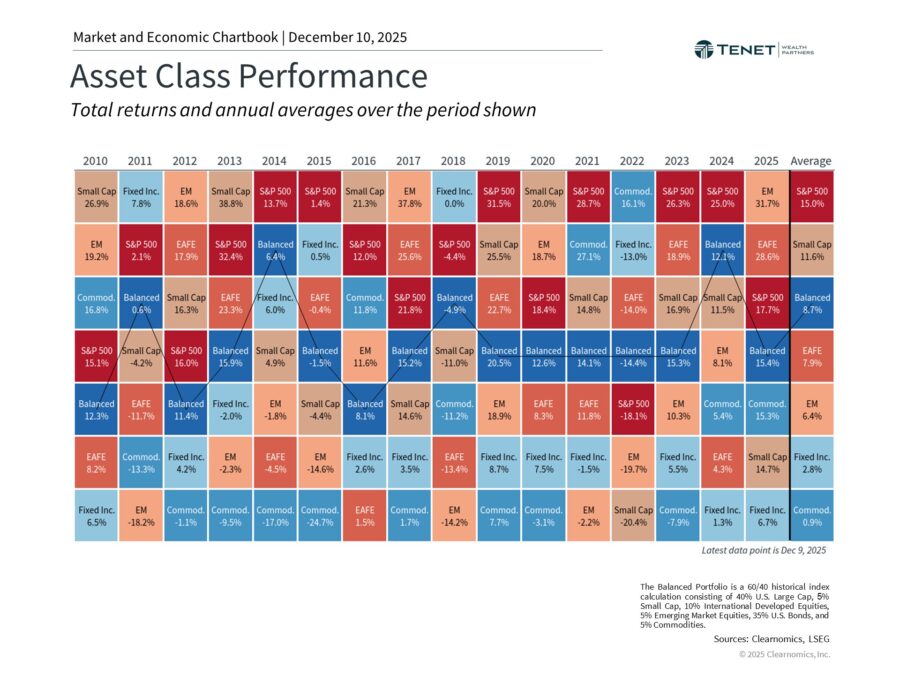

by Kevan Melchiorre, CFP® | Dec 10, 2025 | Insights, Investment Commentary

The stock market appears poised to achieve double-digit gains for the sixth time in seven years. Apart from the inflation-induced decline of 2022, this impressive run has placed numerous investors in favorable financial circumstances. There’s a common saying...

Continue Reading...

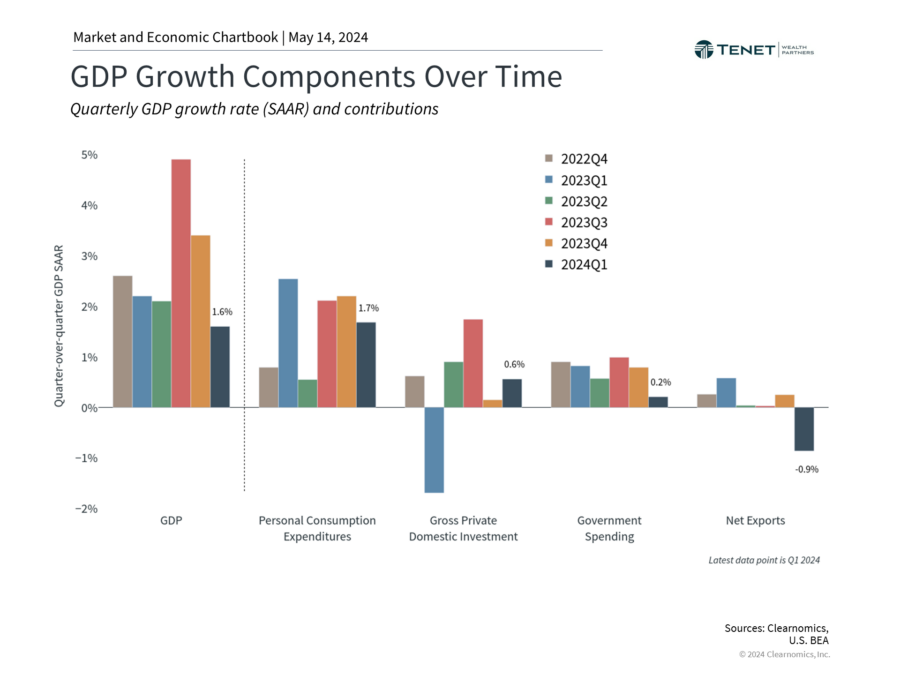

by Kevan Melchiorre, CFP® | May 15, 2024 | Insights, Investment Commentary

With markets nervous about stubborn inflation, a gradually slowing labor market, and the timing of the first Fed rate cut, investors are more focused on this corporate earnings season than usual. This is because while the economy has avoided a “hard landing” corporate...

