by Kyle Wetters, CFP® | Sep 12, 2023 | Insights

In today’s fast-paced world, finding the balance in your investment portfolio can seem like a daunting task. With so many options to choose from, it’s easy to feel overwhelmed and unsure of where to start. That’s where this guide comes in. We...

Continue Reading...

by Kyle Wetters, CFP® | Aug 29, 2023 | Insights

Are you looking to optimize your investment portfolio and maximize your returns? Look no further! In this article, we will explore five asset allocation strategies that can help you achieve your financial goals. Successful investors understand the importance of...

Continue Reading...

by Kevan Melchiorre, CFP® | Aug 21, 2023 | Insights, Investment Commentary

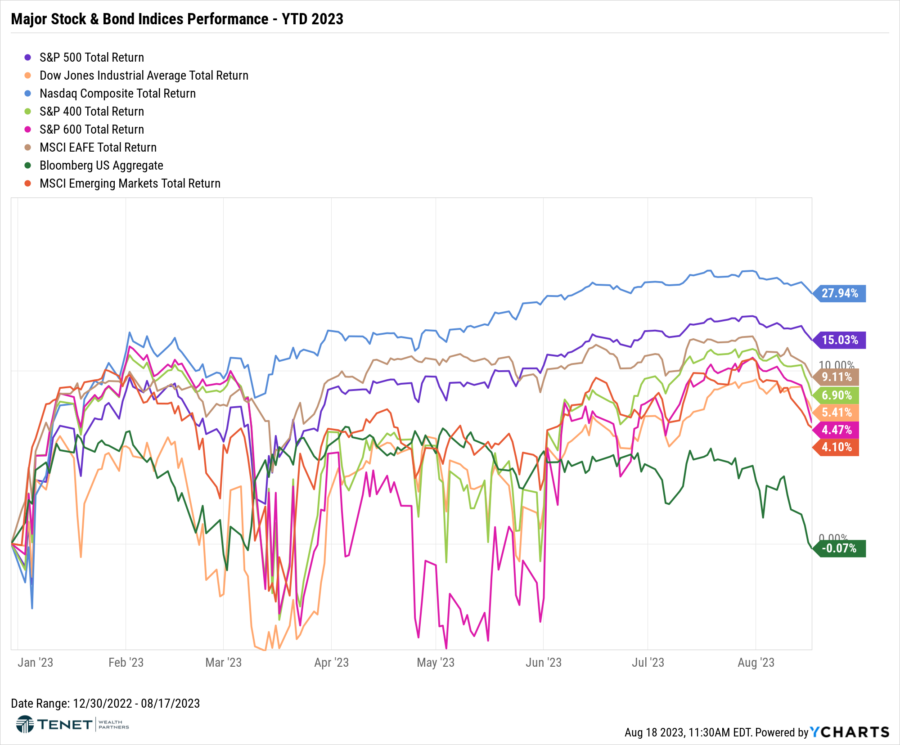

Major Index Returns – QTD & YTD 2023 Strong second quarter U.S. GDP growth, moderating inflation trends and robust earnings reports continued to support equity market performance in July. Equity returns were positive across the spectrum in July as investors raised...

Continue Reading...

by Kevan Melchiorre, CFP® | Aug 21, 2023 | Insights

Building a lasting and meaningful legacy is a goal that many families aspire to. And at the heart of leaving a lasting impact for future generations is generational wealth. But what exactly is generational wealth, and why is it so important? Generational wealth refers...

Continue Reading...

by Kevan Melchiorre, CFP® | Jul 25, 2023 | Insights

Major Index Returns – Q1 2023 Markets roared higher in the 2nd quarter and ended the first half of the year with excellent returns overall. Most of the performance has been driven by inflation that is cooling faster than expected, strong jobs data, and better than...

Continue Reading...

by Kevan Melchiorre, CFP® | Jul 25, 2023 | Insights

As most rising college freshman are on the cusp of becoming legal adults, many of these legal documents can help them to protect themselves and allow you as their parent to help them should something unexpected happen. It is important for your teen and you to discuss...

