Beginning at age 73, most retirement savers are required to take Required Minimum Distributions (RMDs) each year, regardless if they need or want the funds. These distributions are taxable at their ordinary income tax rate, which increases the individual’s total taxable income as a result. While the tax bite may seem inevitable, there is a tax-efficient strategy that allows philanthropic individuals to both save on taxes while also supporting those charitable organizations that they most care about: Qualified Charitable Distributions (QCDs).

Understanding Qualified Charitable Distributions: Eligibility and Rules

Understanding Qualified Charitable Distributions (QCDs) involves a careful consideration of eligibility requirements and adherence to specific rules. To qualify for QCDs, individuals must be at least 70½ years old. Eligible IRA accounts include traditional IRAs, but not Roth IRAs, as the latter do not require RMDs. The key rules governing QCDs encompass an annual limit, restricting distributions to a maximum of $100,000 per taxpayer.

Furthermore, QCDs necessitate a direct transfer from the IRA custodian to the qualified charitable organization, emphasizing the importance of a seamless and direct transaction. This direct transfer requirement distinguishes QCDs from traditional IRA withdrawals for charitable giving purposes, where funds are withdrawn first and then contributed to a charitable organization. QCDs provide a tax-efficient means for eligible individuals to support charitable causes while satisfying RMD obligations, offering a strategic avenue for philanthropy within the framework of retirement planning.

Strategic Considerations for Qualified Charitable Distributions

Strategic considerations for Qualified Charitable Distributions (QCDs) underscore the importance of coordinating these distributions with required minimum distributions (RMDs) to optimize tax benefits. Timely execution of QCDs can minimize the tax impact and align with philanthropic goals, allowing individuals to strategically manage their financial affairs. Coordinating QCDs with RMDs can enhance tax efficiency, as the QCD amount can be used to satisfy the RMD requirement, effectively reducing taxable income. Timing QCDs towards the end of the tax year or during periods of higher expected income may further mitigate tax implications.