Continue Reading...

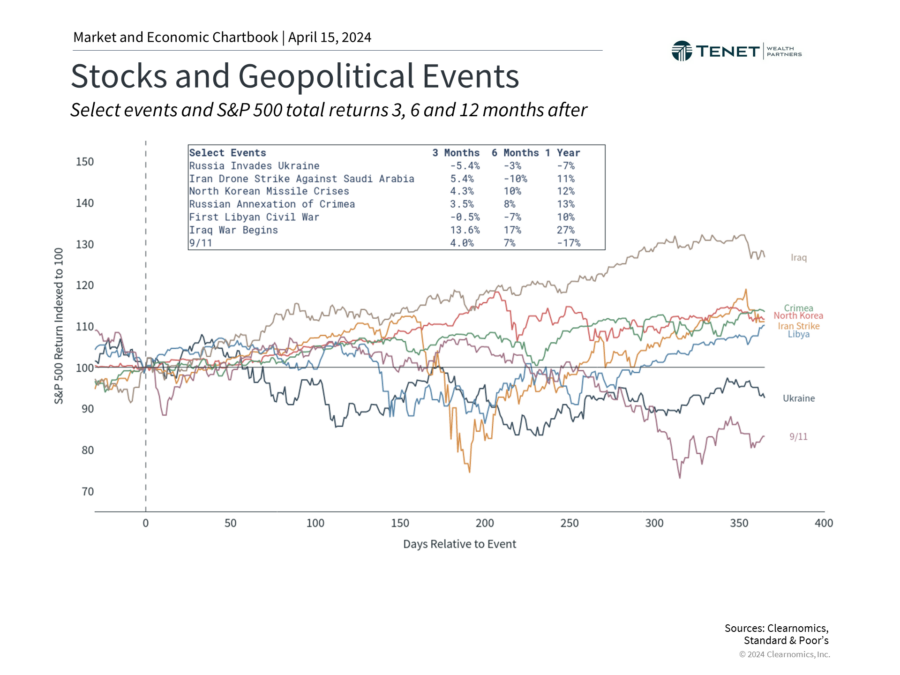

by Kevan Melchiorre, CFP® | Apr 15, 2024 | Investment Commentary

After a historically strong start to the year, markets have now pulled back 2.5% to begin the second quarter. Concerns around geopolitical tensions in the Middle East, inflation, corporate earnings, and other issues have led to a market decline, pushing the VIX index...

Continue Reading...

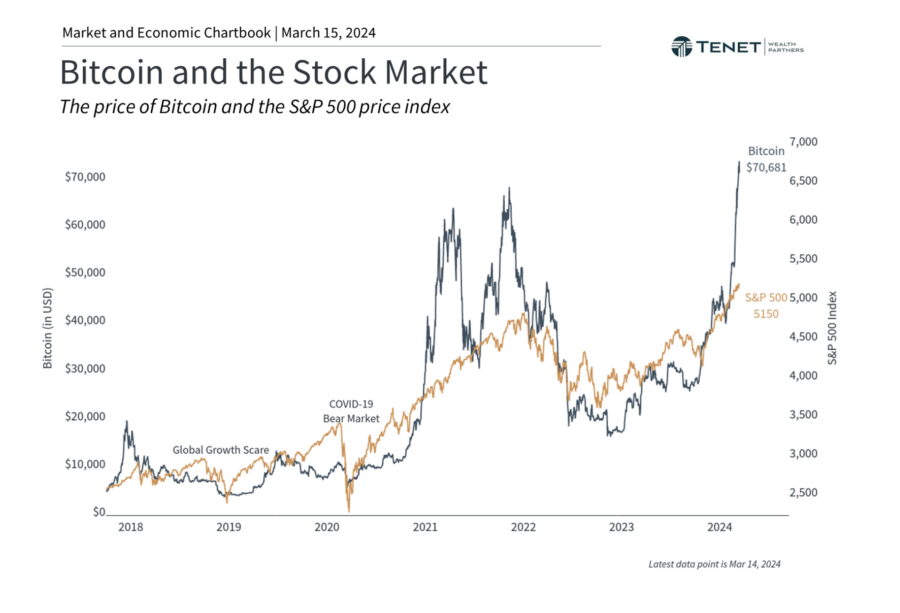

by Kevan Melchiorre, CFP® | Mar 26, 2024 | Investment Commentary

The stock market rally has briefly paused as investors weigh the timing of the first Fed rate cut this cycle. So far this year, the S&P 500 has achieved 16 new all-time highs amid steady economic growth, improving inflation, and the ongoing rally in tech stocks....

Continue Reading...

