In light of recent events, we wanted to focus this month’s commentary on information and perspectives related to concerns with the US banking space, which began with the failures of Silicon Valley Bank (SIVB) and Signature Bank. With the addition of recent struggles pertaining to First Republic Bank and Credit Suisse, investors are understandably on edge about the health of the banking system and the safety of their cash.

What Happened? While most are aware of what happened at this point, we wanted to provide a high-level, chronological breakdown of the events that have transpired. As you can see, there is a lot to unpack in a less than two-week timeframe!

-

- During the pandemic, SIVB, Signature Bank, and several others purchased long-term Government bonds to increase yield during a time when yields on shorter-term bonds were ultra low.

- In early 2022, Federal Reserve began hiking interest rates, causing the values of these long-term bonds to fall sharply. Technology companies, especially venture capital and start-up firms, were particularly harmed by these higher borrowing costs. Of note: SIVB provided deposit and lending services to nearly 50% of US Tech start-ups/venture firms.

- These technology/start-up companies began to use more and more of their cash to fund their businesses as lending became too expensive with higher rates. As a result, the banks began to lose deposits steadily due to an increased cash burn.

- On March 9th, SIVB announced a plan to shore up their balance sheet by attempting to raise nearly $2 billion via a share sale, which they said was needed to plug a large hole caused by selling $21 billion of their long-term Government bond holdings at a $1.8 billion loss.

- Investors became even more concerned by news of the capital raise, leading to the stock to fall 60% and investors attempting to pull $42 billion in one day (25% of SIVB’s total deposit base).

- As SIVB ran out of cash, the FDIC stepped in to take receivership of the bank. Given similar issues and concerns related to Signature Bank based in New York, the FDIC also announced the failure and subsequent takeover at Signature as well.

- To provide a backstop to depositors, given that 94% of SIVB’s deposits and ~90% of Signature’s deposits were uninsured, the FDIC, Treasury, and Federal Reserve jointly announced that they would backstop and protect ALL deposits for customers, both insured and uninsured alike. They also created a new facility (Bank Term Funding Program) aimed at safeguarding deposits by offering loans of up to one year to banks and other financial institutions if they pledge Treasurys and mortgage-backed securities.

- New concerns emerged with First Republic Bank, a California regional bank of a similar profile. While less of First Republic’s deposits were uninsured (~68%), the bank experienced significant withdrawals and also had a larger percentage of long-term Government bond holdings compared with deposits. In a show of faith and strength, a combination of 11 of the largest US banks, led by JPMorgan, deposited $30 billion into First Republic. JP Morgan is also now consulting with First Republic on options for the bank, whether that be a sale or other strategic move.

- Credit Suisse, one of the 50 largest banks in the world, has also seen their ongoing issues come to the forefront given their size and current events. While not related to SIVB’s issues, Credit Suisse has been experiencing consistent financial losses, lost a larger backer in the Saudi National Bank (owned 10% of the bank), and also has been dealing with executive turnover.

- To prevent a potential collapse of Credit Suisse, UBS stepped in and agreed to acquire the bank for $3.2 Billion, which represented a heavy discount.

