For nearly nine decades, Social Security has served as a cornerstone retirement program, but demographic shifts and fiscal pressures have raised questions about its long-term viability. While this federal program remains crucial for millions of Americans, it represents just one element of comprehensive retirement planning. Given today’s economic landscape and political climate, developing a thorough understanding of all retirement planning components is essential for achieving financial security.

Regardless of how close you are to retirement, gaining insight into Social Security’s role within your broader financial strategy is valuable. To make informed decisions about the future, it’s crucial to examine the program’s origins, current obstacles, and available approaches for managing what lies ahead.

Social Security’s historical foundation

|

Created in 1935 amid the Great Depression under President Franklin D. Roosevelt’s administration, Social Security emerged as a protective measure for America’s elderly population. From its humble beginnings providing basic benefits to a limited number of recipients, the program has grown into an intricate system supporting millions of retirees, disabled individuals, and their dependents. Currently, Social Security payments constitute a substantial portion of retirement income for countless Americans.

To understand how Social Security works at a high level, the program functions mainly through a “pay-as-you-go” framework, where current workers’ payroll contributions fund today’s beneficiaries. Put simply, the payroll contributions you make don’t accumulate for your future benefits but instead support someone currently receiving Social Security payments.

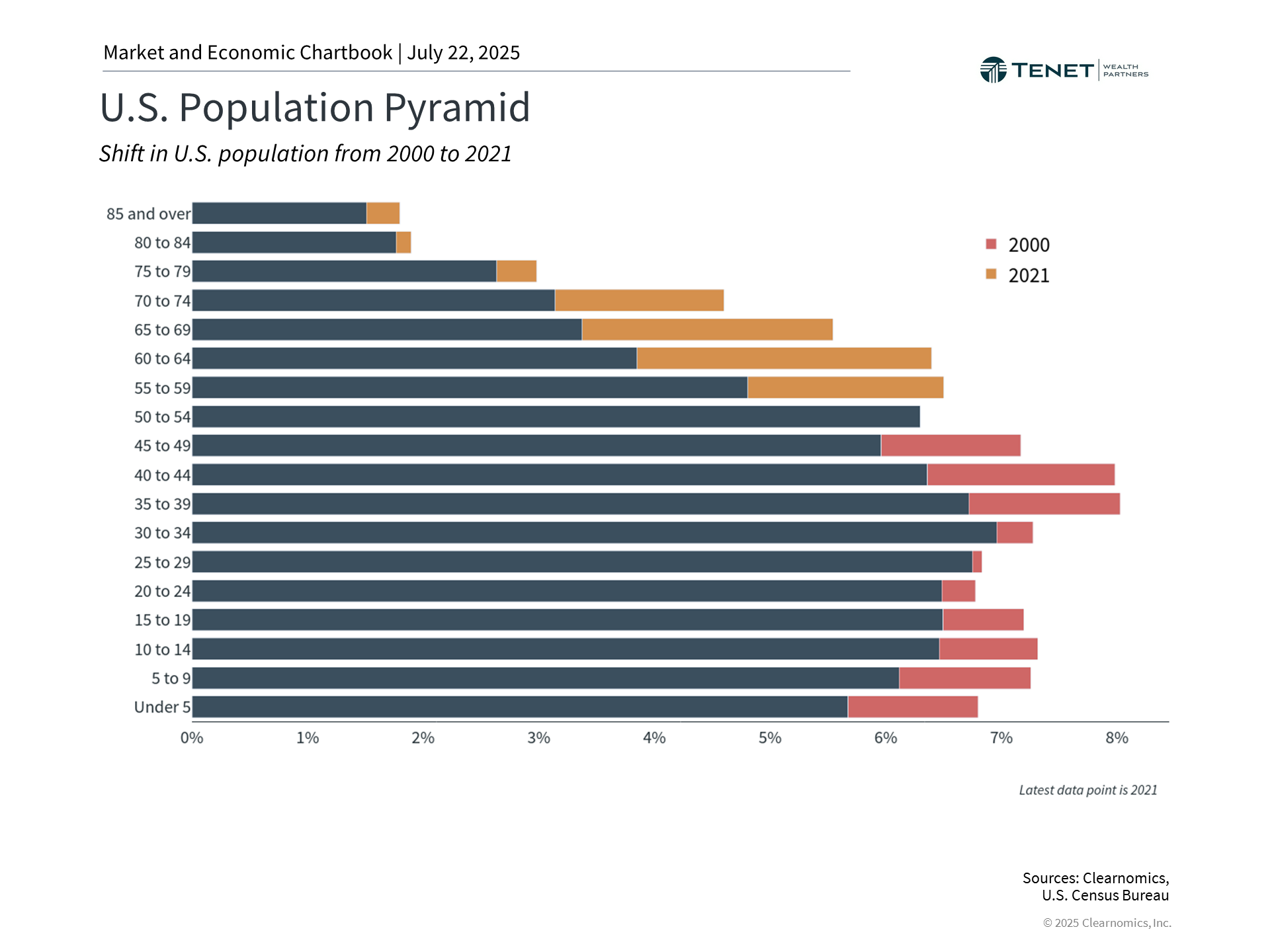

This approach functioned effectively when worker-to-beneficiary ratios remained favorable throughout most of the 20th century. Nevertheless, changing demographics have resulted in fewer workers supporting the program while more retirees claim benefits. To illustrate, 1940 saw 42 workers supporting each retiree, but today that figure has dropped to approximately 2.8 workers per beneficiary, with further decline expected as aging continues and birth rates remain low.

As many are now aware, Social Security faces obstacles in the present day. Various forecasts have attempted to predict when Social Security trust funds will run dry. According to the most recent Social Security Board of Trustees report, reserves should last until 2034, beyond which benefit reductions would become necessary. Currently, continuing payroll contributions would still support roughly 78% of scheduled benefits. Though specific timelines may vary, the fundamental issue persists: without significant reforms, the trust funds may struggle to maintain full scheduled payments over the long term.

