As the year winds down, investors already looking to be tax efficient within their non-retirement investment portfolios may get an unwelcome surprise: year-end capital gain distributions from mutual funds. While these distributions might seem like a positive development—a reflection of profitable activity within the fund—they often come with tax consequences that tend to catch investors off guard.

Here’s what you need to know about capital gain distributions, why they can be challenging to plan for, and strategies to enhance tax efficiency and minimize their impact.

What Are Capital Gain Distributions?

Capital gain distributions occur when mutual funds sell securities at a profit within their portfolios. These profits are then distributed to shareholders, typically at the end of the calendar year, often in November or December. Mutual funds are required to distribute realized capital gains to shareholders to maintain their tax-advantaged status under IRS rules. This ensures that taxes on investment gains are paid by the investors, not the fund itself.

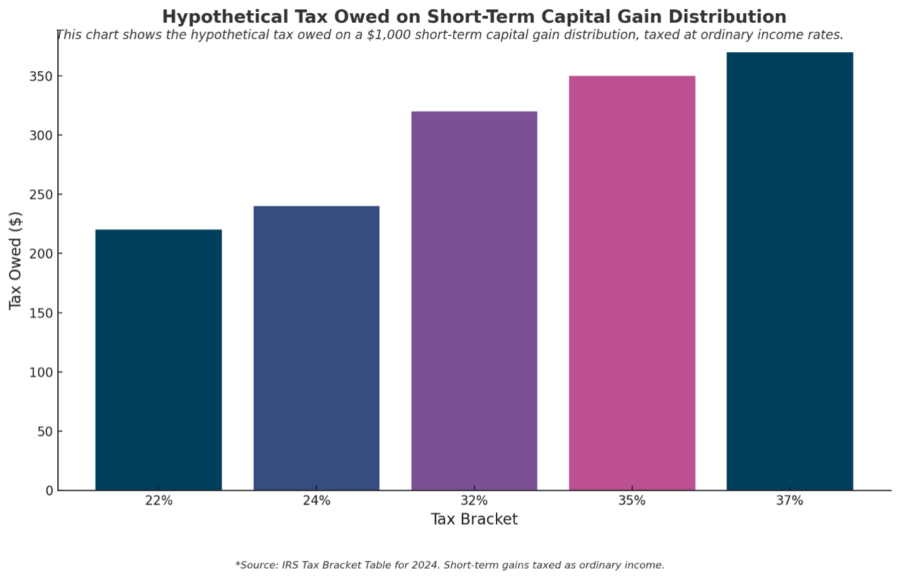

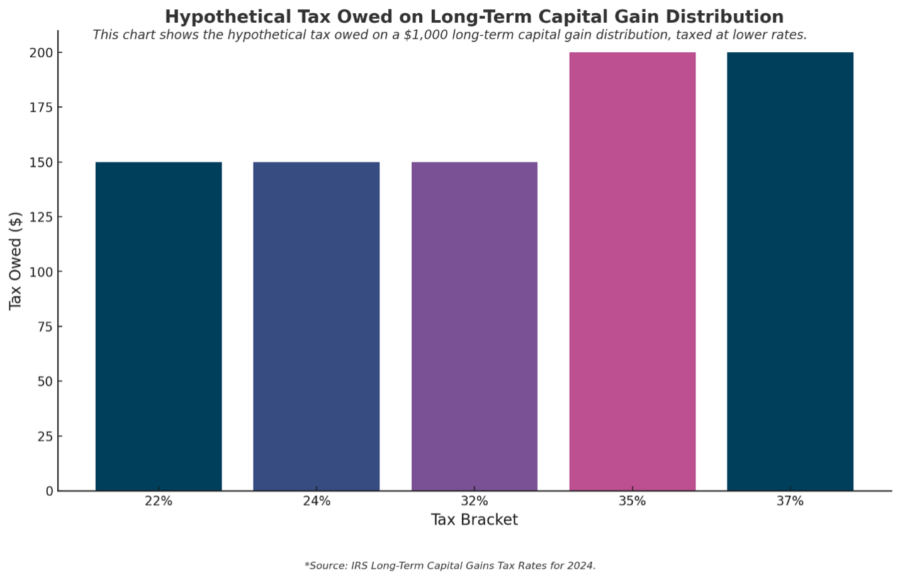

Even if you didn’t sell any shares of the mutual fund, you’re still the lucky recipient of these distributions and are responsible for reporting (and paying) taxes on the distribution. Further complicating things for investors, these distributions can be taxed as either short-term or long-term capital gains depending on how long the fund held the sold investments. While both can create a tax headache, distributions classified as short-term capital gains are taxed at the investor’s ordinary income tax rate, which is generally higher and less favorable than the more attractive long-term capital gains rate of 15% or 20%.

