Gold has surged more than 60% this year, climbing above $4,300 per ounce, while numerous other asset classes have also hit record highs. This remarkable ascent has generated significant media attention and left many investors questioning whether this rally differs from historical precedents.

The phenomenon has been dubbed the “debasement trade,” rooted in concerns that governments may deliberately diminish currency strength through expansive fiscal spending and lenient monetary policies. Combined with dollar weakness and geopolitical concerns, these factors have driven some investors toward assets like gold, which are perceived as reliable stores of value, particularly amid renewed stock market turbulence.

Although fiscal deficit concerns are valid, historical evidence demonstrates that forecasting gold’s trajectory is challenging, and numerous factors beyond currency movements and interest rates are fueling broader market gains. For investors with long-term horizons, the key question isn’t choosing between stocks and bonds versus gold, but rather determining appropriate allocations across these asset classes within a balanced portfolio.

Most crucially, investors must distinguish between short-term trading opportunities and long-term financial objectives centered on income generation and capital appreciation, particularly after an asset has already experienced substantial appreciation.

Historical context of currency debasement

|

Despite being a concept with thousands of years of history, currency debasement remains a recurring concern that emerges periodically. The traditional meaning of “debasement” describes governments reducing precious metal content in their coinage. Historically, this practice enabled authorities to produce more coins from identical metal quantities, though it simultaneously diminished each coin’s purchasing power.

Contemporary currencies are predominantly “fiat currencies,” deriving value from confidence in their issuing governments rather than precious metal backing. Modern debasement concerns therefore focus on whether governments will tolerate elevated inflation and currency depreciation, as these conditions would facilitate management of outstanding debt obligations.

These issues connect to concepts that gained traction following the 2008 financial crisis. Economists Reinhart and Rogoff documented what they termed “financial repression” – policy frameworks maintaining artificially suppressed interest rates to diminish the real burden of government debt. Such policies disadvantage savers by eroding cash value when interest rates fail to match inflation. Given continued national debt expansion, investor concerns about these dynamics and subsequent interest in value-preserving assets are understandable.