Continue Reading...

by Kyle Wetters, CFP® | Jul 25, 2023 | Insights

Congratulations! Your child has successfully navigated their high school years and is preparing to embark on the exciting journey into college life. As CERTIFIED FINANCIAL PLANNER TM Professionals, we understand the importance of setting a strong financial foundation...

Continue Reading...

by Kyle Wetters, CFP® | Jun 18, 2023 | Insights

A Boost for Couples’ Financial Well-being In a world where healthcare costs continue to rise, it’s crucial for individuals and families to have access to robust financial tools that can help them navigate these expenses. Health Savings Accounts (HSAs) have...

Continue Reading...

by Kevan Melchiorre, CFP® | Jun 18, 2023 | News & Features

This past year, we have had the privilege of serving as the sponsor for United Way of Champaign County’s Women Untied initiative. Through our involvement, we have learned so much about our community and the powerful work being done by our neighbors at United Way. ...

Continue Reading...

by Kevan Melchiorre, CFP® | Jun 18, 2023 | Insights, Investment Commentary

June 2023’s Investment Commentary sheds light on the current market situation with an overview of major index returns, stock valuations, and economic indicators. Stay informed about the current market landscape with this comprehensive analysis. Major Index Returns –...

Continue Reading...

by Kevan Melchiorre, CFP® | May 19, 2023 | Insights

Major Index Returns – QTD & YTD 2023 Markets have been mixed early on in Q2. U.S. Small Cap and Mid Cap stocks (S&P 600 and S&P 400) as well as Emerging Markets stocks have been the biggest laggards thus far, while U.S. Large Cap and International...

Continue Reading...

by Kyle Wetters, CFP® | May 13, 2023 | Insights

A Guide to Tax-Advantaged Education Savings 529 Day is a day dedicated to raising awareness about the benefits of 529 plans and encouraging families to start saving for their children’s education- it’s never too soon to start saving! To help you get...

Continue Reading...

by Kevan Melchiorre, CFP® | Mar 23, 2023 | Insights

In light of recent events, we wanted to focus this month’s commentary on information and perspectives related to concerns with the US banking space, which began with the failures of Silicon Valley Bank (SIVB) and Signature Bank. With the addition of recent struggles...

Continue Reading...

by Kyle Wetters, CFP® | Feb 15, 2023 | Insights

Learn more about the SECURE Act 2.0 and the ever-changing landscape for retirement accounts. At the tail-end of 2022, Congress passed new legislation called SECURE 2.0, which includes several important changes affecting current and future retirees. We have highlighted...

Continue Reading...

