Welcome to 2024! With the year officially underway, we are looking ahead at what risks may arise and what opportunities may present themselves along the way. For this year’s outlook, we’ve decided to shine a spotlight on the “most likely” scenarios from an economic and investment perspective. Without further ado, here are our “nominees” for “most likely to” for each of the key themes and opportunities we will be watching closely this year….

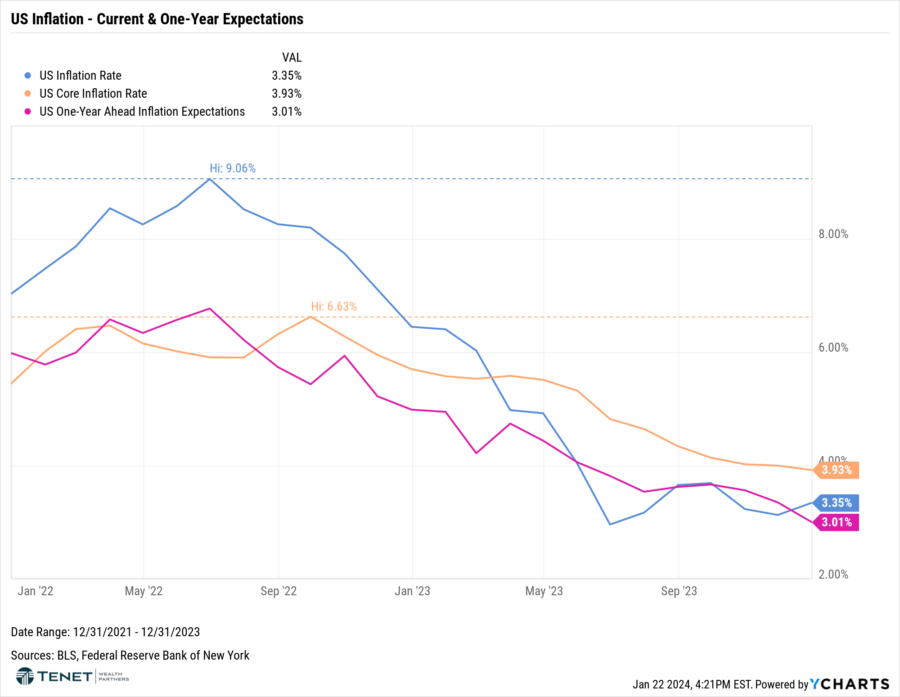

Most Likely to Subside: Inflation

Inflation eased quicker than anticipated and saw a dramatic shift downwards throughout 2023, starting the year over 6.4% and ending near 3.3%.[1] In 2024, the US Federal Reserve is aiming for a 2% target. While there is still work left to do to get closer to this target, we are seeing promising signs such as Core Inflation (which excludes volatile food and energy prices) dropping under 4% for the first time since mid-2021. What is especially encouraging is that inflation rates have also been cooling in service-related sectors, such as hotels and recreation, where inflation tends to be stickier. Speaking of sticky, we should finally see lower shelter costs reflected in inflation data, which is important given that shelter costs make up about one-third of CPI.

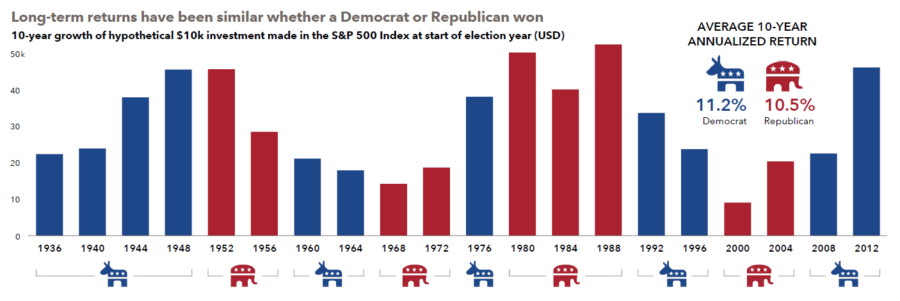

Most Likely to Cause Extra Market Volatility (& Investor Heartburn): US Presidential Election