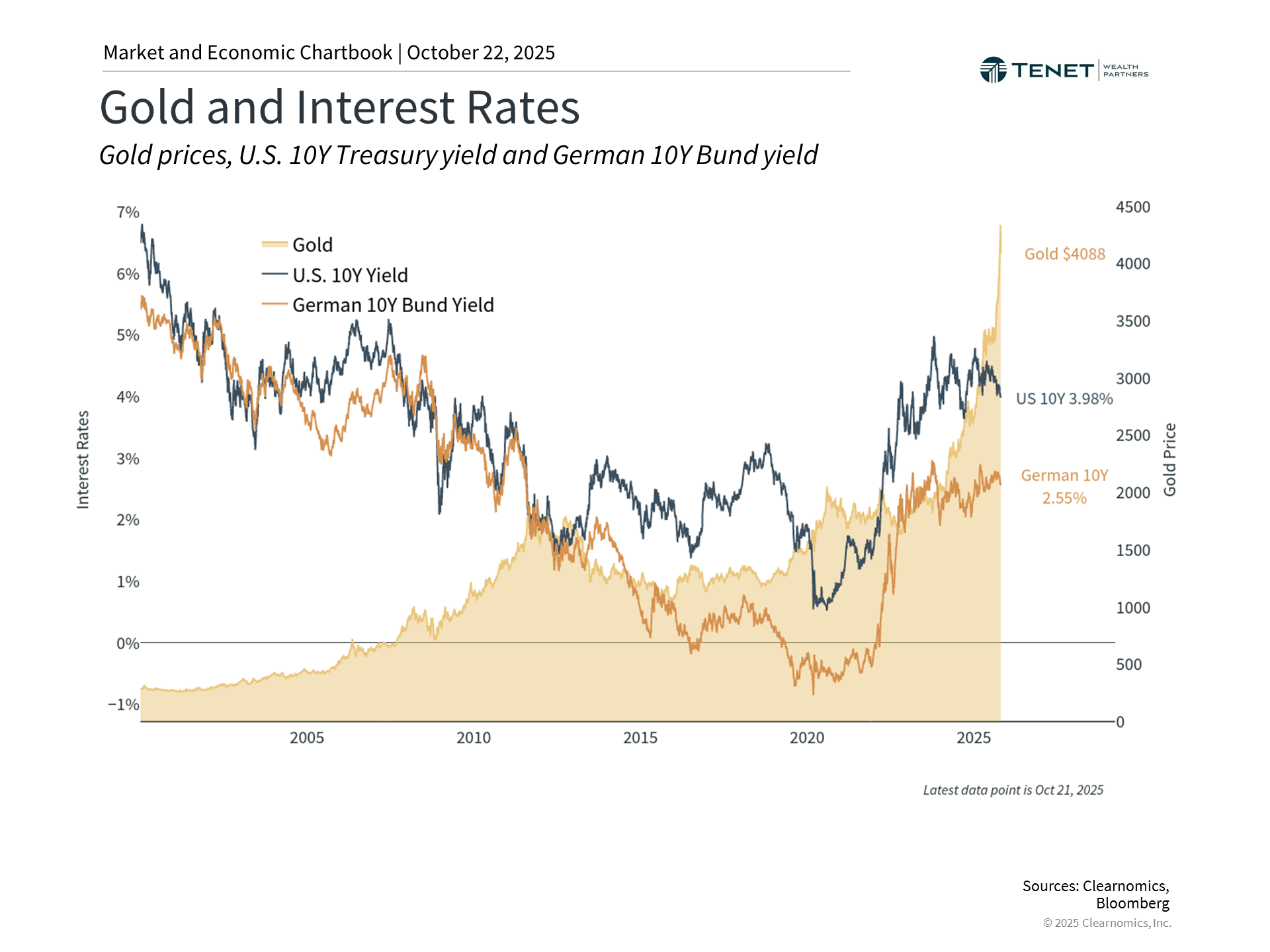

However, evidence regarding whether these conditions currently exist remains mixed, despite legitimate long-term concerns. First, inflation metrics remain elevated but not extreme. The Consumer Price Index, Personal Consumption Expenditures Index, and Producer Price Index all register at 3% or below. Second, bond markets aren’t pricing significant inflation expectations. The 10-year Treasury yield has recently declined below 4%, while Treasury Inflation-Protected Securities (TIPS) imply just 2.3% inflation.

Two additional considerations merit attention: (1.) Global central banks have accelerated gold purchases to strengthen reserves, driven by geopolitical tensions and dollar weakness. (2.) Although the dollar has declined approximately 10% this year, it remains near the upper end of its twenty-year range. From a historical perspective, the dollar maintains considerable strength.

Historical gold rallies and their unpredictability

|

Gold’s nature as a speculative asset naturally attracts investor attention. Recent decades have witnessed several dramatic gold rallies with varying outcomes. During the late 1970s, gold soared amid stagflation fears and Federal Reserve independence concerns. Prices peaked above $800 in 1980 – a threshold not revisited until 2007.