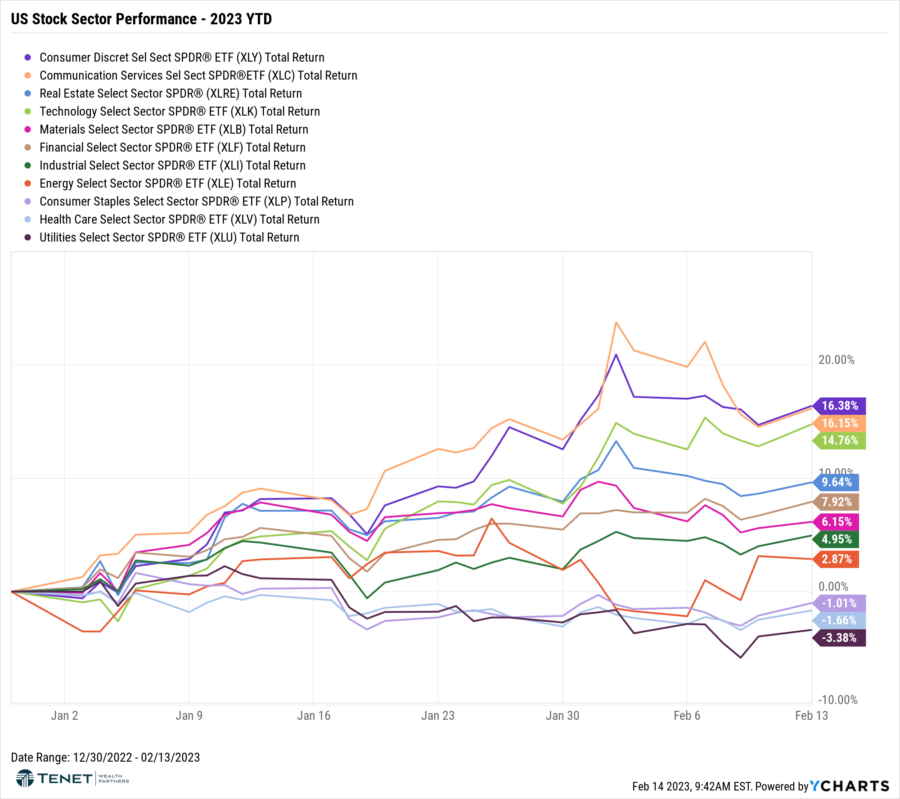

by Kevan Melchiorre, CFP® | Feb 15, 2023 | Insights, Investment Commentary

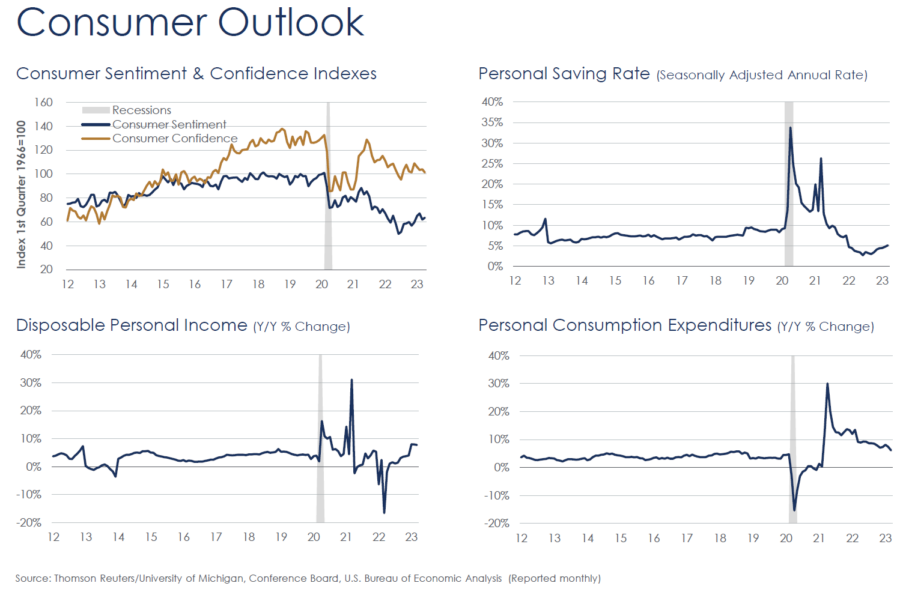

All major stock and bond indexes positive thus far, driven by optimism of falling inflation and a slowdown of future Federal Reserve Rate hikes. The economy has also shown resilience with stronger jobs data and continued consumer (and corporate) resiliency. In a...

Continue Reading...

by Kyle Wetters, CFP® | Feb 12, 2023 | Featured In The News

Coming to a Bank Account Near You – Social Security’s Largest Increase Since 1981 Higher Social Security payments are hitting bank accounts everywhere, as the Social Security Administration granted an 8.7% raise for beneficiaries. The increase, the highest seen since...

Continue Reading...