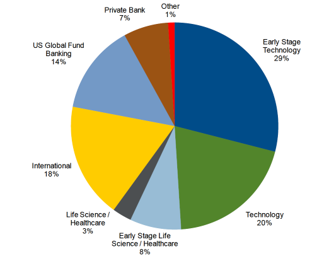

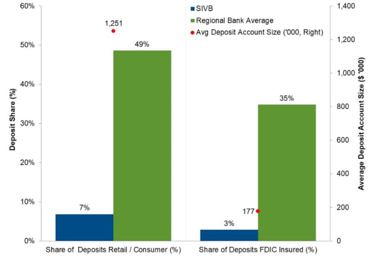

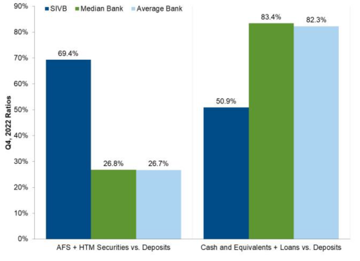

Is the banking system still safe and healthy? It is easy to see all of the headlines and issues with multiple banks and become concerned that these events may spread to the banking system at large. However, based on current information, we do not believe that this has broader implications, mainly because the cases of banks like SIVB and Signature Bank are unique. For both SIVB and Signature, each bank had a niche customer base that was concentrated in the technology start-ups and cryptocurrency spaces, respectively (see Chart 1). Most banks have a much more diverse customer base and are not concentrated in just one or two industries, especially those that were most impacted by the rising rate environment like SIVB’s and Signature’s customers. Additionally, larger regional banks’ more diversified deposit base has a higher share of insured deposits compared to SIVB, as well as an average account size that falls within the $250,000 FDIC limit (see Chart 2). Lastly, it is important to note that in comparison to average banks, SIVB had both (1) a significantly higher concentration of Government bonds (AFS + HTM securities) relative to deposits, and (2) a lower share of cash and loans vs. deposits (see Chart 3). In other words, most banks are much better capitalized and have the short-term liquidity necessary to cover heightened levels of withdrawals in a short time period.

Chart 1: SIVB Deposit Mix

Chart Source: Goldman Sachs Investment Strategy Group (“Investment Strategy Group: Q&A on Silicon Valley Bank (SIVB) and the Implications for Financial Markets” – 3/12/23), Bloomberg, SVB Earnings Filings

Chart 2: SIVB Deposit Profile vs. Other Large Regional Banks

Chart Source: Goldman Sachs Investment Strategy Group (“Investment Strategy Group: Q&A on Silicon Valley Bank (SIVB) and the Implications for Financial Markets” – 3/12/23), Bloomberg, Goldman Sachs Global Investment Research. Regional Bank Average is average of 15 large regional banks.

Chart 3: Average Banks are Better Capitalized vs. SIVB

Chart Source: Goldman Sachs Investment Strategy Group (“Investment Strategy Group: Q&A on Silicon Valley Bank (SIVB) and the Implications for Financial Markets” – 3/12/23), Bloomberg, Company Financials. Comparison universe is the set of banks in the S&P Banks Select Industry Index. AFS stands for “Available for Sale” and HTM stands for “Held to Maturity.”

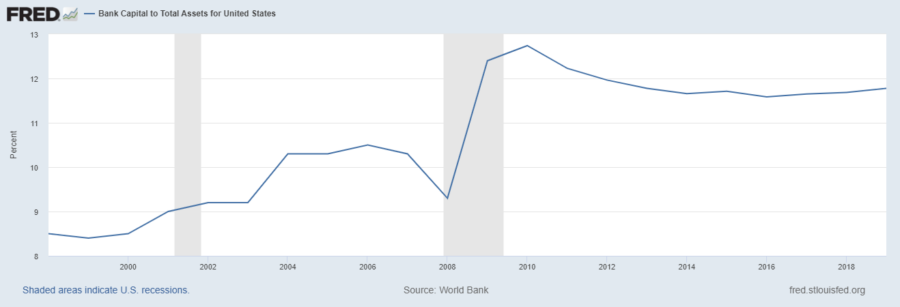

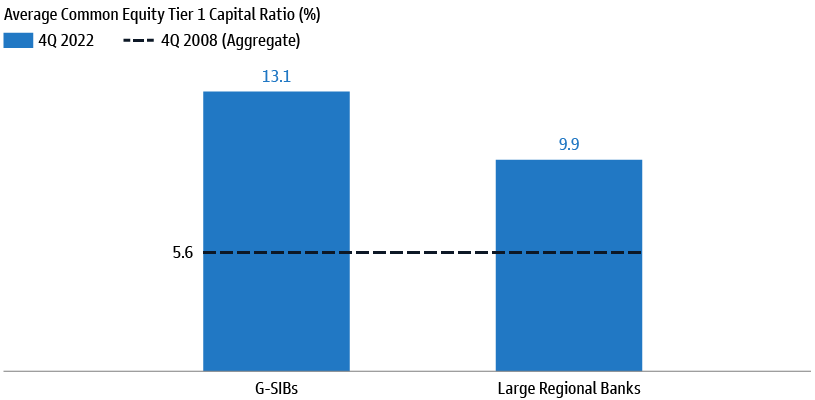

It is also worth mentioning that US banks overall, including both GSIBs (Global Systematically Important Banks) and large regional banks, are well capitalized. Chart 4 illustrates total bank capital available compared with total assets, showing that the composite of US banks has remained well-capitalized since 2008 and has actually grown steadily since 2016. Levels of Common Equity Tier 1, or CET 1, Capital (i.e., the highest quality of regulatory capital used in bank stress tests and includes bank holdings such as cash and stock) have also grown as a percent of total bank assets since 2008 (see Chart 5).