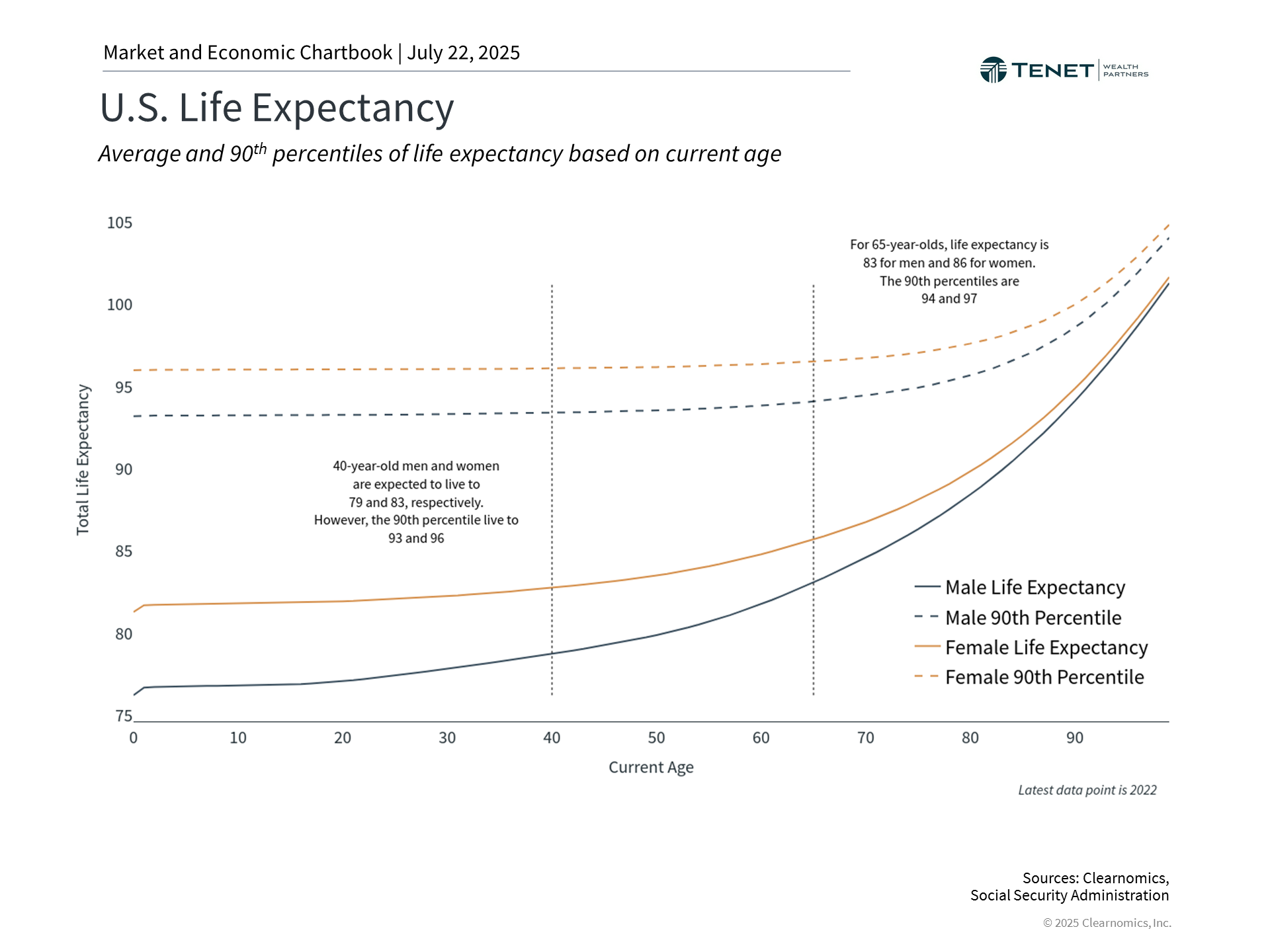

Increased longevity benefits individuals but strains Social Security funding

|

The national debt approaching $37 trillion and ongoing budget deficits add another layer of concern regarding the program’s long-term sustainability. Despite Social Security’s “mandatory” classification, mounting pressure to reduce government expenditures creates uncertainty about potential congressional modifications to these programs.

Given the politically charged nature of potential solutions, achieving a quick fix for Social Security appears unlikely. Various proposals under consideration include adjusting retirement age requirements for benefit eligibility, expanding the taxable wage ceiling, and enhancing fraud prevention measures. Regrettably, comprehensive long-term solutions for Social Security remain elusive.

Examining how other developed nations have addressed similar demographic challenges can provide valuable insights. Multiple European countries, including France and the UK, have raised retirement ages to alleviate pressure on their systems. Australia has adopted an alternative “means-tested” approach, providing benefits only to retirees meeting specific asset and income criteria.

Although the projected 2034 depletion remains years away, the urgency for solutions will continue mounting. While complete benefit elimination seems highly improbable, Social Security’s ongoing funding difficulties will likely necessitate program adjustments.

Retirement Planning Strategic Elements

Given these aforementioned uncertainties, thoughtful personal planning becomes essential to maintain your retirement progress. Appropriate decisions depend on your comprehensive financial situation, objectives, tax considerations, and various other factors.

While everyone’s situation is different and should be evaluated on a personalized basis, here are several key factors to consider from a Social Security planning perspective:

- Choosing to Postpone

Benefits may begin as early as age 62, but early claiming reduces monthly payments. Alternatively, postponing benefits until age 70 can boost monthly payments by roughly 8% annually beyond full retirement age (ages 66-67, based on birth year), per Social Security Administration guidelines.

Breakeven calculations can help evaluate whether postponement makes financial sense. Typically, living beyond your early 80s makes delaying benefits advantageous for lifetime payments. However, this analysis shifts when considering time value of money or opportunity costs.

- Bridging Approaches

The benefits of delaying largely depend on your income source during the waiting period. Some retirees utilize investment portfolio distributions as a “bridge” to enhanced Social Security payments later. For example, taking a higher distribution rate from retirement and brokerage accounts in the earlier years of retirement, and then reducing this amount when you start Social Security later. This approach proves especially valuable for married couples, where maximizing the higher earner’s benefit establishes a larger survivor benefit.

