The detention of Venezuelan President Nicolás Maduro by United States forces marks a notable and unanticipated geopolitical development that could impact financial markets. According to widespread reports, U.S. military personnel executed an operation resulting in Maduro’s arrest on allegations involving drug trafficking and corruption. In a public address, President Trump indicated that the United States would assume administrative control of Venezuela and pursue expansion of the nation’s oil production capacity.

While the most significant considerations involve humanitarian concerns and geopolitical ramifications for Venezuela and the broader region, portfolio managers and investors understandably seek clarity on market implications. This development prompts numerous questions regarding American involvement in South America, prospects for democratic governance in Venezuela, consequences for drug trade dynamics, potential oil production increases, and shifts in influence among nations such as Iran and China.

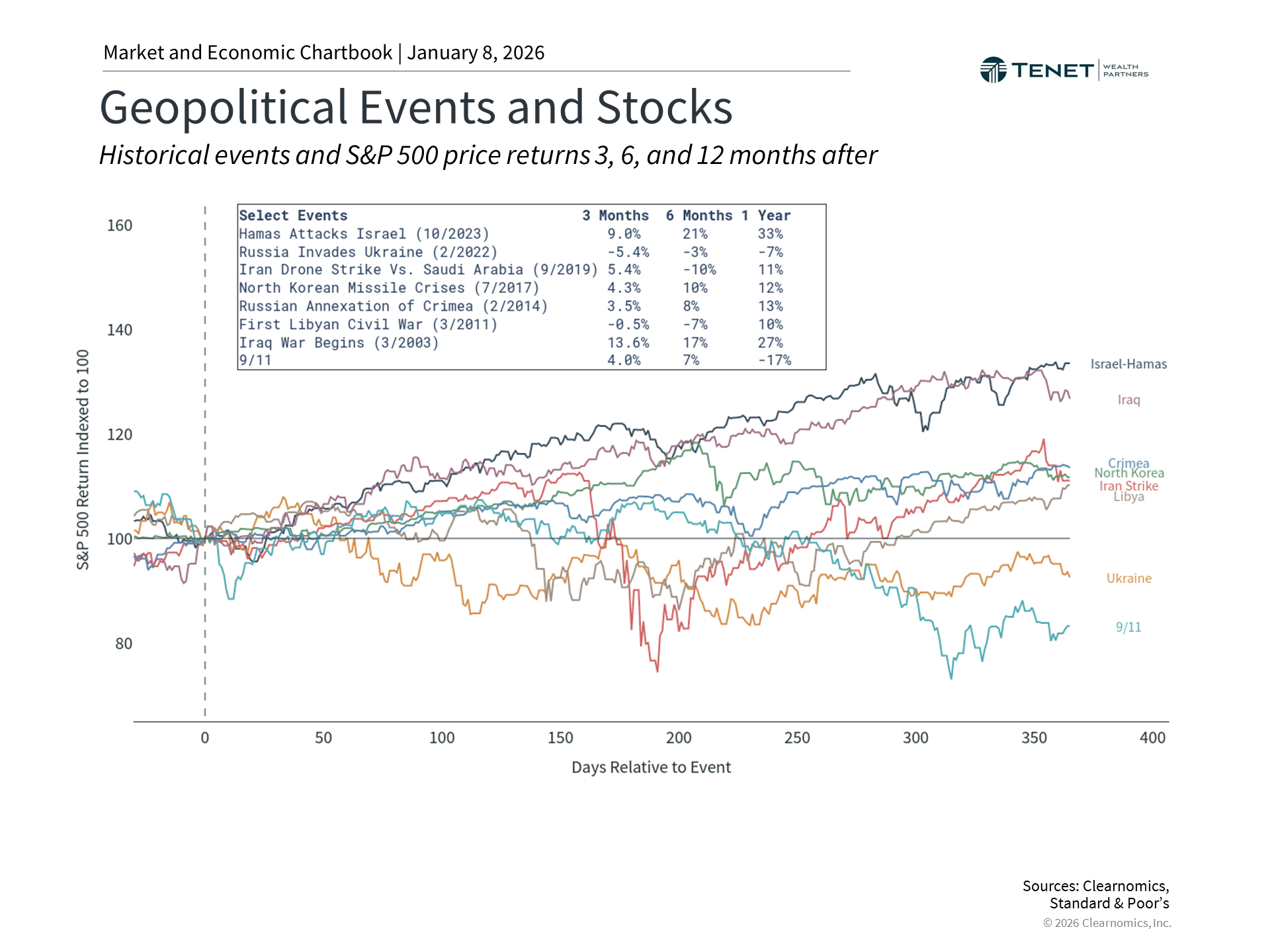

Historical analysis offers valuable perspective: geopolitical developments frequently generate near-term market fluctuations, yet their lasting impact on markets typically remains modest. Such events rarely alter the fundamental trajectory of broader economic and market forces, even when commodity production is affected. Recent geopolitical tensions in Ukraine and the Middle East illustrate this pattern. Recognizing these historical trends helps investors maintain balanced judgment and concentrate on factors with proven influence on long-term market outcomes.