Chart 4: US Bank Capital vs. Total Assets

Chart 5: Tier 1 (CET1) Capital Ratio for G-SIB’s & Large Regional Banks (2022 vs. 2008)

Chart Sources: Federal Reserve Bank of St. Louis (FRED), World Bank, Goldman Sachs Asset Management (Market Monitor for March 17),

What else are we seeing and watching relevant to investors? We have already seen a boost to market volatility as a result of the recent banking concerns, and we will likely continue to see higher levels of fluctuations in the coming weeks/months until the situation calms down. In addition to monitoring and navigating recent market volatility, we are also keeping a close eye on the following.

-

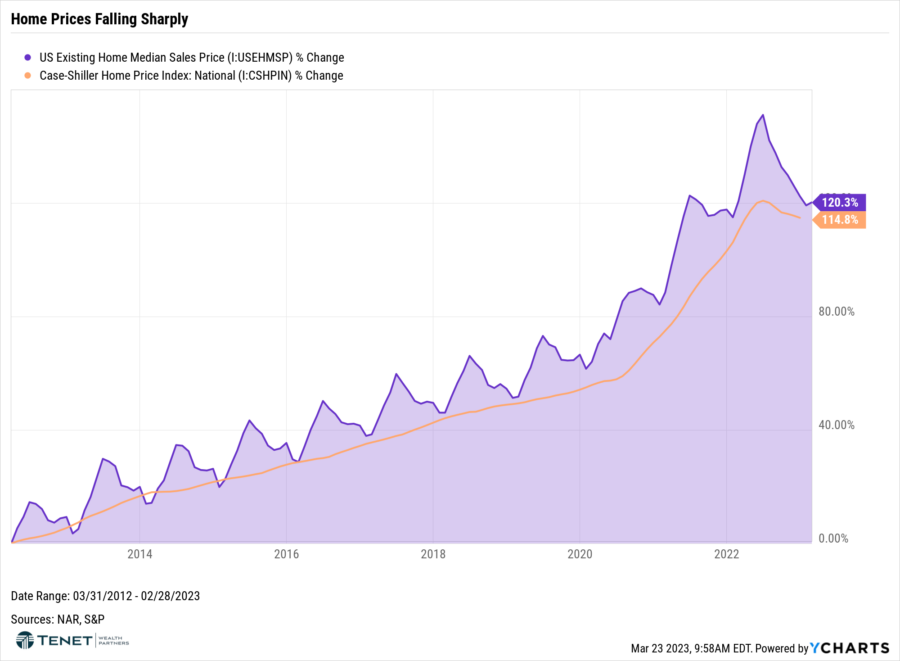

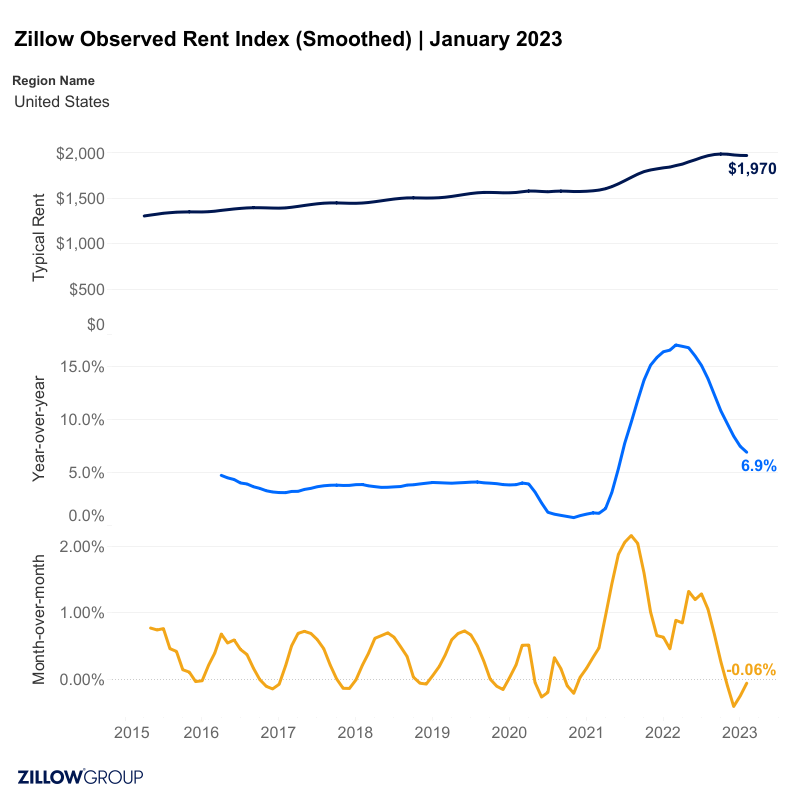

- Federal Reserve Actions / Inflation – Many have been expecting the Fed to pause (or completely stop) their rate hiking cycle given current bank concerns. However, even in the face of recent events, Chair Powell announced a 25 basis point hike on 3/22 as the Fed continues their fight against inflation. Based on Powell’s comments, it appears that the Fed will either proceed with only one more rate hike or be done completely, which is also what the market is now pricing in. In terms of inflation, and as we have mentioned before, there is still a big part of the CPI inflation reading (falling shelter costs) which is yet to truly be reflected in the actual data. Just this week, it was reported that home prices dropped in February for the first time in 11 years. When included with falling rents that we have seen since September 2022, we anticipate that these numbers will begin showing up in CPI in the coming months. This should help illustrate that past rate hikes have been helpful and further increases may not be necessary.

