Artificial intelligence (AI) has dominated financial headlines this year, propelling markets to new highs and sparking a familiar question among investors: Are we in another bubble, similar to the dot-com era?

It’s a fair question—and one worth exploring seriously. The rapid rise in valuations, coupled with the enormous sums being poured into AI infrastructure, has naturally raised eyebrows. Yet, as fiduciary financial advisors, our goal is to help clients benefit from innovation while managing risk thoughtfully and deliberately. Let’s take a look into whether we are facing an artificial intelligence bubble or a technological revolution.

Understanding the Scale of AI Investment

Corporate spending on AI already totals in the trillions of dollars. From building massive data centers to purchasing specialized chips and hiring world-class researchers, the level of investment is staggering.

In some cases, the relationships driving this growth appear almost circular. For example, Nvidia has invested billions in OpenAI—one of its biggest customers. These overlapping investments have fueled concerns about how sustainable the ecosystem might be if market enthusiasm fades.

Still, it’s important to recognize that such large-scale spending reflects AI’s immense infrastructure requirements—costs that few companies can shoulder alone. For now, these investments are also contributing meaningfully to U.S. economic growth.

Bubble or Building Block?

Distinguishing between healthy growth and speculative excess is notoriously difficult in real time. The late-1990s dot-com bubble seems obvious in hindsight—companies with no revenue were valued in the billions. But not every period of rapid market appreciation turns out to be a bubble.

Consider the early years of cloud computing. Many questioned whether companies were overspending on servers and software. Today, cloud technology underpins nearly every aspect of modern business.

A key difference this time is that many of today’s AI leaders—think Microsoft, Alphabet (Google), and Meta—are profitable, established firms with strong balance sheets. They’re investing from a position of strength, not speculation.