Context from history

|

Understanding U.S. engagement in Latin America requires examining historical precedent, as debates surrounding American intervention in Venezuela encompass topics ranging from international legal frameworks to regional equilibrium. The Monroe Doctrine, initially proclaimed by President James Monroe in 1823, declared that European nations should refrain from interfering in Western Hemisphere affairs. Applying this principle to current circumstances suggests South America falls within the nation’s sphere of influence, meaning hostile actions in the region would constitute threats to American interests. President Trump has referenced this concept, recently describing his foreign policy approach as the “Don-roe Doctrine.”

American intervention in Latin American nations has occurred previously. Notably, in 1990, precisely 36 years prior, the U.S. apprehended Manuel Noriega in Panama on drug trafficking allegations. While the recent Venezuelan operation came as a surprise to many, Maduro has faced U.S. Department of Justice indictment since 2020 on narco-terrorism and drug trafficking charges. The Biden administration enforced sanctions against Venezuela and established a $25 million reward for Maduro in early 2025, subsequently increased to $50 million under the Trump administration.

Similar to other U.S. military and law enforcement initiatives, multiple interconnected goals are involved. The operation’s official justification centered on combating narco-terrorism, the basis for criminal charges filed against Maduro and 14 Venezuelan officials in 2020. International perceptions of Maduro’s governance as illegitimate, stemming from the country’s 2024 electoral process, reinforce this rationale. Before the administrations of Maduro and Hugo Chávez, Venezuela functioned as a democracy and ranked among the region’s most prosperous nations.

For those focused on long-term investment horizons, the essential consideration is that geopolitical uncertainty represents an inherent aspect of market participation, regardless of varying circumstances. Such developments may generate heightened concern since they diverge from typical business coverage involving corporate performance and economic indicators. The accompanying chart illustrates numerous major geopolitical events spanning recent decades. Typically, markets rebounded within weeks or months when impacts occurred at all.