Case Study: A Real-World QCD Example

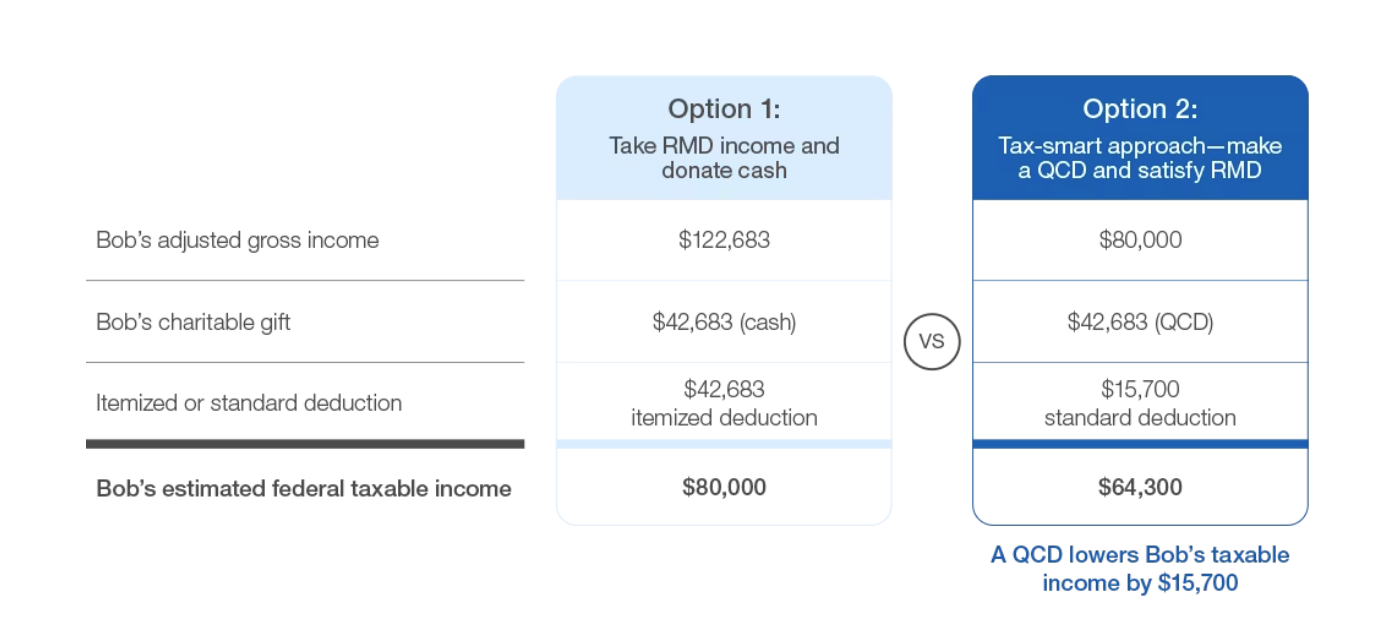

Source: Schwab Charitable (“Two tax-smart tips for charitable giving with an IRA” – dated 2/15/2023). This example is only for illustrative purposes. Both examples assume no Social Security income and that the charitable gift is to an operating charity.

In the above example, “Bob” is 74 years old and is required to withdraw his $42,683 Required Minimum Distribution (RMD) from his $1 Million IRA. Let’s assume his ordinary income (after accounting for itemized deductions) is $80,000 this year. If he goes the route of option #1 where he takes his RMD and then donates the funds to charity, his Federal taxable income will be $80,000. However, if he instead distributes his RMD directly from his IRA to a qualified charity, his taxable income would drop by $15,700 to $64,300. Given he is a single individual and in the 22% tax bracket for 2023, his approximate Federal tax savings from this QCD would be ~$3,500.

Navigating Qualified Charitable Distributions: A Step-by-Step Guide

For those that qualify and are interested in taking a QCD, the process of doing so is straightforward, whether you self-manage or work with an advisor:

- Donor identifies the charitable organization(s) to whom they would like to make a donation and confirms that the receiving organization is qualified under Internal Revenue Code § 170(b)(1)(A).

- Donor decides on a total amount to give within the $100,000 annual maximum.

- Donor contacts their IRA administrator/custodian, or Financial Advisor, to request the distribution from their IRA account, specifically citing the desire to make a “Qualified Charitable Distribution.” This is usually done via check made payable to the qualifying charity. Donor may need to sell securities to raise the cash necessary to satisfy the distribution amount.

- During tax season, donor must provide documentation to their tax preparer that shows the amount they gave to charity from their IRA as well as the qualified charity as payee. Unfortunately, Form 1099-R, which normally reports distributions from retirement accounts, does not currently include an area to designate QCDs.

A QCD can be an excellent tax-efficient mechanism to consider as part of your overall charitable giving strategy. Like any strategy involving taxes, it is critical to work with a qualified tax professional and financial planner when considering moves such as a QCD.

Harnessing the Power of Qualified Charitable Distributions for Tax-Smart Charitable Giving

In summary, Qualified Charitable Distributions (QCDs) provide a robust strategy for individuals seeking to align philanthropy with tax-efficient retirement planning. The key benefits encompass the dual fulfillment of required minimum distributions (RMDs) and charitable contributions, leading to optimized tax advantages and a strategic approach to financial management. To harness these advantages effectively, it is imperative for individuals to engage with experienced financial advisors or tax professionals who can evaluate their unique circumstances and offer tailored guidance.

Collaboration with experts enables individuals to navigate the complexities of QCDs, ensuring the optimization of charitable contributions in a manner that aligns with both financial and philanthropic objectives. For those interested in delving deeper into QCDs, the Tenet team is readily available to discuss QCDs and their potential benefits for your specific situation. Feel free to reach out with any questions—your financial well-being is our priority!

Registered Representative of Sanctuary Securities Inc. and Investment Advisor Representative of Sanctuary Advisors, LLC. Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. Advisory services offered through Sanctuary Advisors, LLC., a SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice.

This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.