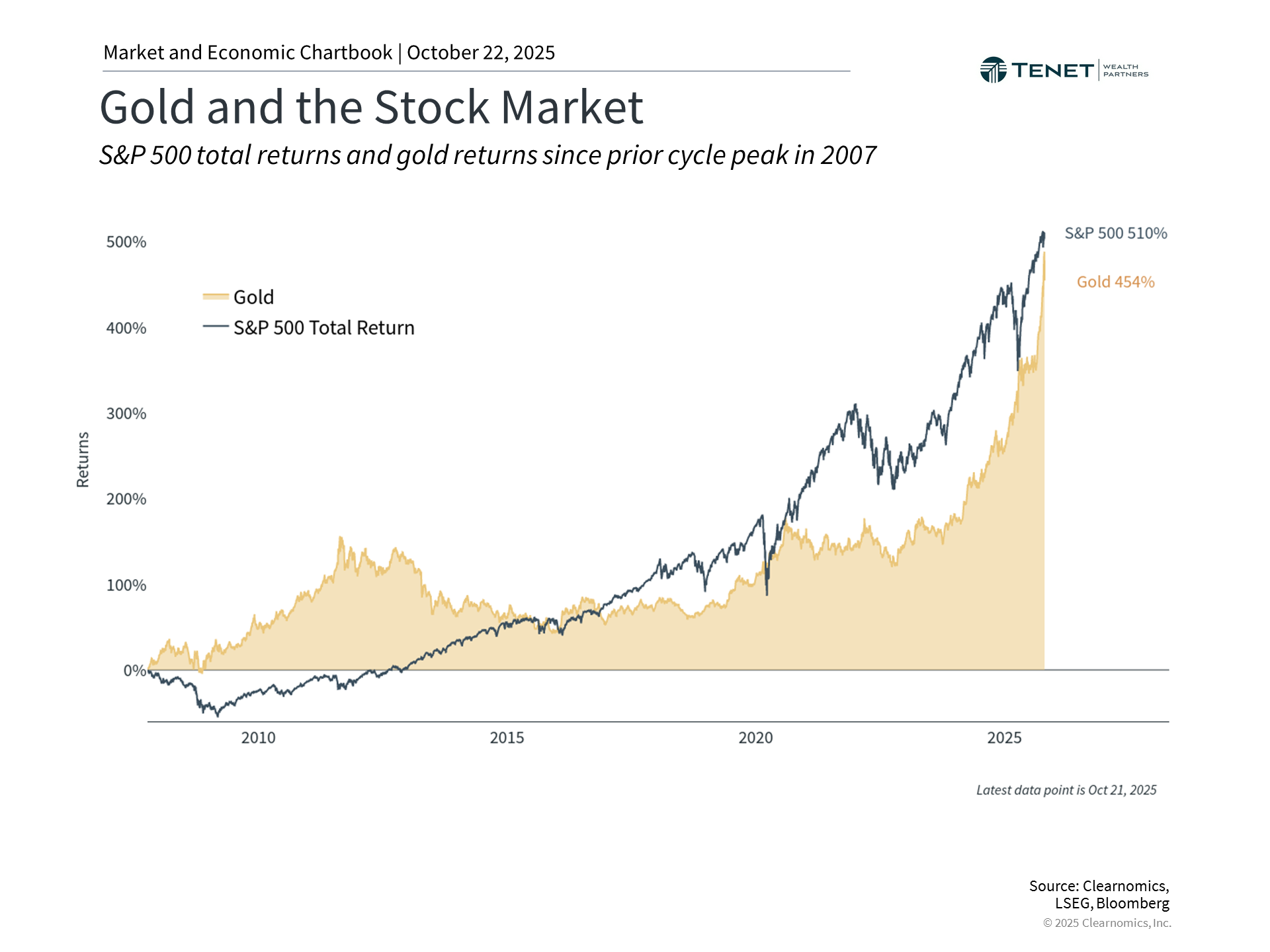

A comparable pattern emerged after the 2008 financial crisis as central banks implemented massive stimulus programs. Many investors reasonably feared uncontrolled inflation and dollar collapse, neither of which materialized. Gold doubled between 2009 and 2011, reaching approximately $1,900 per ounce, before retreating toward $1,000 over subsequent years. This occurred despite the Fed maintaining stimulus until 2013 and keeping rates at zero until 2015.

The accompanying chart above compares gold’s performance against the S&P 500 since the 2007 market peak. Although gold has delivered strong returns during certain periods, providing diversification advantages, the S&P 500 has generated superior returns across the complete timeframe. This fact may surprise investors fixated on daily market fluctuations, reinforcing the importance of evaluating all asset classes within a comprehensive portfolio framework.