- Tax Considerations

Social Security benefits may be taxable up to 85%, based on your combined income level. Future tax legislation could potentially raise this percentage. Strategic withdrawal planning with professional guidance can help reduce the tax burden on your benefits.

- Cautious Planning

Those earlier in their careers have more time for retirement preparation and greater flexibility to adapt to Social Security uncertainty. Therefore, younger workers might consider developing retirement plans that don’t depend heavily on Social Security. This approach doesn’t mean completely disregarding it, but rather viewing potential benefits as supplementary to personal savings rather than foundational support.

- Monitor Policy Developments

Policy modifications will likely emerge before trust fund depletion occurs. Staying current on proposed reforms enables you to modify your planning strategy accordingly. Potential changes may include additional full retirement age increases, benefit formula adjustments, or payroll tax cap modifications.

- Optimize Tax-Advantaged Savings

Given Social Security’s uncertain future, it has never been more important to focus on maximizing 401(k), IRA, and HSA contributions. These accounts offer tax benefits that can help offset potentially diminished government benefits, while also building your retirement nest egg on your terms and maintaining control.

Social Security’s Future Demands Thoughtful Preparation

While concerns are legitimate about the long-term viability of Social Security, maintaining proper perspective remains important. Social Security has weathered funding challenges previously, and political motivation to preserve the program continues strong.

The sensible approach involves neither complete reliance on nor total dismissal of Social Security’s retirement planning role. Instead, savers should acknowledge the program’s significance while viewing it as just one element of a well-rounded retirement approach.

The bottom line? Understanding Social Security’s challenges enables you to construct a more robust retirement strategy, no matter your current age or professional phase.

If you have specific questions or concerns about Social Security’s role in your personal retirement planning, please don’t hesitate to contact our team or schedule a meeting with us.

Investment advisory services offered through Tenet Wealth Partners, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third-party sources and is believed to be reliable.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice. This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.