Oil links geopolitical events to markets

|

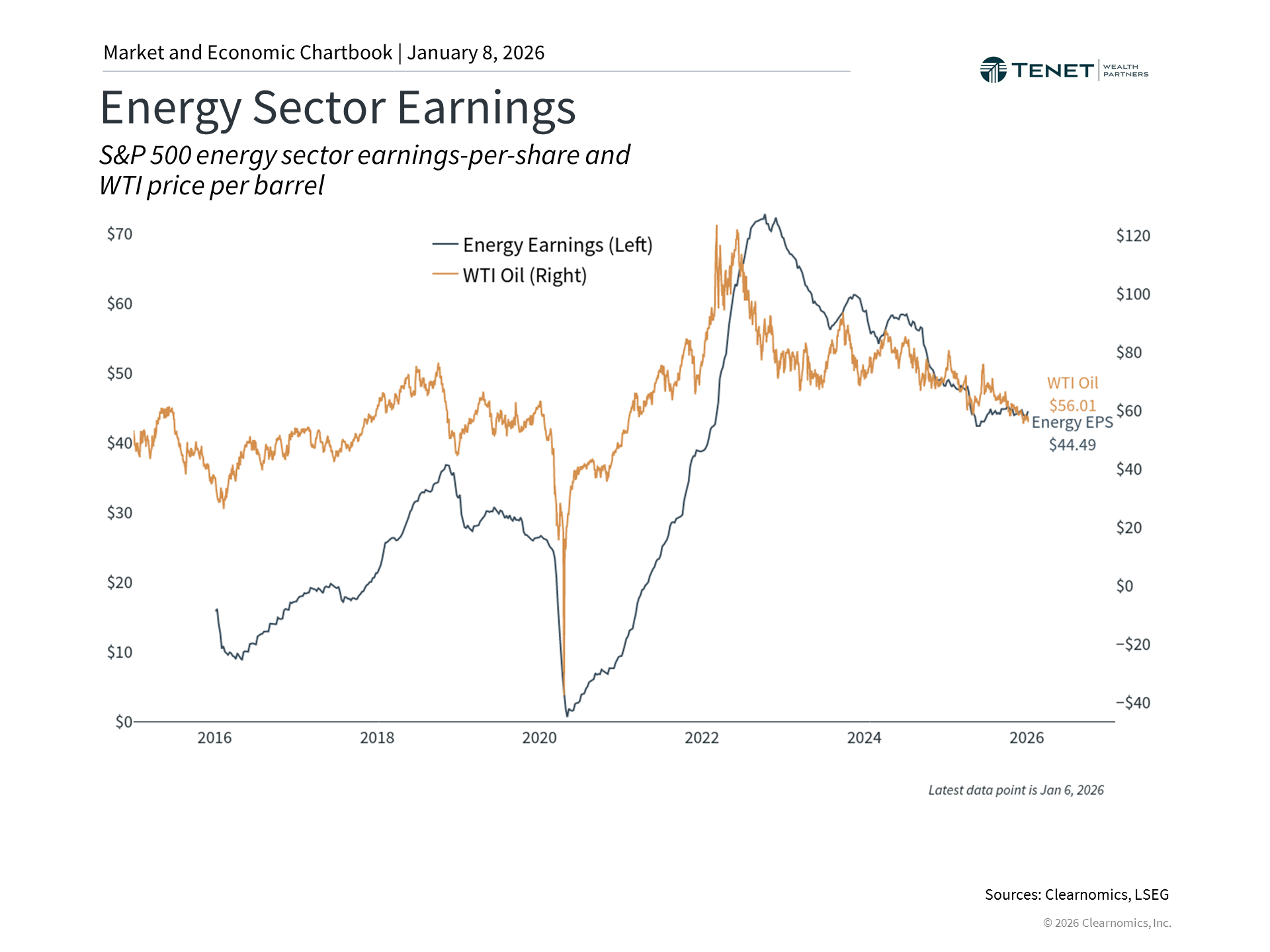

From an investment perspective, oil price implications may represent the most significant consideration. Commodity prices serve as the principal mechanism through which geopolitical developments influence financial markets, with oil maintaining its central role in global economic activity. Venezuela’s significance stems from possessing the world’s largest confirmed oil reserves at approximately 304 billion barrels, per U.S. Energy Information Administration data. This surpasses even Saudi Arabia’s 267 billion barrel reserves.

Notwithstanding these substantial reserves, Venezuelan oil production lags behind other major producers. Output has experienced dramatic decline over the past twenty years due to operational mismanagement, inadequate infrastructure investment, and economic sanctions. Current production has dropped below 1 million barrels daily, compared to nearly 14 million for the U.S.1 Expanding Venezuelan production will likely require considerable time and capital investment to materially impact global supply. This limits near-term market effects.

Looking ahead, U.S. energy producers might gain enhanced access to these reserves, though increased supply potentially leading to lower prices could partially offset benefits. For the broader economy and consumers, market impacts could prove favorable since expanded Venezuelan output would exert downward pressure on oil prices over time. This contrasts with conflicts such as Russia’s 2022 Ukraine invasion, which disrupted existing supply chains and drove oil prices toward $128 per barrel. Those circumstances intensified post-pandemic inflation and pushed average U.S. gasoline prices above $5 per gallon.

Present oil prices remain well below those peak levels. Prices have remained moderate over the past year, with WTI crude trading under $60 per barrel and Brent crude near that threshold. According to available information, OPEC+ countries have maintained existing production quotas in immediate response to recent Venezuelan developments, indicating they are assessing the situation before implementing strategic changes. The U.S. position as the world’s largest oil and gas producer helps further diminish domestic economic impact.

Nevertheless, energy price forecasting involves considerable uncertainty, and the U.S. maintains reliance on crude imports. Following Russia’s Ukraine invasion, many analysts anticipated sustained elevated oil and natural gas prices, particularly given projections for severe European winter conditions. However, prices stabilized and declined much sooner than expected. This serves as a reminder that oil’s status as a global commodity means numerous factors can unexpectedly influence pricing.