The 2024 US presidential election can present a crucial turning point for markets and the economy, most likely to introduce volatility with policy stances potentially changing. First and foremost, an important disclaimer: historical market volatility due to US elections has been short-lived and has not created a long-term negative impact one way or another. Since the mid-1930s, the 10-year annualized return of U.S. stocks (measured by the S&P 500) made at the start of an election year was near 11% when a Democrat won and near 10.5% in years when a Republican won.[2]

Most Likely to Drive Transformation: AI & Related Technology

Artificial intelligence and advanced technologies are poised for continued expansion, most likely to drive significant transformation across various industries. Cybersecurity spending is expected to reach $348.3 billion by 2027, presenting robust growth potential. We are also seeing strong demand for chips as Taiwan Semiconductor, the world’s largest contract semiconductor maker, is forecasting 20% growth in 2024 revenue. Cloud computing, projected to grow at a 17.5% CAGR from 2023 to 2028, may offer investment opportunities as well. Automation may create a shift in jobs as well with potential displacement of 85 million jobs globally by 2025 while creating 97 million new ones. While this may seem scary, the early introductions of other technologies in our history (i.e., automobiles, the internet, etc.) have caused initial concerns yet helped our society and economy thrive as we adapted, which we believe will be the case this time as well.[3, 4, 5, 6]