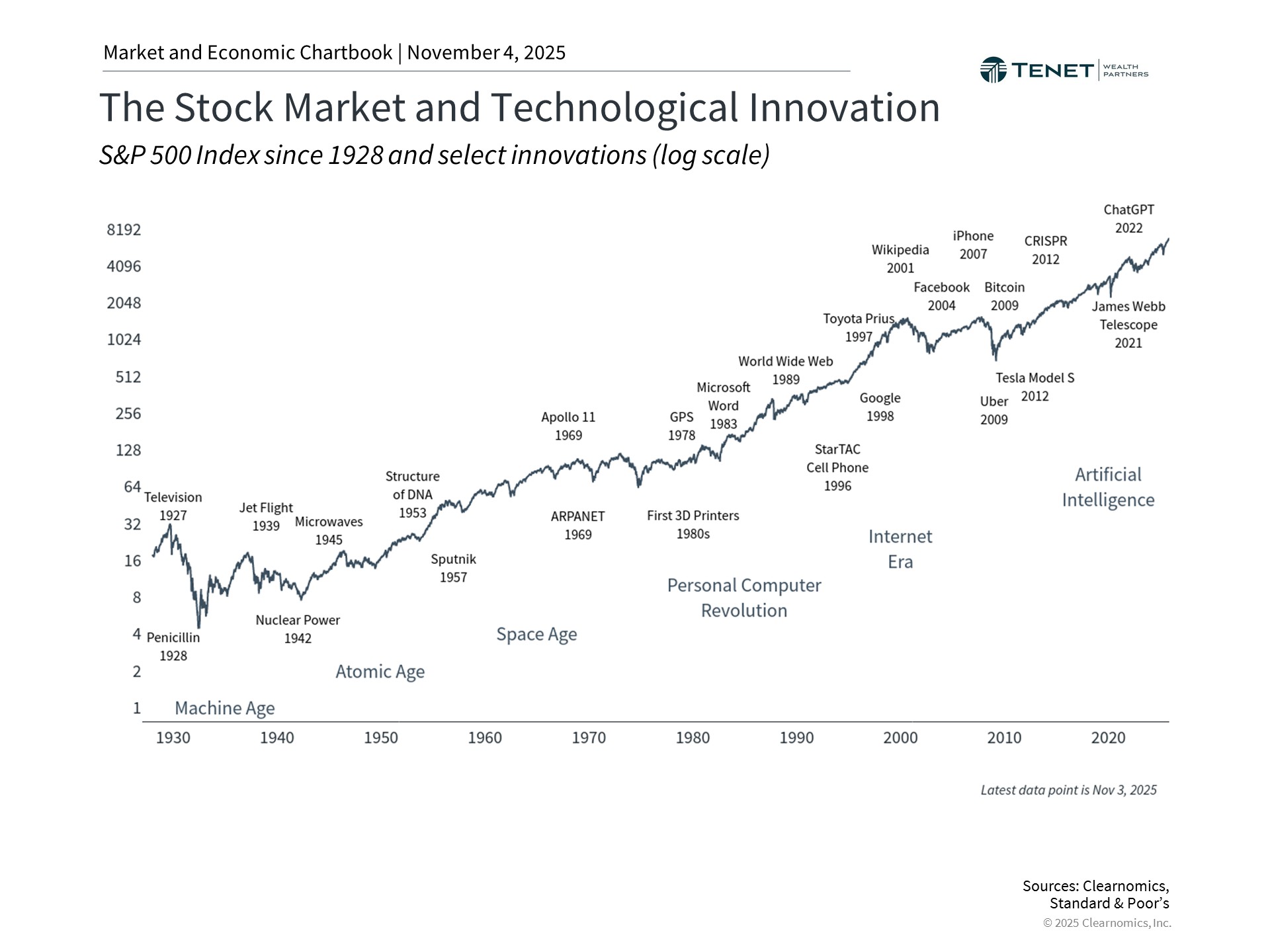

Even when markets do overshoot, history reminds us that transformative technologies often endure. The internet revolution was born from the ashes of the dot-com crash. Amazon, for instance, lost 95% of its value at one point before becoming one of the most valuable companies in the world.

Innovation Takes Time

AI’s potential is extraordinary, but so too are the challenges in fully realizing it. Productivity gains from major technological advances rarely happen overnight. Businesses must reengineer how they operate to harness new tools effectively.

The same pattern has repeated throughout history—the railroad boom, the electrification of cities, the transistor and electronics wave, and the rise of the internet. Each began with surging optimism, followed by a market correction, before ultimately transforming the global economy.

Today, the S&P 500 trades near a price-to-earnings ratio of 22.5x—close to its all-time high of 24.5x—reflecting lofty expectations for future growth. Whether these valuations are justified will depend on how quickly AI translates its promise into measurable economic value.

Incorporating AI & Technology into Your Overall Financial Strategy

At Tenet Wealth Partners, our team of fiduciary financial advisors design portfolios to participate in long-term technological growth while balancing risk across the broader economy. That means:

-

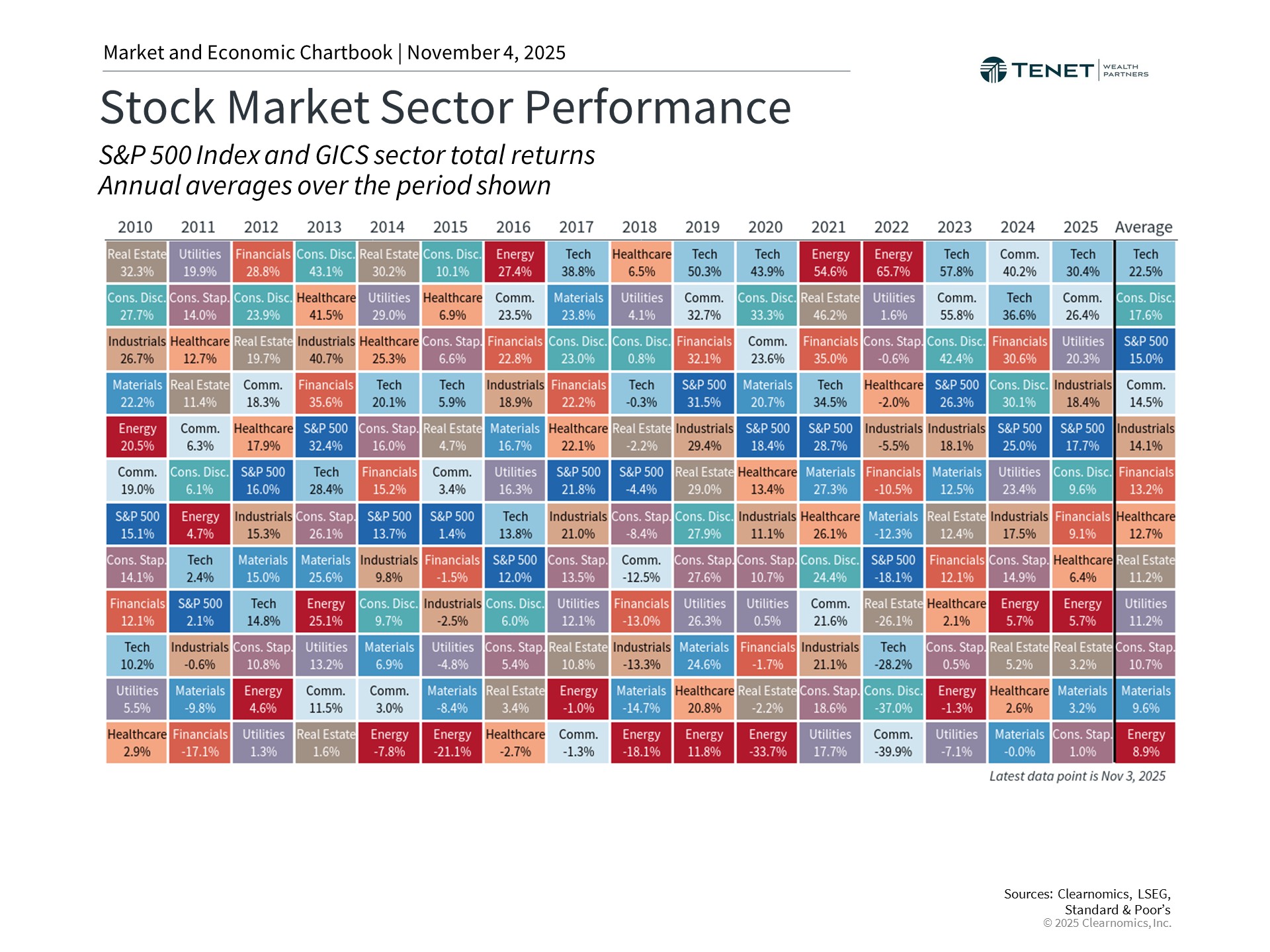

Diversification across sectors and asset classes. Technology remains an important growth driver, but concentrating too heavily in one area—no matter how exciting it may be in the short-term—can create unnecessary volatility over time.

-

Balancing growth with income and stability. Bonds, dividend-paying equities, and other asset classes can provide ballast when markets shift or enthusiasm cools.

-

Staying disciplined through cycles. Your portfolio should be built around your goals—not headlines. While well-diversified portfolios may not capture every last bit of upside during speculative rallies, it can help endure through changing markets while keeping you on track over the long haul.

Bottom Line

Artificial intelligence is likely to reshape industries and redefine productivity for decades to come. Whether current market enthusiasm proves excessive or not, innovation remains one of the enduring engines of wealth creation.

Rather than trying to predict whether we’re in a bubble, investors are better served by maintaining a disciplined, diversified, and forward-looking approach—positioned to benefit from technological progress while prudently managing risk.

Disclosures: Investment advisory services offered through Tenet Wealth Partners, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third-party sources and is believed to be reliable.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice. This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.