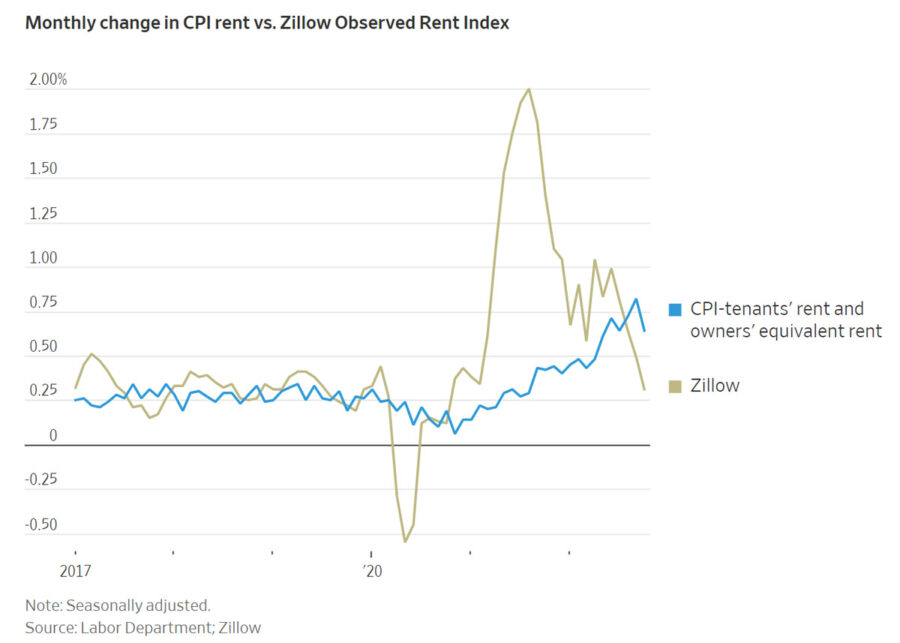

by Kevan Melchiorre, CFP® | Jan 18, 2023 | Insights

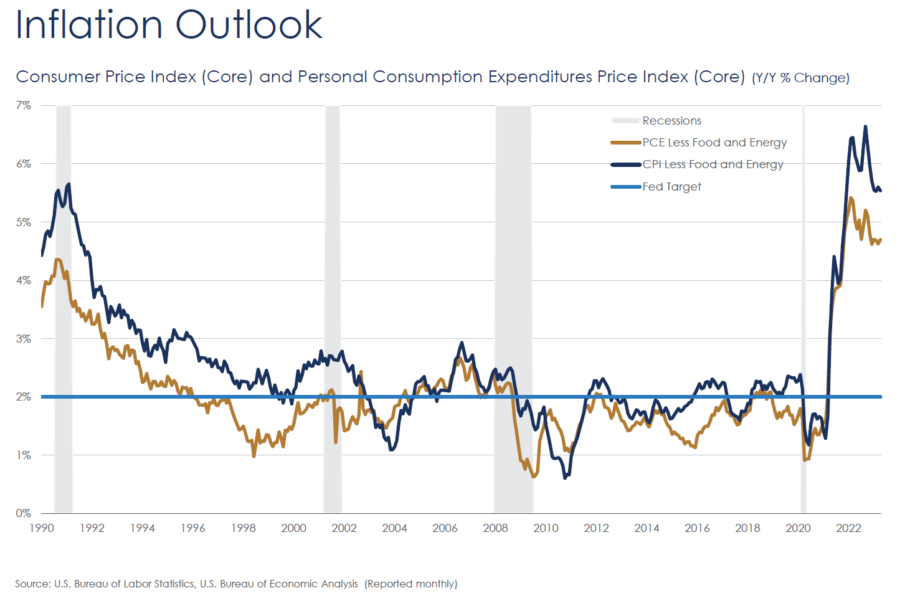

Inflation – Finally Fading? Inflation has been much stickier than anyone anticipated, but we have seen signs of a downward trend forming. Will this continue? With supply chains normalizing, the biggest question mark is when the falling real estate prices and...

Continue Reading...

by Kevan Melchiorre, CFP® | Jan 12, 2023 | Insights

Review and update your “personal balance sheet”. Reviewing your total net worth is helpful to understand progress throughout the year. How did balances change in investment accounts, retirement accounts, and liabilities? Did you see progress that supports...

Continue Reading...

by tenetwp | Dec 30, 2022 | Investment Commentary

Volatility Persists Yet Q4 Returns Have Remained Positive While we have seen more volatility in December, major indices are still up significantly since the start of Q4. Even with many prominent CEOs and investors predicting a recession in 2023, investors have become...

Continue Reading...