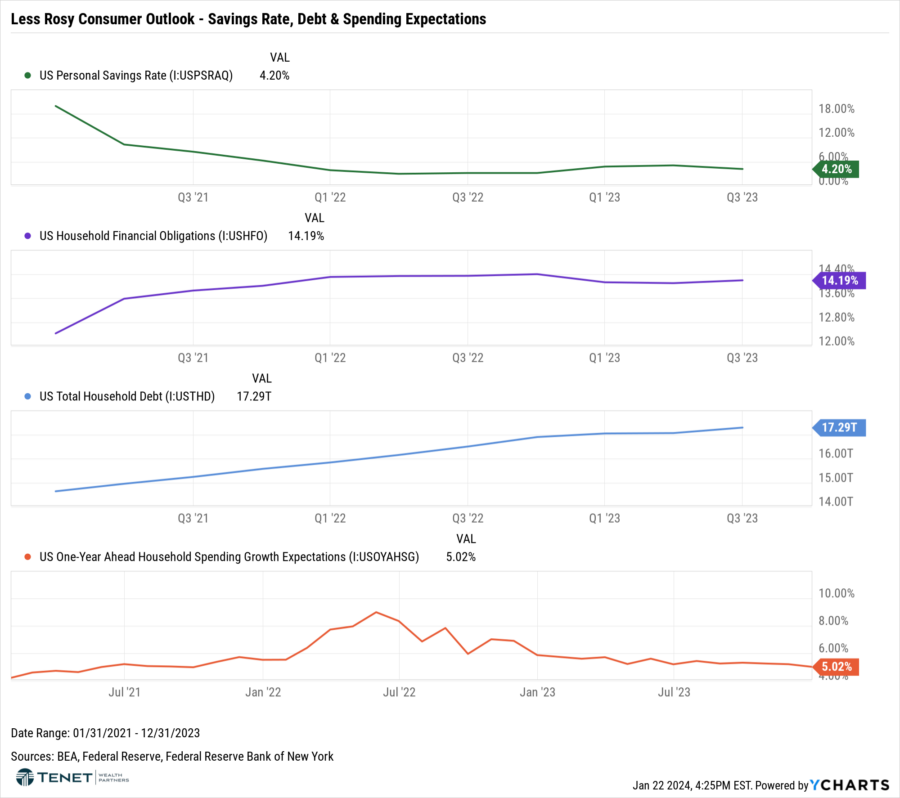

Most Likely to See a Mild Slowdown: The Economy

A mild economic slowdown is the most likely scenario compared to earlier predictions of a full-blown recession. Corporate earnings should remain resilient overall this year, but consumers may continue to reduce their spending levels as we saw towards the end of last year. Inflation is still somewhat elevated, and rates are likely to remain higher for longer on a relative basis, which may keep a lid on “big ticket” spending on items such as homes and cars. We have already started to see savings rates decline and household debt levels rise towards the end of 2023.[7] Elevated rates may continue to hamper potential new business spending as well.

Most Likely to Reverse Course: The Federal Reserve

With inflation continuing to subside, the Fed is nearing the end of its rate-hike cycle with many economists (and even Fed members themselves) projecting potential rate cuts as soon as mid-year. Goldman Sachs is predicting three quarter-point rate cuts in 2024, which may benefit interest-rate sensitive assets like bonds that tend to increase in value as rates fall.[8] Broad US equities would also likely see an added boost, even though these potential cuts have been somewhat priced in already. On the other hand, cutting rates too quickly or too much may cause inflation to come roaring back, leading to fresh rate hikes if the economy runs too hot again. We believe the Fed will take a careful and measured approach before proceeding with any hikes, and as a result, we believe 2 or 3 rate cuts is most likely this year.

Most Likely to Cause Continued Uncertainty: Geopolitical Risks/Conflicts

Ongoing geopolitical tensions and conflicts, such as the Ukraine-Russia and Israel-Hamas wars, remain unpredictable wildcards that are likely to continue weighing on the minds of investors in 2024. The S&P 500’s 6.7% drop in the month following Russia’s invasion highlights the potential for geopolitical events to impact markets. We have also seen economic disruptions in trade, transport, and supply chains as a result of these conflicts. While market volatility has remained short-term and fairly contained to this point, it is always possible for one of these conflicts to spread more broadly and impact markets further. There is also the risk of new conflicts occurring, such as between China and Taiwan which warrants keeping a close eye on moving forward.

Most Likely to Boost Growth: US Infrastructure Spending

The US government’s infrastructure spending spree is on track to be a major driver of growth, most likely to create investment opportunities in construction (projected 3.9% growth in 2024), engineering firms, and transportation (estimated 4.2% increase). The Infrastructure Investment and Jobs Act is injecting $1.2 trillion into infrastructure projects, $550 billion of which would be new federal spending, over the next five years. The CHIPS Act added another $600 billion of public/private to build new facilities over several years. Overall, the government is set to spend approximately $300 billion a year, potentially translating to a 37% increase in revenue for infrastructure companies. Since the infrastructure bill was passed in November 2021, sales have been revised up 18%, with earnings expectations increased by just 15%. Additionally, infrastructure remains reasonably priced despite outperforming the S&P 500 by 13% in the past two years. With a current multiple of 16.0x earnings, this is 3x lower than the S&P 500. These historic investments included in the legislation, from clean energy to broadband, could significantly enhance the future of infrastructure in the US.[9, 10]

Most Likely to Be an Attractive Alternative Asset: Private Credit

Tightening regulations on traditional banks are most likely to fuel further growth in private debt, offering alternative, potentially higher-yield options for investors at the same time. Private credit offers flexible financing solutions and tailored structures that cater to borrowers’ specific needs, attracting diverse companies, including those in growth sectors. The real estate lending market is expected to reach $1.3 trillion by 2028, while corporate debt is projected to grow at a 10% CAGR through 2027.[11, 12] Preqin’s 2024 Global Private Debt Outlook estimates global private debt fundraising to reach $1.2 trillion this year, highlighting investor confidence. For investors, private credit historically boasts low correlation with public markets, which may provide valuable diversification potential and portfolio risk mitigation. Private credit strategies also currently provide an average yield of around 11-12%, creating a unique and compelling option for investors seeking income. Of course, understanding the risks and rewards of private credit strategies will be key to tapping into this growing market.