Why Are They Challenging to Plan For?

To be clear, these year-end capital gain distributions specifically present challenges for only taxable, non-retirement investment accounts (i.e., brokerage, trust, etc.) as retirement accounts (i.e., IRAs, Roth IRAs, etc.) are already shielded from these taxes. Here are a few reasons why these distributions can be difficult to predict:

- Lack of Transparency: Funds don’t always provide clear information about the size or timing of distributions in advance. Even when they do, it is oftentimes too late as most fund companies do not finalize the details until sometime in December (usually closer to the middle or end of the month).

- Market Volatility & Appreciation: Changes in the market throughout the year can cause fund managers to sell securities unexpectedly, resulting in gains. Years where we see high market appreciation, such as 2024, tend to lead to higher-than-normal distributions as well.

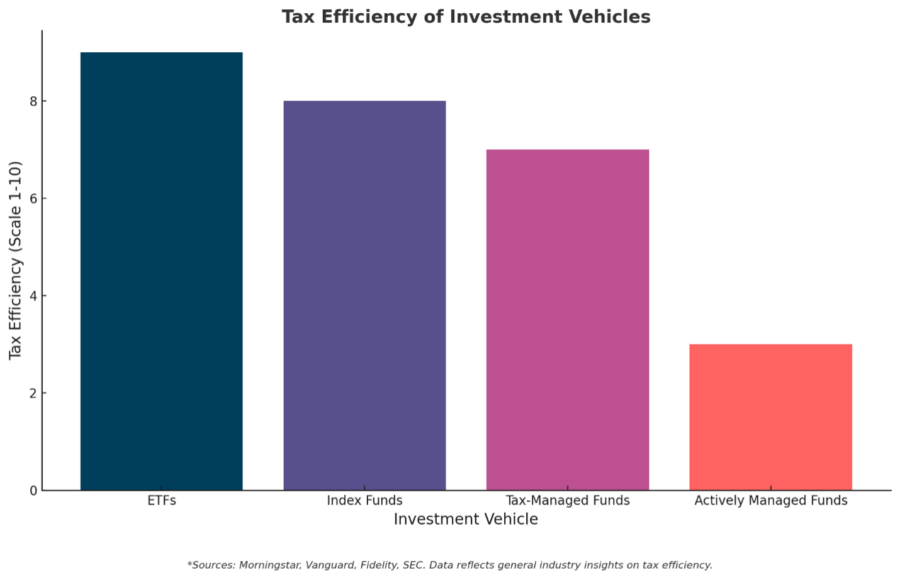

- Fund Turnover: Actively managed funds, which often have higher turnover, are more likely to generate significant capital gains. As more and more gains are generated throughout the year, investors likely see a more profound level of gains distributions.

This unpredictability makes it hard for investors to proactively plan their tax liabilities, potentially leading to surprises during tax season.

Which Types of Funds Typically Pay These Distributions?

Some funds are more prone to capital gain distributions than others. These include:

- Actively Managed Mutual Funds: Due to frequent buying and selling of securities within the portfolio.