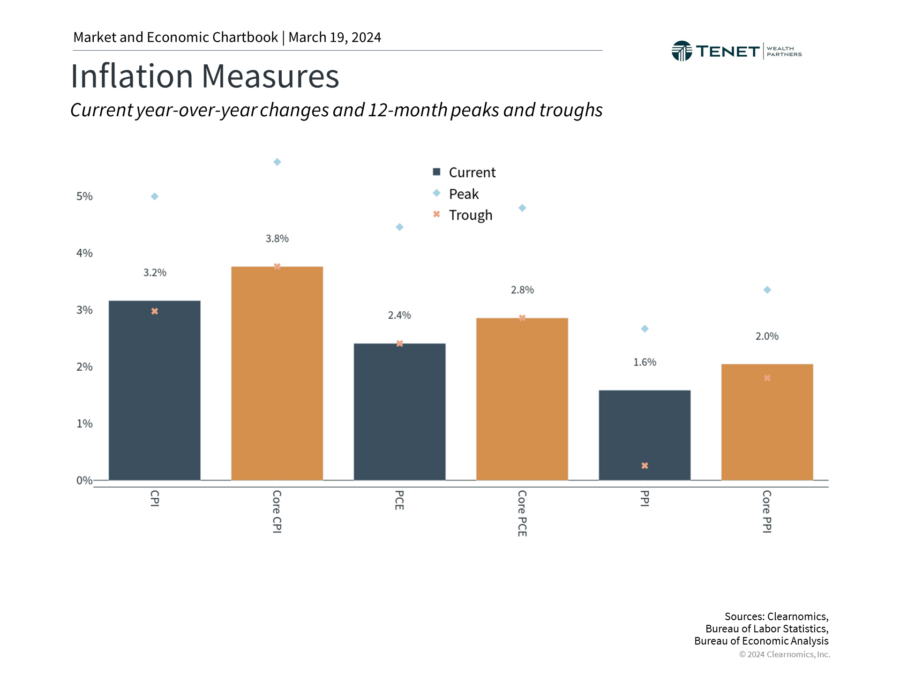

by Kevan Melchiorre, CFP® | Mar 19, 2024 | Investment Commentary

Markets continue to be driven by artificial intelligence stocks and the timing of the Fed’s first rate cut. Beyond the day-to-day swings, these drivers reflect important trends in innovation, productivity, and the health of the economy. They are also the result...

Continue Reading...

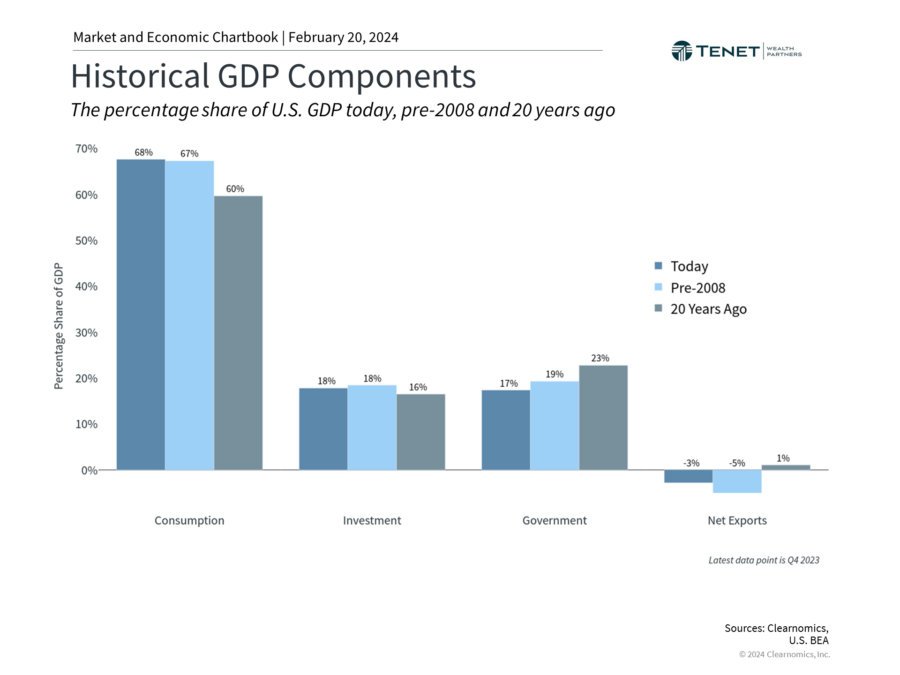

by Kevan Melchiorre, CFP® | Feb 22, 2024 | Insights, Investment Commentary

Consumer spending is the backbone of the U.S. economy, constituting over two-thirds of our nearly $28 trillion GDP. When consumers spend money on everyday goods and services, and make large one-time purchases, it not only helps to spur economic growth but is also a...

Continue Reading...