-

- Future Government Actions (New Legislation/Regulations/Oversight) – We will cover this further below, but we do believe more regulation/new legislation is likely coming. While there have already been backstops announced to help in the short-term, a long-term action plan could help investors and consumers breathe an even deeper sigh of relief. Renewing confidence and reducing fears is critical to moving forward.

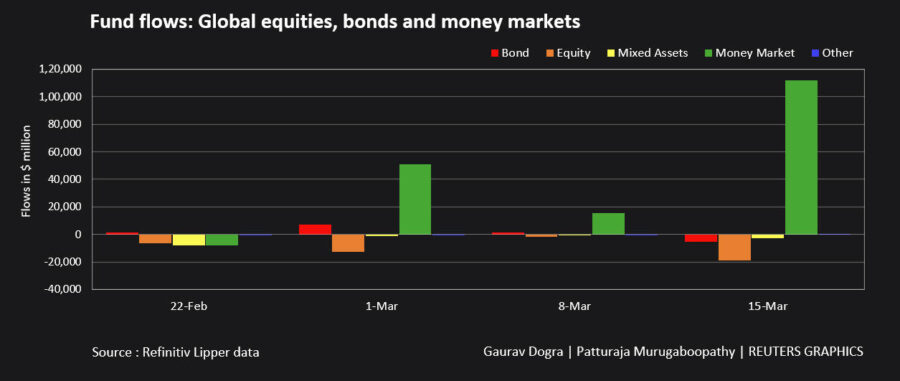

- Bank & Money Market Fund Flows – Not surprisingly, many consumers and investors have been pouring cash into money market funds over the last two weeks as confidence in banks has waned. Even looking at the week of March 15th alone, we saw over $100 billion invested into global money market funds, most of which went to Government/Treasury money funds. As of the start of this past week, assets held in money market funds has jumped to a record-high of $5.4 trillion, the fastest pace since the pandemic. For investors, this represents an alternative, cash-equivalent that is both liquid and considered safe, even though these funds are securities and not FDIC-insured. For banks, losing deposits to these types of products is the opposite of what they need and detrimental to their ability to manage withdrawals. With that being said, some positive comments made by Fed Chair Powell this week (who has a lot more data at his disposal than anyone in the industry) should instill more confidence on this topic: “The banking system is safe. Deposit flows in the banking system have stabilized over the last week,” Powell said.