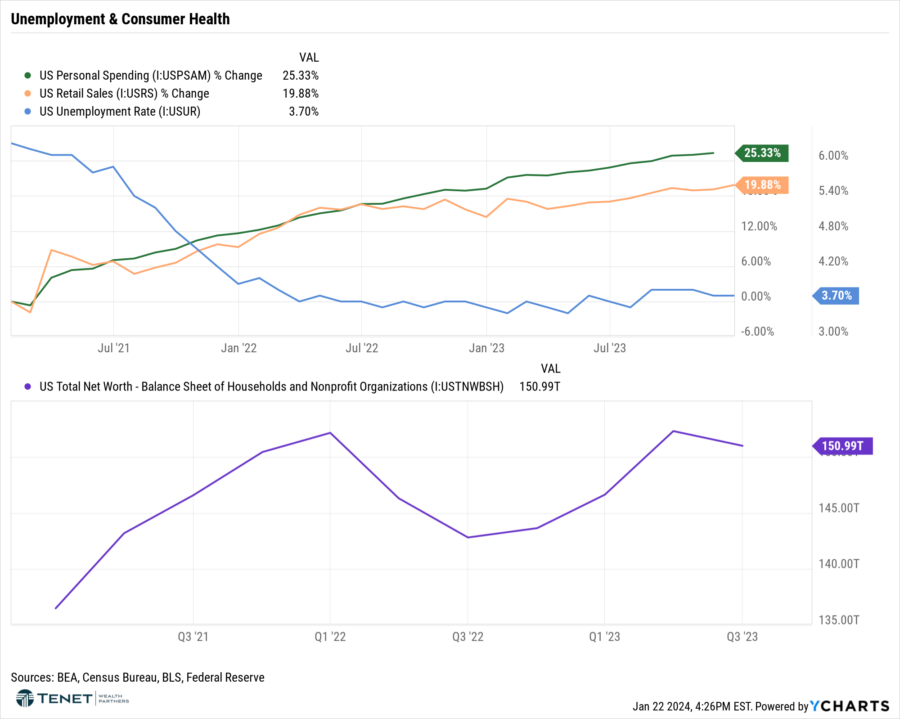

Most Likely to Stay Resilient: Consumers

Despite potential spending slowdown concerns, strong household balance sheets (US personal spending and retail sales up 25% and 20% respectively, over the last three years) and low unemployment (3.7% as of December 2023) suggest consumers are most likely to remain resilient.[13] We have started to see slowing wage growth and a lower spending over the last few months, but an expected boost from potential Fed rate cuts this year may help buoy spending this year. This is important for our economy as consumer spending makes up nearly 68% of GDP.