Venezuela’s limited financial market presence

|

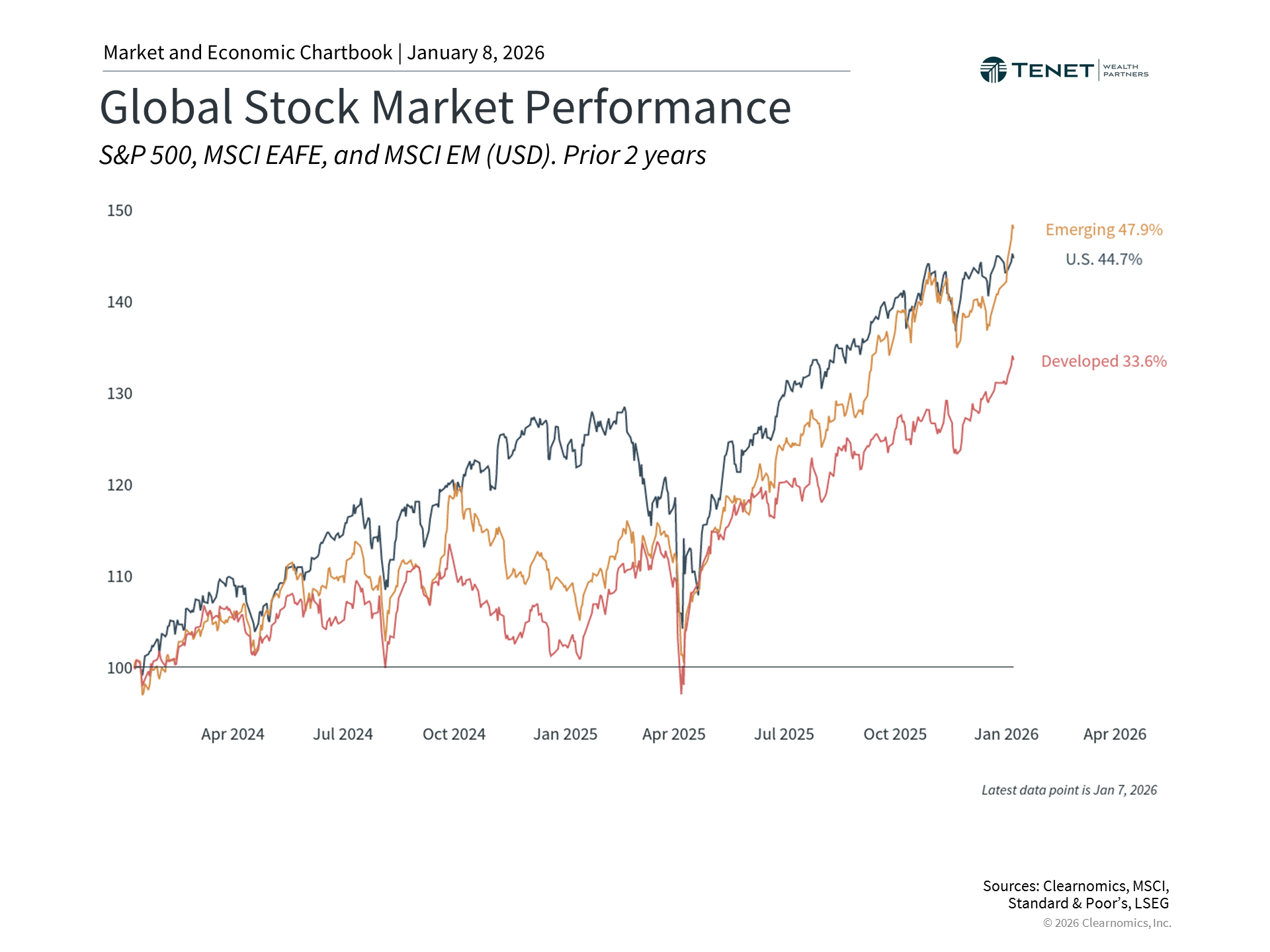

Another crucial consideration for investors is Venezuela’s negligible presence in global financial markets. The Bolsa de Valores de Caracas, Venezuela’s stock exchange, remains small and illiquid with restricted foreign participation. It lacks inclusion in the MSCI Emerging Markets Index, meaning most international portfolios contain minimal or zero direct Venezuelan equity exposure. The nation’s economic deterioration over the preceding decade has effectively removed it from emerging market investment consideration.

Regarding fixed income markets, Venezuela has maintained default status since 2017 following missed debt payments. Bondholders continue negotiating restructuring arrangements, though bonds trade at severely distressed valuations reflecting expectations of substantial losses.

The Venezuelan situation will continue developing, potentially generating additional market attention. Indirect effects through oil price movements and general uncertainty will likely exceed direct impacts from the country and its equity markets. Rather than attempting to forecast specific outcomes, investors benefit most from ensuring portfolios remain aligned with their financial objectives.

The bottom line? While the detention of Venezuela’s president constitutes a meaningful geopolitical event with humanitarian and regional consequences, historical evidence demonstrates that portfolios constructed around long-term financial objectives can successfully navigate geopolitical uncertainty.

References

1. https://www.eia.gov/outlooks/steo/tables/pdf/3dtab.pdf

Investment advisory services offered through Tenet Wealth Partners, LLC, a registered investment advisor with the U.S. Securities and Exchange Commission. This material is intended for informational purposes only. It should not be construed as legal or tax advice and is not intended to replace the advice of a qualified attorney or tax advisor. This information is not an offer or a solicitation to buy or sell securities. The information contained may have been compiled from third-party sources and is believed to be reliable.

The information provided in this communication was sourced by Tenet Wealth Partners through public information and public channels and is in no way proprietary to Tenet Wealth Partners, nor is the information provided Tenet Wealth Partner’s position, recommendation or investment advice. This material is provided for informational/educational purposes only. This material is not intended to constitute legal, tax, investment or financial advice. Investments are subject to risk, including but not limited to market and interest rate fluctuations.

Any performance data represents past performance which is no guarantee of future results. Prices/yields/figures mentioned herein are as of the date noted unless indicated otherwise. All figures subject to market fluctuation and change. Additional information available upon request.