Broad-based asset class performance in the current environment

|

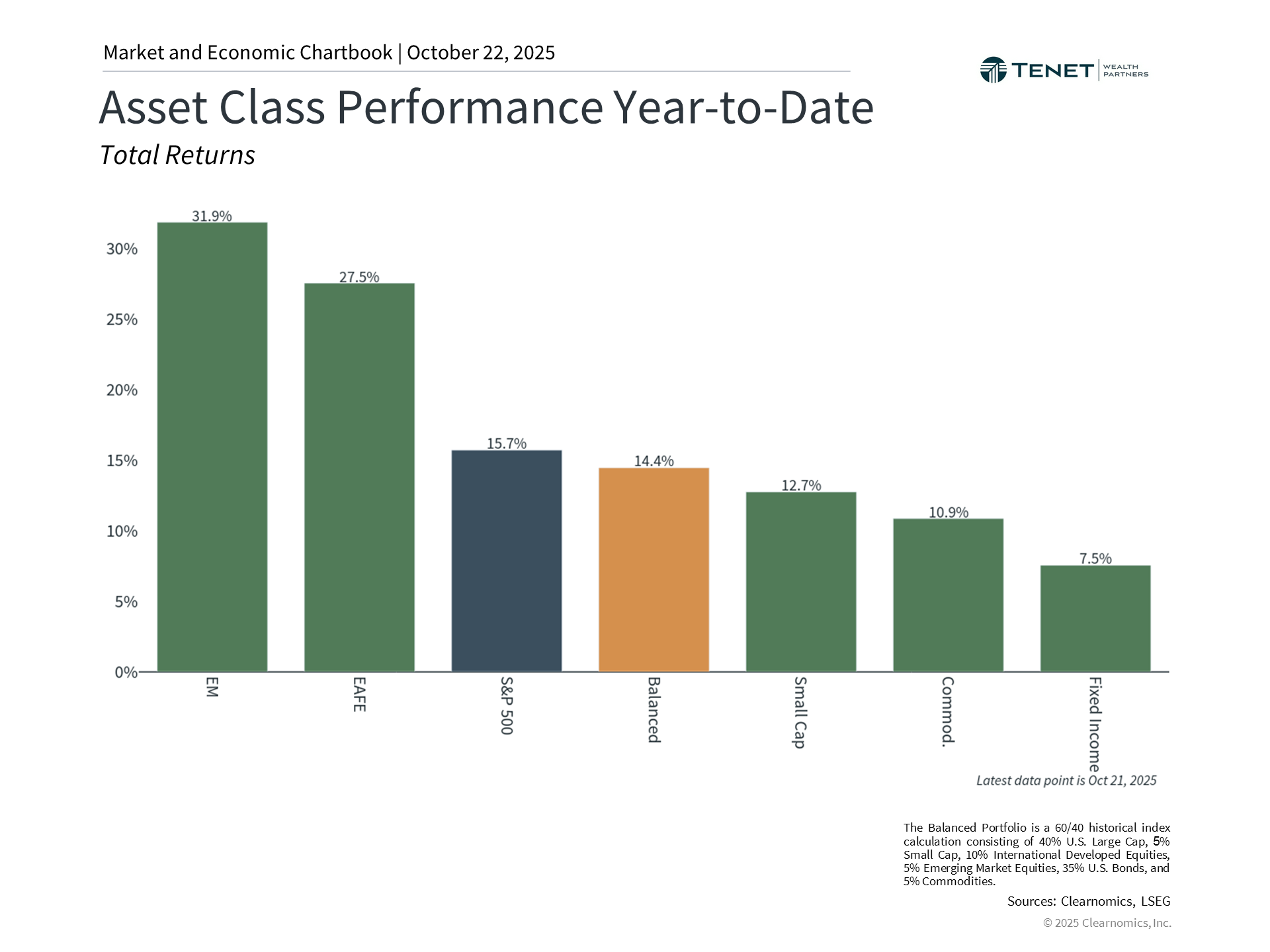

The current gold rally, which commenced in 2024, has coincided with robust performance across numerous assets, including artificial intelligence-related equities like the Magnificent 7, international stocks, fixed income securities, and cryptocurrencies. The accompanying chart above illustrates how many different asset classes have contributed to portfolio returns this year. While gold has certainly delivered impressive gains, individual stocks and other assets can consistently achieve strong performance in any given year.

For many investors, gold can function as an alternative investment that can add enhanced diversification benefits. Gold has historically maintained a low (and in some cases – negative) correlation to traditional stocks and bonds, making it a complimentary asset when strategically incorporated in diversified portfolios. From a long-term perspective, these diversification benefits can pay off while aligning with personal objectives. Consequently, it is also important to note that portfolios with excessive gold weighting sacrifice the extended-term appreciation potential of traditional equities and the income streams from fixed income investments.

As an investor, the key is to understanding if gold is a prudent option for your portfolio and how it can be implemented strategically into your allocation. As a fiduciary financial advisor, our team at Tenet has the expertise to explore gold as a piece of a client’s overall strategy to determine if it is appropriate and can add value.

The bottom line? While some investors express concern about dollar debasement as gold continues its rally, gold should be viewed as one element within a diversified portfolio constructed to align with long-term financial goals.

Investment advisory services offered through Tenet Wealth Partners, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third-party sources and is believed to be reliable.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice. This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.