Sources: Reuters (“Global money market funds draw massive inflows in week to March 15”), MarketWatch

-

- Banking Sector Stocks – Banks stocks, particularly those of regional banks, have taken a big hit over the last couple of weeks. Of course, this has been driven by fear about the health and stability of banks overall but particularly with banks of similar profiles as SIVB and Signature Bank. Most regional banks are on very strong footing at this stage, so there is not evidence of widespread fundamental issues across banks. However, the need for banks to potentially start paying higher interest rates on deposits could squeeze their margins and hurt profitability, not to mention potentially stricter lending requirements moving forward. The largest banks have deeper pockets to absorb and adjust accordingly, so this could impact regional banks the most. Being selective, focusing on quality, and having a deep understanding of the financial health of each bank will be key in the months ahead, as well as keeping your Financial sector exposure well-diversified overall.

What happens next? While there are still several unknowns, we are confident that the Government will be (and likely already is) reviewing ways to better regulate US banks and protect consumer deposits to prevent a future crisis. While the structural issues we have learned about have been limited to a handful of banks thus far, it will be important to shore up the system overall and plug holes where current and potential risks may lie.

Some predicted changes with longer-term implications include raising the FDIC limit to a higher level than the current $250,000, similar to what happened after the Great Recession. If this happens, it could provide more confidence in the safety of deposits, but it could also indicate more Government control of the banking system at large. Some have suggested that the Government could move to insure all deposits across the board. However, this is extremely unlikely given that it would essentially seem like the nationalization of banks at that point. Speaking of Government involvement, President Biden and other lawmakers have recently made comments suggesting the need to strengthen rules and regulations for banks. However, many other lawmakers have said that the rules needed to prevent these issues are already in place and saying that the responsibility falls on regulators (and bank management) to better oversee and manage potential risks. More official discussions are set to take place on March 29th when the House Financial Services Committee meets to have its first hearing on the matter.

Another potential change is to expand the more stringent capital requirements that currently apply to only the largest banks to include large regional banks as well. After 2008, the Dodd-Frank Act initially subjected all banks with $50 billion or more in assets to greater regulation, including annual stress testing and resolution plans in the event of bankruptcy. However, after years of concerns and complaints from regional and community banks about compliance costs, Congress increased the size threshold to $250 billion. Banks under $100 billion were completely exempted from the heightened regulations, while banks between $100 billion and $250 billion were reviewed on a case-by-case basis (SIVB and Signature Bank were part of this group).

From a strategic and operational perspective for banks, it is possible that banks (particularly regional banks) may need to offer higher deposit rates to both attract and keep deposits. Generally, you only see higher-yielding interest rates at online banks, such as Capital One or Discover. However, we may see this change to increase capital and liquidity for regional banks. We may also see more competitiveness on the lending side as well. Additionally, it is likely that banks internally review and update their risk management practices to be more prepared and find ways to proactively identify issues before they occur.

Confidence in the banking system is currently fragile, and the biggest risk from our perspective is a continuance of fear and anxiousness amongst consumers and investors. This low confidence will likely remain for the next several weeks/months until there is more certainty around next steps to curb future issues, as well as further reassurances about the health and stability of the system. In the short-term, and even considering their recent unprecedented actions, we expect the Government to continue supporting the banking system and pulling all levers necessary to protect deposits. We also expect longer-term proposals and solutions in the weeks and months ahead.

As with any period of uncertainty and market volatility, staying well-diversified in portfolios remains critical to managing risk. Our team will continue to monitor the situation and portfolios closely, but please don’t hesitate to reach out to us with any questions!

Registered Representative of Sanctuary Securities Inc. and Investment Advisor Representative of Sanctuary Advisors, LLC. Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. Advisory services offered through Sanctuary Advisors, LLC., a SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice. Tenet makes no representations as to the accuracy and completeness of information provided herein. Any investment discussed may not be suitable for all investors. Investors must make their own decisions based on their specific investment objectives and financial circumstances. Additional information available upon request.

This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.