- Funds with High Turnover Ratios: These funds tend to realize more gains as managers adjust the portfolio several times throughout the year.

- Older Mutual Funds: As they accumulate significant unrealized gains over time, distributions can be triggered when managers rebalance or redeem positions. For example, if managers realize gains from positions where unrealized gains have accumulated over several years, the level of realized gains is likely to be much higher.

Alternatives to Enhance Tax Efficiency

Investors looking to reduce the impact of capital gain distributions may want to consider the following options:

- Exchange-Traded Funds (ETFs): Unlike mutual funds, ETFs typically have lower turnover and use a structure that minimizes taxable events for shareholders. Their unique in-kind creation and redemption process allows ETFs to avoid realizing gains during portfolio adjustments.

- Index Funds: These funds aim to track a benchmark index and generally have lower turnover, resulting in fewer capital gains distributions. Their passive nature makes them inherently more tax-efficient than actively managed funds.

- Tax-Managed Funds: These are specifically designed to minimize taxable distributions by employing strategies like offsetting gains with losses or limiting turnover within the fund.

- Separately Managed Accounts (SMAs): For certain investors, SMAs (such as direct indexing – which we specialize in here at Tenet) offer the ability to customize portfolios with tax efficiency in mind, avoiding unnecessary taxable events.

Strategies to Minimize the Tax Impact

Even if you can’t completely avoid capital gain distributions, there are ways to mitigate their tax consequences:

- Harvest Tax Losses: Offset capital gains by selling investments that have declined in value. This strategy can help reduce your overall taxable income and is especially effective in years with significant market downturns.

- Review Asset Location: Place tax-inefficient investments, such as actively managed mutual funds, in tax-advantaged accounts like IRAs or 401(k)s. This shields distributions from immediate taxation, allowing gains to grow tax-deferred.

- Be Aware of When You Purchase a New Mutual Fund: You may consider waiting a bit to buy a mutual fund if you are close to when the fund is scheduled to pay these distributions. Otherwise, you could be taxed on gains earned before you even owned the shares. Check a fund’s distribution schedule before investing late in the year.

- Monitor Unrealized Gains: Identify funds with large, embedded gains and/or have high Tax Cost Ratio. Consider transitioning to more tax-efficient investments in a year when the tax impact may be lower or you consider spreading out potential gains over time. Given the complexities involved, it is highly recommended to work with a qualified financial advisor like our team at Tenet.

- Diversify with Tax-Efficient Investments: Shift a portion of your taxable portfolio to alternative vehicles, like ETFs, tax-managed funds, or direct indexing, which can offer even greater control over realized gains and losses.

- Consult with a Qualified Financial Advisor/Planner and Tax Advisor: Having a trusted financial advisor as well as a tax professional can help you integrate year-end distribution strategies into your broader financial plan and explore advanced techniques like Roth conversions or charitable giving to offset gains.

Wrap Up

While year-end capital gain distributions can create unexpected tax liabilities, remaining aware of these distributions and having a thoughtful approach can help you manage and even reduce their impact. At Tenet Wealth Partners, we specialize in tax-efficient investing and remain both alert and aware of these distribution schedules and their potential impact so you have less on your plate to worry about. We believe our proactive approach helps clients navigate these challenges with confidence and clarity. With 2024 winding down, don’t hesitate to contact us or schedule a meeting if you need help preparing for these potential distributions as part of your overall plan!

Registered Representative of Sanctuary Securities Inc. and Investment Advisor Representative of Sanctuary Advisors, LLC. Securities offered through Sanctuary Securities, Inc., Member FINRA, SIPC. Advisory services offered through Sanctuary Advisors, LLC., a SEC Registered Investment Advisor. Tenet Wealth Partners is a DBA of Sanctuary Securities, Inc. and Sanctuary Advisors, LLC. The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice. This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations. Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.