Markets demonstrated resilience in January despite significant policy shifts and technological developments. The first month of 2025 saw President Trump’s return to office, groundbreaking AI developments from China, and the Federal Reserve maintaining its cautious stance on monetary policy. These events created both opportunities and challenges across global markets, as investors processed their implications for economic growth and inflation.

Market Performance and Economic Indicators

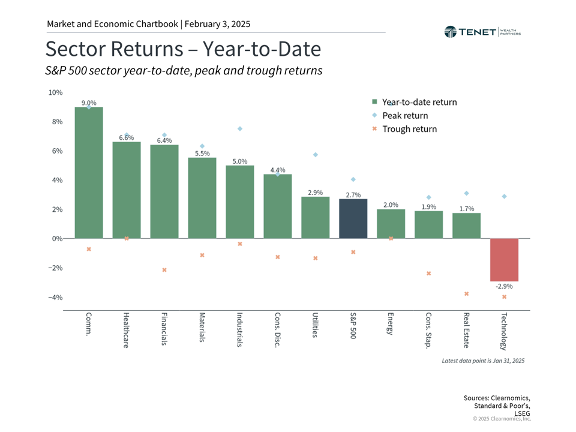

- The S&P 500 advanced 2.7%, while the Dow Jones Industrial Average led gains at 4.7%, and the Nasdaq rose 1.6%.

- Treasury yields fluctuated, with the 10-year reaching 4.8% before settling at 4.5%.

- The Fed maintained rates between 4.25% and 4.50%, pausing its recent easing cycle.

- The economy expanded by 2.3% in Q4, resulting in 2.8% growth for 2024.

- Inflation indicators showed persistent price pressures, with CPI at 2.9% and PCE at 2.6% year-over-year.

Technology sector stocks were impacted by recent AI news

As illustrated in the chart above, the technology sector and landscape overall experienced significant disruption in January following DeepSeek’s reported AI breakthrough. The Chinese company’s claim of developing models requiring substantially fewer computing resources sent ripples through the tech sector. While controversy and questions surround these developments, with OpenAI contesting the originality of DeepSeek’s approach, the potential implications for resource efficiency in AI have captured market attention.

The significance of these technological developments extends beyond the tech sector, given the growing integration of technology and AI across the broader economy. These innovations increasingly influence market dynamics and corporate strategies across all industries.

Additionally, a major policy shift occurred as the Trump administration introduced new trade measures, including substantial tariffs on imports from China (10%), Canada (25%), and a temporarily suspended 25% tariff on Mexican goods. These actions have introduced new variables into the global trade equation, with Canada already implementing retaliatory measures.

Trade relationships face new challenges under revised tariff structure

The stated purpose of these tariffs is to generate additional government revenue, to negotiate on border security, and to protect domestic industries. It’s important to keep in mind that markets also feared escalating trade wars from 2017 to 2019. Despite many uncertainties, markets generally performed well over that period and businesses adapted by diversifying their supply chains. Inflation also remained relatively neutral during that period as well. Ultimately, tariffs were a means of negotiating new trade deals such as the United States-Mexico-Canada Agreement (USMCA) and the Phase 1 trade deal with China.

Economists and market analysts project these measures could have economic implications for consumers and businesses, including the possibility of higher inflation. Various sectors face distinct challenges – the automotive industry must navigate complex cross-border supply chains, agricultural importers are grappling with potential price increases on fresh produce, and energy markets must adjust to new costs on Canadian oil imports, albeit at a lower 10% rate. Despite the market’s immediate reaction, this will take time to play out.

The Fed stands pat on interest rates

Finally, the Federal Reserve decided to keep rates steady at 4.25 to 4.50% at its January meeting. This represents a pause in rate cuts after it lowered rates at the previous three meetings. Current market-based measures suggest that the Fed may cut rates only twice in 2025, although these expectations can change quickly.

The Fed made this decision because the economy is growing steadily, the job market is strong, and inflation remains fairly stubborn. Recent data shows that inflation edged slightly higher for the third straight month, mainly due to factors such as energy costs. Long-term interest rates have remained elevated as well, which suggests that investors also believe that monetary policy will need to remain restrictive for an extended period to ensure price stability.

Staying disciplined will only grow in importance with investor attention focused on the implementation of new administration policies, Federal Reserve decisions, and ongoing technological developments. With these factors continuing to influence markets, those who can maintain a broader perspective will be better positioned to achieve their financial goals.

The bottom line? Market moves in January reinforce the need to stay focused on the long run. Markets generally rose over the month despite day-to-day swings due to headlines and policy announcements. As always, regardless of short-term volatility and disruptions, maintaining a well-diversified portfolio aligned with long-term goals remains the most effective strategy for navigating market uncertainty.

Investment Advisor Representative of Sanctuary Advisors, LLC. Advisory services offered through Sanctuary Advisors, LLC., a SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice.

This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.

Copyright (c) 2025 Clearnomics, Inc. All rights reserved. The information contained herein has been obtained from sources believed to be reliable, but is not necessarily complete and its accuracy cannot be guaranteed. No representation or warranty, express or implied, is made as to the fairness, accuracy, completeness, or correctness of the information and opinions contained herein. The views and the other information provided are subject to change without notice. All reports posted on or via www.clearnomics.com or any affiliated websites, applications, or services are issued without regard to the specific investment objectives, financial situation, or particular needs of any specific recipient and are not to be construed as a solicitation or an offer to buy or sell any securities or related financial instruments. Past performance is not necessarily a guide to future results. Company fundamentals and earnings may be mentioned occasionally, but should not be construed as a recommendation to buy, sell, or hold the company’s stock. Predictions, forecasts, and estimates for any and all markets should not be construed as recommendations to buy, sell, or hold any security–including mutual funds, futures contracts, and exchange traded funds, or any similar instruments. The text, images, and other materials contained or displayed in this report are proprietary to Clearnomics, Inc. and constitute valuable intellectual property. All unauthorized reproduction or other use of material from Clearnomics, Inc. shall be deemed willful infringement(s) of this copyright and other proprietary and intellectual property rights, including but not limited to, rights of privacy. Clearnomics, Inc. expressly reserves all rights in connection with its intellectual property, including without limitation the right to block the transfer of its products and services and/or to track usage thereof, through electronic tracking technology, and all other lawful means, now known or hereafter devised. Clearnomics, Inc. reserves the right, without further notice, to pursue to the fullest extent allowed by the law any and all criminal and civil remedies for the violation of its rights.