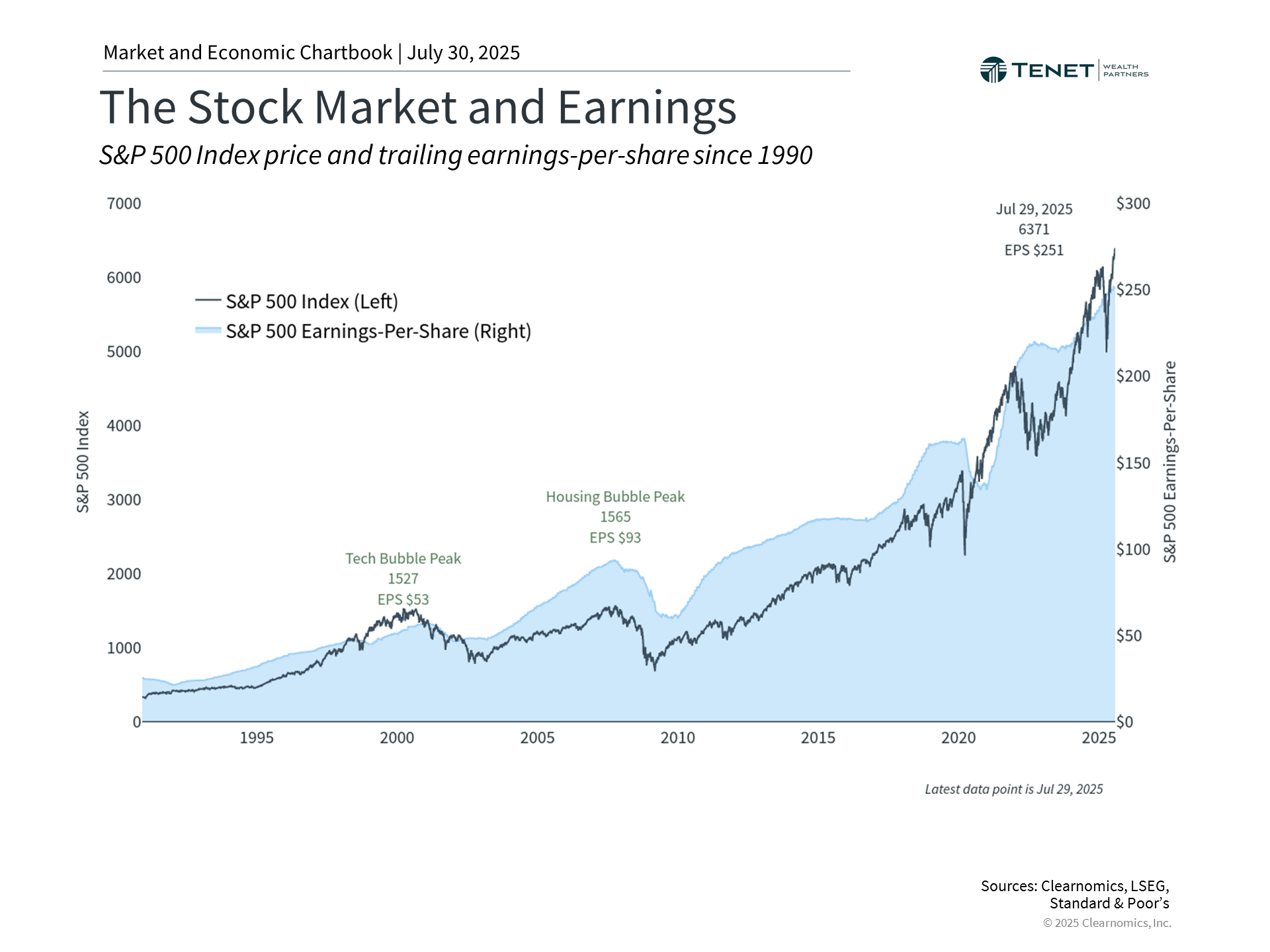

Stock markets generally track corporate earnings over extended periods. The related chart demonstrates that while S&P 500 prices and earnings don’t align perfectly, they share similar overarching patterns. This occurs because economic expansion drives earnings higher, which subsequently elevates stock valuations. Thus, while the economy and equity markets aren’t identical, they connect closely through corporate performance.

This relationship explains how tariff effects on profits can influence investors. Whether markets appear “undervalued” or “overvalued” depends on both stock prices and corporate results. The price-to-earnings ratio, for instance, equals stock or index prices divided by earnings metrics like forward twelve-month projections.

This means rising earnings can enhance market attractiveness even with unchanged prices, and the reverse holds true. The current S&P 500 price-to-earnings ratio stands at 22.2x, well above the 15.8x historical average. While current earnings trends appear positive, continued market appeal will depend on economic growth and earnings performance.

The bottom line? This earnings season may offer key insights into tariff impacts on consumers and businesses. For investors, grasping these developments while maintaining long-term focus remains the optimal approach to reaching financial objectives.

1. https://budgetlab.yale.edu/research/state-us-tariffs-july-23-2025

2. https://insight.factset.com/topic/earnings

3. https://investor.gm.com/static-files/eaf4a73f-ef85-4134-8533-902e6a9a8177

4. https://www.clevelandcliffs.com/investors/news-events/press-releases/detail/678/cleveland-cliffs-reports-second-quarter-2025-results

Investment Advisor Representative of Sanctuary Advisors, LLC. Advisory services offered through Sanctuary Advisors, LLC., a SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Advisors, LLC.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice.

This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.