Most Likely to Surprise: US Small-Cap Stocks

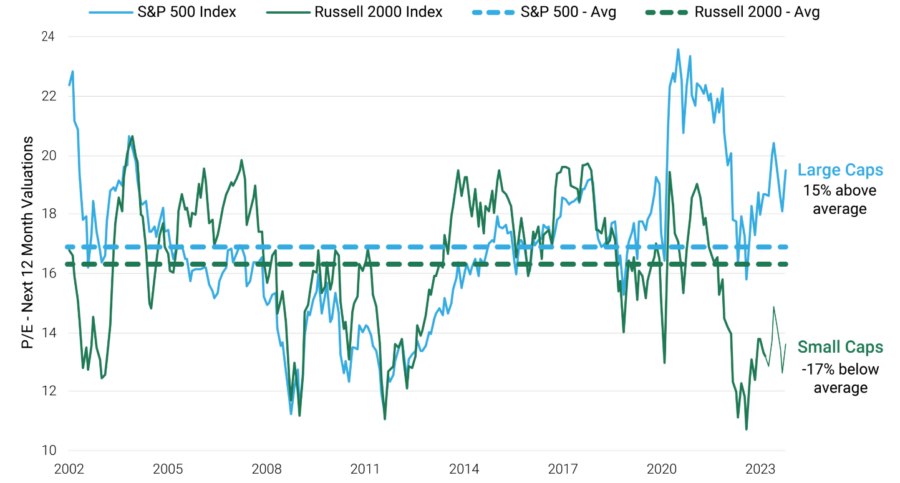

US Small Cap stocks, with historically attractive valuations (S&P 600 P/E ratio of 14x vs. 22.5x historical average, and CAPE ratio of 23.5 vs. 28.4 historical average), currently appear compelling in terms of long-term growth potential. Broader US Small Cap stocks are also significantly cheaper than their US Large Cap counterparts when compared to 20-year averages.[14]

A more stable interest rate environment this year should remove the prior headwind of rising/higher rates that weighed heavily on these stocks over the last 12-18 months. Small Cap’s more domestic base and lower exposure to global headwinds compared to Large Cap companies further adds to their allure as well. Speaking of which, Small Cap stocks may benefit from the ongoing trend of bringing jobs back to the US, driven both by geopolitical tensions as well as recent legislation such as the aforementioned CHIPs Act.

While we like Small Cap stocks as a long-term growth opportunity, we are taking a more quality-focused approach to investing in this space as well. About 41% of the most popular Small Cap index, the Russell 2000, consists of unprofitable companies. Unlike the Russell 2000, other indexes such as the S&P 600 include additional criteria for companies to be included in the index based on profitability, liquidity, and investability. Due to lingering economic uncertainty, we believe it is most prudent to focus on quality and profitability within the US Small Cap space.[15, 16, 17]

Wrapping Things Up

2024 is likely to present unique challenges and opportunities throughout the year, with both established trends and emerging forces shaping the investment and economic landscape. Staying aware and well-informed should help investors remain prepared and vigilant for possible risks, while hopefully capitalizing on opportunities that arise. As we always say, there will always be something impacting markets on a regular basis, so this year is no different. Focusing on diversification and strategic allocation will be key overall, and our team stands ready as your advocate and dedicated financial partner. As always, reach out to us with any questions, and we will be ready to guide you through whatever comes our way this year!

Sources:

[1] YCharts – Bureau of Labor Statistics, Federal Reserve

[2] Capital Group 2024 Outlook 2024 Edition – Standard & Poor’s

[3] Reuters – US semiconductor index jumps as TSMC signals strong AI chip demand (1/18/24)

[4] Cybersecurity Market Research Report 2023-2027, Grand View Research

[5] Cloud Computing Market Size and Growth Analysis 2023-2028, Grand View Research

[6] World Economic Forum, The Future of Jobs Report 2020

[7] YCharts – Bureau of Economic Analysis, Federal Reserve, Federal Reserve Bank of New York

[8] Goldman Sachs Investment Research, US Rates & FX Outlook 2024, October 2023

[9] White House, Fact Sheet: The Infrastructure Investment and Jobs Act

[10] FactSet, US Census Bureau

[11] Preqin, Global Private Credit Report 2023

[12] PWC, US Private Credit: 2023 Outlook and Beyond

[13] YCharts – Bureau of Economic Analysis, Census Bureau, Bureau of Labor Statistics, Federal Reserve

[14] Fact Set – American Century Investments “5 Questions About Investing in Small-Cap Stocks for 2024”

[15] YCharts – Standard & Poor’s, FactSet

[16] Morningstar 2024 Market Outlook: What a ‘Return to Normal’ Means for Stocks 12/29/2023

[17] JP Morgan Q1 2024 Guide to the Markets

Registered Representatives of Sanctuary Securities Inc. and Investment Advisor Representatives of Sanctuary Advisors, LLC. Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. Advisory services offered through Sanctuary Advisors, LLC., an SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.